We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Honma Golf Limited's (HKG:6858) CEO For Now

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Honma Golf Limited's (HKG:6858) CEO For Now

Key Insights

主要見解

- Honma Golf's Annual General Meeting to take place on 15th of September

- CEO Jianguo Liu's total compensation includes salary of JP¥32.4m

- Total compensation is 38% above industry average

- Over the past three years, Honma Golf's EPS grew by 76% and over the past three years, the total shareholder return was 19%

- 本馬高爾夫公司年度大會將於9月15日舉行

- 首席執行官劉建國的總薪酬包括3240萬元的JP工資

- 總薪酬比行業平均水準高出38%

- 過去三年,Honma Golf的每股收益增長了76%,過去三年的總股東回報率為19%

Under the guidance of CEO Jianguo Liu, Honma Golf Limited (HKG:6858) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 15th of September. However, some shareholders may still want to keep CEO compensation within reason.

在首席執行官劉建國的指導下,本馬高爾夫有限公司(HKG:6858)最近表現相當不錯。鑑於這一表現,CEO薪酬可能不會是股東們在9月15日舉行的年度股東大會上的主要關注點。然而,一些股東可能仍希望將CEO的薪酬控制在合理範圍內。

Check out our latest analysis for Honma Golf

查看我們對Honma Golf的最新分析

How Does Total Compensation For Jianguo Liu Compare With Other Companies In The Industry?

劉建國的總薪酬與業內其他公司相比如何?

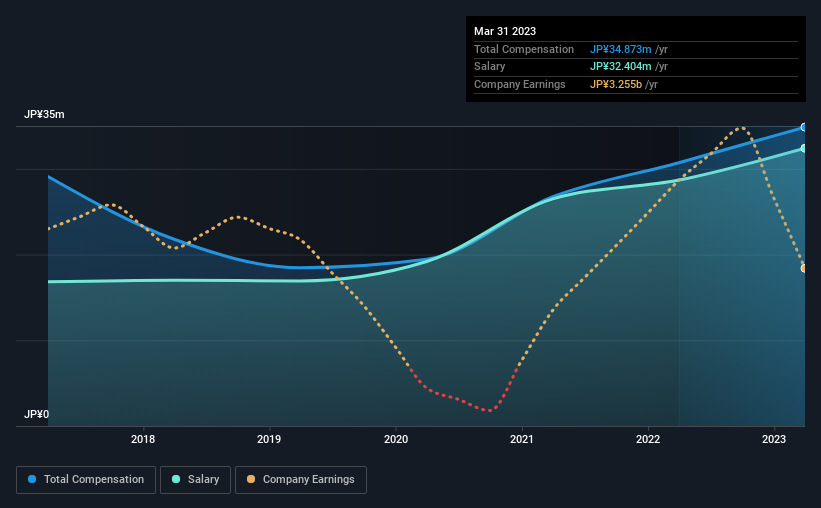

Our data indicates that Honma Golf Limited has a market capitalization of HK$2.0b, and total annual CEO compensation was reported as JP¥35m for the year to March 2023. Notably, that's an increase of 14% over the year before. Notably, the salary which is JP¥32.4m, represents most of the total compensation being paid.

我們的數據顯示,本馬高爾夫有限公司的市值為20億港元,截至2023年3月的一年,首席執行官的年薪總額為3500萬元人民幣。值得注意的是,這比前一年增長了14%。值得注意的是,摩根大通3240萬元的薪酬佔到了全部薪酬的大部分。

On examining similar-sized companies in the Hong Kong Leisure industry with market capitalizations between HK$784m and HK$3.1b, we discovered that the median CEO total compensation of that group was JP¥25m. Hence, we can conclude that Jianguo Liu is remunerated higher than the industry median. Moreover, Jianguo Liu also holds HK$761m worth of Honma Golf stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

在考察了香港休閒行業市值在7.84億港元至31億港元之間的類似規模的公司後,我們發現,這類公司首席執行官的總薪酬中值為2500萬元。因此,我們可以得出結論,劉建國的薪酬高於行業中位數。此外,劉建國還直接以自己的名義持有價值7.61億港元的Honma Golf股票,這向我們表明,他們在該公司擁有相當大的個人股份。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | JP¥32m | JP¥29m | 93% |

| Other | JP¥2.5m | JP¥2.0m | 7% |

| Total Compensation | JP¥35m | JP¥31m | 100% |

| 元件 | 2023年年 | 2022 | 比例(2023年) |

| 薪金 | 太平紳士3200萬元 | 太平紳士2900萬元 | 93% |

| 其他 | JP人民幣250萬元 | 太平紳士200萬元 | 7% |

| 全額補償 | 太平紳士3500萬元 | 太平紳士3100萬元 | 100% |

Speaking on an industry level, nearly 93% of total compensation represents salary, while the remainder of 7% is other remuneration. There isn't a significant difference between Honma Golf and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

從行業層面來看,近93%的薪酬是工資,其餘7%是其他薪酬。就整體薪酬方案中的薪酬分配而言,本馬高爾夫與大盤並無顯著差異。如果薪酬是總薪酬的主要組成部分,這表明無論業績如何,首席執行官都應該獲得更高的固定比例的總薪酬。

A Look at Honma Golf Limited's Growth Numbers

本馬高爾夫有限公司增長數位一瞥

Over the past three years, Honma Golf Limited has seen its earnings per share (EPS) grow by 76% per year. In the last year, its revenue is up 1.8%.

在過去的三年裡,Honma Golf Limited的每股收益(EPS)以每年76%的速度增長。去年,它的收入增長了1.8%。

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

這表明公司最近一直在改善,對股東來說是個好消息。營收小幅增長也是件好事,這表明基本業務是健康的。雖然我們沒有分析師對該公司的預測,但股東們可能想看看這張關於收益、收入和現金流的詳細歷史曲線圖。

Has Honma Golf Limited Been A Good Investment?

本馬高爾夫有限公司是一筆不錯的投資嗎?

With a total shareholder return of 19% over three years, Honma Golf Limited shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

由於三年來股東的總回報率為19%,Honma Golf Limited的股東總體上會相當滿意。但他們可能不希望看到CEO的薪酬遠遠超過中位數。

In Summary...

總結一下..。

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

鑑於該公司的整體業績一直是合理的,CEO薪酬政策可能不是股東在即將到來的年度股東大會上的核心焦點。儘管如此,並非所有股東都贊成給CEO加薪,因為他們的薪酬已經高於行業。

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Honma Golf that you should be aware of before investing.

雖然CEO薪酬是一個需要注意的重要因素,但投資者也應該注意其他領域。這就是為什麼我們做了一些挖掘並確定了本馬高爾夫球場的2個警示標誌在投資之前你應該意識到這一點。

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

當然了,通過觀察不同的股票組合,你可能會發現這是一項非常棒的投資。所以讓我們來看看這個免費有趣的公司名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.