Yusei Holdings (HKG:96) Will Want To Turn Around Its Return Trends

Yusei Holdings (HKG:96) Will Want To Turn Around Its Return Trends

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after briefly looking over the numbers, we don't think Yusei Holdings (HKG:96) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

如果我們想找到潛在的多袋裝袋機,通常有一些潛在的趨勢可以提供線索。一種常見的方法是嘗試找一家公司 回報 論資本使用率(ROCE)在增加的同時增長 金額 已動用資本的百分比。基本上,這意味着一家公司有可以繼續進行再投資的盈利計劃,這是複合機的一個特徵。但是,在簡短地看完這些數字之後,我們認爲友成控股(HKG: 96)不具備未來多袋公司的實力,但讓我們來看看爲什麼會這樣。

Understanding Return On Capital Employed (ROCE)

了解資本使用回報率 (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Yusei Holdings, this is the formula:

對於那些不知道的人來說,ROCE是衡量公司年度稅前利潤(其回報率)的指標,相對於該業務使用的資本。要計算Yusei Holdings的這個指標,公式如下:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

已動用資本回報率 = 息稅前收益(EBIT)÷(總資產-流動負債)

0.035 = CN¥34m ÷ (CN¥2.3b - CN¥1.3b) (Based on the trailing twelve months to December 2022).

0.035 = 34m CN¥34m ≤(CN¥2.3b-CN¥1.3b) (基於截至2022年12月的過去十二個月)。

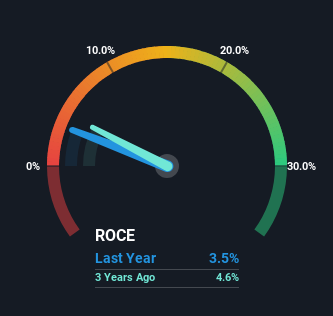

Thus, Yusei Holdings has an ROCE of 3.5%. Ultimately, that's a low return and it under-performs the Chemicals industry average of 9.3%.

因此,友成控股的投資回報率爲3.5%。歸根結底,這是一個低迴報,其表現低於化工行業9.3%的平均水平。

View our latest analysis for Yusei Holdings

查看我們對友成控股的最新分析

Historical performance is a great place to start when researching a stock so above you can see the gauge for Yusei Holdings' ROCE against it's prior returns. If you'd like to look at how Yusei Holdings has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

歷史表現是研究股票的絕佳起點,因此在上方您可以看到Yusei Holdings的投資回報率與先前回報的對比。如果你想在其他指標中查看Yusei Holdings過去的表現,你可以查看這張過去的收益、收入和現金流的免費圖表。

What The Trend Of ROCE Can Tell Us

ROCE 的趨勢能告訴我們什麼

In terms of Yusei Holdings' historical ROCE movements, the trend isn't fantastic. Over the last five years, returns on capital have decreased to 3.5% from 17% five years ago. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. If these investments prove successful, this can bode very well for long term stock performance.

就優成控股的歷史ROCE走勢而言,這種趨勢並不理想。在過去五年中,資本回報率從五年前的17%下降到3.5%。儘管考慮到該業務的收入和資產數量都有所增加,但這可能表明該公司正在投資增長,而額外的資本導致了投資回報率的短期下降。如果這些投資被證明是成功的,這對長期股票表現來說可能是個好兆頭。

On a side note, Yusei Holdings' current liabilities are still rather high at 58% of total assets. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

順便說一句,友成控股的流動負債仍然相當高,佔總資產的58%。這實際上意味着供應商(或短期債權人)正在爲業務的很大一部分提供資金,因此請注意,這可能會帶來一些風險因素。理想情況下,我們希望看到這種情況減少,因爲這將意味着減少承擔風險的債務。

In Conclusion...

總之...

In summary, despite lower returns in the short term, we're encouraged to see that Yusei Holdings is reinvesting for growth and has higher sales as a result. And the stock has followed suit returning a meaningful 71% to shareholders over the last three years. So while the underlying trends could already be accounted for by investors, we still think this stock is worth looking into further.

總而言之,儘管短期內回報率較低,但令我們感到鼓舞的是,友成控股正在進行再投資以實現增長,因此銷售額有所增加。在過去三年中,該股緊隨其後,爲股東帶來了可觀的71%的回報。因此,儘管投資者已經可以解釋潛在的趨勢,但我們仍然認爲這隻股票值得進一步研究。

Yusei Holdings does have some risks, we noticed 4 warning signs (and 3 which shouldn't be ignored) we think you should know about.

Yusei Holdings確實存在一些風險,我們注意到我們認爲你應該知道的4個警告信號(還有3個不容忽視)。

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

如果你想尋找收益豐厚的穩健公司,可以免費查看這份資產負債表良好且股本回報率可觀的公司名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。