On November 21, Gelonghui real estate stocks rose; 365 Network and Tefa Service rose by more than 10%; Rongsheng Development, Jinke Co., Ltd., Shenzhen Zhenye A, and Dalong Real Estate rose and stopped.

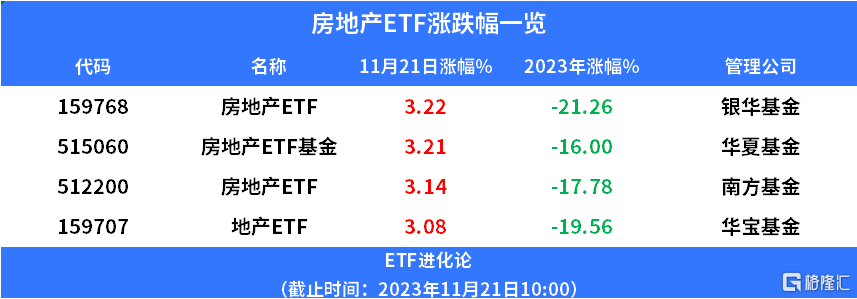

In terms of ETFs, the Yinhua Fund Real Estate ETF, Huaxia Fund Real Estate ETF Fund, China Southern Fund Real Estate ETF, and Huabao Fund Real Estate ETF increased by more than 3%.

According to some sources, regulators are drafting a white list of Chinese real estate agents. It is possible that 50 state-owned and private housing enterprises will be included. The white list includes Xincheng Development, Vanke, and Longhu Real Estate, etc., but it has not yet been finalized. The listed companies will receive support from various sources, including credit, debt, and equity financing. This white list has expanded the scope of systemically important high-quality housing enterprises compared to the beginning of this year.

Furthermore, Sunac China issued an announcement last night stating that all conditions for the company's overseas debt restructuring have been met and will officially take effect on November 20. The company said that with the completion of all domestic and foreign open market debt restructuring, Sunac has resolved the overall debt risk of about 90 billion yuan, and there is no rigid debt repayment pressure in the overseas open market within 2-3 years. A senior analyst said that Sunac's debt restructuring is large-scale and difficult. In the end, the plan proposed by the company is relatively innovative and pragmatic, and has great reference significance for the industry.

On November 17, the Central Bank, the General Administration of Financial Supervision, and the Securities Regulatory Commission jointly held a symposium on financial institutions to clearly support real estate companies in rational equity financing through the capital market.

Furthermore, according to media reports such as First Finance and Surge News, on November 19, the Securities Regulatory Commission stated that it will adhere to “one strategy, one policy” to resolve the risk of major housing companies' bond defaults, continue to deal with the centralized delisting of listed housing enterprises, and ensure “retreat and stability.”

Guojin Securities pointed out that the performance of the main real estate data for October was weak, and supply-side support was ready to go. According to the National Bureau of Statistics, the new construction area in January-October was 791.77 million square meters, -23.2% year-on-year, 0.2 pct narrower than January-September; in October it was 70.54 million square meters, -14.3% month-on-month and -21.1% year-on-year. Commercial housing sales in January-October were 9716.1 billion yuan, -4.9% year on year, up 0.3 pct from January-September; October was 809.1 billion yuan, -8.1% year on year, and have been declining for three consecutive months. Looking at new housing prices, new housing prices in energy level cities stopped rising starting in June. Among them, the first tier fell the least, and the third tier fell for 5 consecutive months; prices in 56 of the 70 large and medium-sized cities fell month-on-month in October. Looking at second-hand housing prices, second-hand housing prices in energy level cities began to fall in May, and the duration of the decline and the decline was greater than that of new housing; prices in 67 of the 70 largest and medium-sized cities fell month-on-month in October. Policy impulse effects tend to weaken, or force both supply and demand to introduce stronger policies to boost market confidence.

At the Central Financial Work Conference held at the end of October, senior management once again set the tone of “treating all housing enterprises equally to meet the reasonable financing needs of different housing enterprises.” On November 17, the Central Bank, the Financial Administration, and the Securities Regulatory Commission jointly held a symposium on financial institutions, proposing that financial institutions do not hesitate to lend, draw, or cut loans to real estate enterprises operating normally; continue to make good use of the “second arrow” to support private real estate enterprises in issuing bonds and financing; and support real estate enterprises to rationalize equity financing through the capital market. The supervisory authorities have made frequent statements showing their determination to continue maintaining the stability of key financing channels such as credit, bonds, and equity for housing enterprises. It is expected that in the future, financial institutions' support for real estate industry financing will increase, and more financial policies to support real estate will be implemented. Supply-side financing support is conducive to easing the current credit contraction problems and cash flow pressure of housing enterprises, boosting market confidence, and promoting the return of the real estate industry to stable development.

Dongwu Securities believes that the current real estate support policy has changed from focusing on the demand side to a two-pronged approach between supply and demand, and from “insurance projects” to “insured entities.” Housing enterprises with high-quality land storage, stable finances, resource endowments, and continuous improvement of product strength are expected to cross the cycle, seize the local auction window and actively adjust positions, and take the lead in benefiting from the recovery in industry sales in the future; at the same time, some local housing enterprises and contract construction enterprises are expected to benefit from the incremental opportunities brought about by the continuous promotion of urban village renovation.

Fangzheng Securities pointed out that at present, the restoration of the property market continues, the market's concerns about the credit risk of leading stable housing enterprises have abated, the central government's continued statement is expected to boost confidence in the property market, the reform framework for the new real estate model is gradually being clarified, and the industry is worth looking forward to completing a smooth transition to the new model in development and exploration.