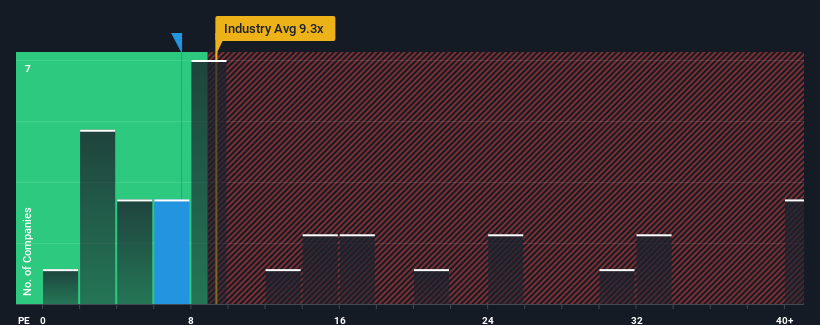

It's not a stretch to say that Luk Fook Holdings (International) Limited's (HKG:590) price-to-earnings (or "P/E") ratio of 7.4x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been pleasing for Luk Fook Holdings (International) as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Luk Fook Holdings (International)

Is There Some Growth For Luk Fook Holdings (International)?

There's an inherent assumption that a company should be matching the market for P/E ratios like Luk Fook Holdings (International)'s to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 12% last year. Pleasingly, EPS has also lifted 137% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 11% per year as estimated by the nine analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 15% per year, which is noticeably more attractive.

With this information, we find it interesting that Luk Fook Holdings (International) is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From Luk Fook Holdings (International)'s P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Luk Fook Holdings (International)'s analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Luk Fook Holdings (International) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.