National Electronics Holdings' (HKG:213) Shareholders May Want To Dig Deeper Than Statutory Profit

National Electronics Holdings' (HKG:213) Shareholders May Want To Dig Deeper Than Statutory Profit

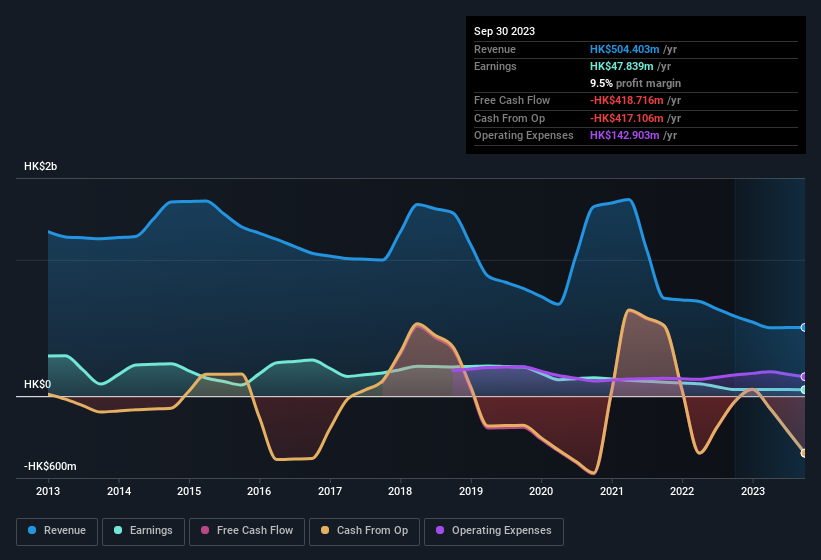

National Electronics Holdings Limited's (HKG:213) healthy profit numbers didn't contain any surprises for investors. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

國家電子控股有限公司(HKG: 213)的健康利潤數字並沒有讓投資者感到意外。但是,法定利潤數字並不能說明全部情況,我們發現了一些可能引起股東關注的因素。

View our latest analysis for National Electronics Holdings

查看我們對國家電子控股公司的最新分析

The Impact Of Unusual Items On Profit

不尋常物品對利潤的影響

Importantly, our data indicates that National Electronics Holdings' profit received a boost of HK$271m in unusual items, over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. National Electronics Holdings had a rather significant contribution from unusual items relative to its profit to September 2023. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

重要的是,我們的數據表明,與去年相比,國家電子控股公司的利潤在不尋常項目上增加了2.71億港元。雖然獲得更高的利潤總是件好事,但來自不尋常物品的巨額捐款有時會抑制我們的熱情。當我們計算數千家上市公司的數字時,我們發現,特定年份中不尋常的項目所帶來的提振通常不會在第二年重演。考慮到這個名字,這並不奇怪。截至2023年9月,國家電子控股公司從不尋常的項目中獲得了相當大的利潤。因此,我們可以推測,這些不尋常的物品使其法定利潤明顯高於原來的水平。

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of National Electronics Holdings.

注意:我們始終建議投資者檢查資產負債表的實力。點擊此處查看我們對國家電子控股公司的資產負債表分析。

Our Take On National Electronics Holdings' Profit Performance

我們對國家電子控股公司利潤表現的看法

As we discussed above, we think the significant positive unusual item makes National Electronics Holdings' earnings a poor guide to its underlying profitability. As a result, we think it may well be the case that National Electronics Holdings' underlying earnings power is lower than its statutory profit. The good news is that its earnings per share increased slightly in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Every company has risks, and we've spotted 4 warning signs for National Electronics Holdings (of which 2 make us uncomfortable!) you should know about.

正如我們上面討論的那樣,我們認爲這一重大利好不尋常的項目使美國國家電子控股公司的收益無法衡量其潛在盈利能力。因此,我們認爲國家電子控股公司的基礎盈利能力很可能低於其法定利潤。好消息是,其每股收益在去年略有增長。當然,我們只是在分析其收益時才浮出水面;人們還可以考慮利潤率、預測增長和投資回報率等因素。考慮到這一點,除非我們對風險有透徹的了解,否則我們不會考慮投資股票。每家公司都有風險,我們已經發現了國家電子控股公司的4個警告信號(其中2個讓我們感到不舒服!)你應該知道。

Today we've zoomed in on a single data point to better understand the nature of National Electronics Holdings' profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

今天,我們放大了單一數據點,以更好地了解國家電子控股公司利潤的性質。但是,還有很多其他方法可以讓你對公司的看法。例如,許多人認爲高股本回報率是有利的商業經濟的標誌,而另一些人則喜歡 “關注資金”,尋找內部人士正在買入的股票。雖然可能需要你進行一些研究,但你可能會發現這份免費收集的擁有高股本回報率的公司,或者這份內部人士正在購買的股票清單很有用。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。