The third quarter, which is the beginning of the peak season for new energy vehicles, benefited from the arrival of gold, nine, silver, and ten in the car market. It should have been an important time for major battery manufacturers to turn their backs on the decline in production capacity utilization, reduced shipments, and loss of profitability during the off-season.

However, as the leader Ningde Era first revealed its report card for the third quarter, it is worth putting a question mark on whether it has regained blood or lost blood.

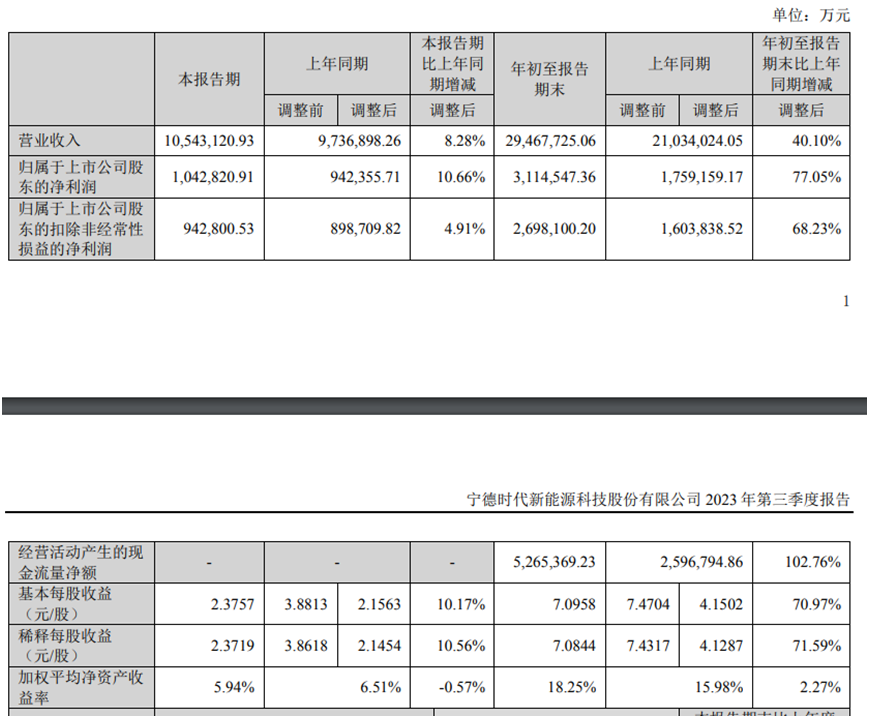

On the evening of October 19, the power battery giant Ningde Times announced its results for the third quarter of 2023.

In the third quarter of this year, Ningde Era achieved operating income of 105.4 billion yuan, up 8.28% year on year, up 5.21% month on month; net profit of 10.428 billion yuan, up 10.66% year on year, down 4.28% month on month; gross margin reached 22.42%, up 3.15 percentage points year on year, up 0.46 percentage points month on month; net profit margin was 10.47%, up 0.24 percentage points year on year, down 0.9 percentage points month on month.

1. Is the profit growth rate slowing down in the Q3 Ningde era?

Simply judging from the absolute value of Ningde Era's third-quarter results data and year-on-year growth rate, both profitability and revenue scale were below expectations. This is in stark contrast to the situation of “increasing revenue and profit while simultaneously increasing gross margin” in the first half of this year, but it is not a leading thunderstorm, but there is a reason for the incident.

First, the financial expenses of the Ningde Era in the third quarter of this year reached 1,325 billion yuan, in stark contrast to the second quarter's -2,693 million yuan and the third quarter's -467 million yuan, which directly affected the current profit level of the Ningde era in the third quarter.

The main reason behind this is mainly that the Linde era's exchange losses due to the appreciation of the renminbi against the euro in the third quarter of this year. If this part of the exchange losses is added back, the net profit of the Ningde era will rise to 11.753 billion yuan, and the month-on-month growth rate will also change from negative to positive.

However, since overseas business in the Ningde era required the use of Euros and US dollars, it itself required hedging of foreign currencies to a certain extent, and some foreign currencies had overseas uses, so depreciation did not affect use.

Second, Ningde Era calculated asset impairment preparations for the first three quarters totaling 3,097 billion yuan, which would reduce the company's net profit to the parent of the first three quarters by 2.63 billion yuan. If spread evenly to the three quarters, Ningde Era would also face impairment losses of 877 million yuan in the third quarter.

Specifically, in the Ningde era, the main source of impairment losses in the three quarters of this year was preparation for a fall in inventory prices, accounting for close to 50%. This year, lithium prices have been in a downward range for three consecutive quarters. The average price of battery-grade lithium carbonate fell from 450,000 tons in the first quarter to 250,000 yuan/ton in the second quarter to 200,000 yuan/ton in the third quarter.

As of October 19, the latest price of battery-grade lithium carbonate has fallen to 170,000 yuan/ton. In the short term, it is difficult for lithium prices to recover. This obviously has a significant impact on the profit of the Ningde Era, which holds some high-priced lithium carbonate stocks and has implemented lithium mine rebate plans to target end customers.

Finally, this year's decline in power battery prices is a common phenomenon. The average prices of lithium iron phosphate battery power models and ternary cell power models fell from 0.79 yuan/Wh and 0.86 yuan/Wh at the end of the first quarter to 0.68 yuan/Wh and 0.75 yuan/Wh at the end of the second quarter, to 0.5 yuan/Wh and 0.56 yuan/Wh at the end of the third quarter, with an overall decline of 35%-40%.

Even if it is as strong as the leading Ningde era, it is necessary to compromise on the downstream, and it is impossible to continue to maintain high prices. In the third quarter of this year, the installed volume of power batteries in the Ningde era reached 43.27 GWh, with a year-on-year increase of only 9.5%, which is basically the same as the 10.66% year-on-year growth rate of net profit of the Ningde era. It is difficult to reproduce the performance of the previous net profit growth level far higher than the installed power battery level during the same period.

2. In the Ningde era, production capacity utilization has picked up, and orders are still growing at a high level

Even though competition in the power battery market is becoming more and more cruel, the leading position in the Ningde era has not changed at all. It is still favored by end customers. Shipments and capacity utilization have increased, and the right to speak has not been lost.

In the third quarter of this year, total battery shipments from the Ningde era were around 100 GWh, an increase of 20% over the previous month. Among them, power batteries and energy storage batteries accounted for 80% and 20%, respectively, and the overall battery capacity utilization rate increased from 62% in the first half of the year to 70%.

This also made the cash flow from operating activities in the Ningde era continue to be strong, reaching 15.58 billion yuan at the end of the third quarter, an increase of 113.8% over the same period, which is still higher than the net profit level for the same period.

It is worth noting that in the third quarter of this year, the number of inventory turnover days and contract liabilities of the Ningde era were 73.86 days and contract liabilities of the Ningde era, respectively. The former was a new low in the past five years, while the latter reached a record high. It can be seen that demand for terminal new energy vehicles remains strong, and most end customers are still willing to pay for purchases in advance to quickly obtain power battery products.

3. Thunderstorm is false, but we need to be wary of the continued decline in domestic market share in the Ningde era

In the first three quarters of this year, although the Ningde Era still won the title of domestic power battery installed volume, its overall market share has declined to 42.75%, a year-on-year decline of 4.76 percentage points. The glory that once occupied half of the domestic power battery market is no longer replicated.

It is worth noting that in the latest September power battery market, the market share of the Ningde era fell below 40% to 39.41% for the first time in the year. The former one-family pattern in the Ningde era has been completely broken. Now the domestic market has entered a new situation where power battery manufacturers such as BYD, China Innovation Airlines, and Everweft Lithium Energy are collectively competing.

Specifically, the challengers of the Ningde era each had advantages. Among them, the second BYD relied on the increase in the sales volume of its new energy vehicle products and continued to expand the capacity of its own power batteries through its own production and self-sale of batteries. The market share in the first three quarters of this year reached 28.94%, an increase of 6.71 percentage points over the previous year.

Innovation Airlines is betting on lithium iron phosphate batteries and ternary lithium batteries. In these two fields, it closely followed the era of BYD and Ningde, respectively, and won some orders from new energy vehicle companies such as GAC Aian, Xiaopeng, and Deep Blue through a low price advantage. Benefiting from big sales of popular models such as Xiaopeng's G6 and GAC Aion Aion's Aion Y, China Airlines also increased 2.04 percentage points to 8.92% in the first three quarters of this year.

In addition to maintaining close ties with domestic new energy vehicle companies such as GAC Aian, Xiaopeng Motor, and Nacha Automobile, etc., the old 400 million weft lithium energy energy energy energy energy has also tightened the legs of the overseas car giant BMW Motor and enjoyed the power battery orders for BMW's 70 GWh seats with the big brother Ningde Era. This represents the recognition of Everweft lithium power battery products in overseas markets, and greatly strengthened the popularity of Everweft lithium energy.

In the first three quarters of this year, Everweft Lithium Energy's power battery market share reached 4.3%, defeating four competitors in a row, Honeycomb Energy, LG New Energy, Sunwoda, and Guoxuan Hi-Tech, increasing by 2.02 percentage points over the previous year to fourth place.

Of course, from a global perspective, the market share of the Ningde era did not decrease but increase. In January-August of this year, the global market share of power batteries of the Ningde era increased by 1.3 percentage points to 36.9%. Among them, the share of the European market reached 34.9%, an increase of 8.1 percentage points over the previous year, and the market share of power batteries in regions other than China, the US and Europe reached 27.2%, a sharp increase of 9.8 percentage points over the previous year.

In summary, in the third quarter of this year, the performance of the Ningde era was not as good as expected, yet it was far from a thunderstorm. Apart from objective impairment and exchange losses, overall business development and profit plans have not had any impact; on the contrary, the decline in domestic market share is worth being wary of.

Fortunately, in the later stages, with the Ningde era, the focus gradually shifted to overseas markets. After the Ningde era gradually implemented overseas battery factories of up to 120 GWh in Thuringia in Germany and Debrecen in Hungary, and cooperative construction between the US and Ford, etc., the new markets developed are expected to continue to bring new growth points to the Ningde era.