Some Confidence Is Lacking In First Sponsor Group Limited's (SGX:ADN) P/E

Some Confidence Is Lacking In First Sponsor Group Limited's (SGX:ADN) P/E

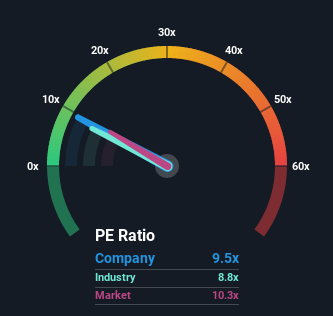

It's not a stretch to say that First Sponsor Group Limited's (SGX:ADN) price-to-earnings (or "P/E") ratio of 9.5x right now seems quite "middle-of-the-road" compared to the market in Singapore, where the median P/E ratio is around 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

這麼說一點也不牽強第一贊助商集團有限公司新加坡證券交易所(SGX:ADN)的本益比(或“本益比”)目前為9.5倍,與新加坡市場相比,似乎相當“中等”,新加坡的本益比中值約為10倍。儘管如此,在沒有解釋的情況下簡單地忽視本益比是不明智的,因為投資者可能會忽視一個獨特的機會或代價高昂的錯誤。

First Sponsor Group could be doing better as it's been growing earnings less than most other companies lately. One possibility is that the P/E is moderate because investors think this lacklustre earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

第一贊助商集團可能會做得更好,因為它最近的收益增長低於大多數其他公司。一種可能性是,本益比是溫和的,因為投資者認為這種平淡無奇的收益表現將會好轉。如果不是,那麼現有股東可能會對股價的生存能力感到有點緊張。

Check out our latest analysis for First Sponsor Group

查看我們對第一贊助商集團的最新分析

What Are Growth Metrics Telling Us About The P/E?

增長指標告訴我們關於本益比的哪些資訊?

There's an inherent assumption that a company should be matching the market for P/E ratios like First Sponsor Group's to be considered reasonable.

有一種固有的假設,即一家公司應該與市場匹配,才能讓第一贊助商集團這樣的本益比被認為是合理的。

If we review the last year of earnings growth, the company posted a worthy increase of 5.5%. However, this wasn't enough as the latest three year period has seen an unpleasant 23% overall drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

如果我們回顧去年的收益增長,該公司公佈了5.5%的合理增長。然而,這還不夠,因為在最近三年的時間裡,每股收益下降了23%,令人不快。因此,公平地說,最近的收益增長對公司來說是不可取的。

Turning to the outlook, the next year should bring plunging returns, with earnings decreasing 26% as estimated by the one analyst watching the company. With the rest of the market predicted to shrink by 1.1%, it's a sub-optimal result.

談到前景,明年的回報率應該會大幅下降,據一位關注該公司的分析師估計,收益將下降26%。鑑於其他市場預計將縮水1.1%,這是一個次優的結果。

With this information, it's perhaps strange that First Sponsor Group is trading at a fairly similar P/E in comparison. With earnings going quickly in reverse, it's not guaranteed that the P/E has found a floor yet. There's potential for the P/E to fall to lower levels if the company doesn't improve its profitability.

有了這些資訊,第一贊助商集團的本益比可能會很奇怪,相比之下,它的本益比相當相似。隨著盈利的快速逆轉,還不能保證本益比已經觸底。如果該公司不提高盈利能力,本益比有可能降至更低水準。

What We Can Learn From First Sponsor Group's P/E?

我們可以從第一贊助商集團的本益比中學到什麼?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

我們會說,本益比的力量主要不是作為一種估值工具,而是衡量當前投資者的情緒和未來預期。

Our examination of First Sponsor Group's analyst forecasts revealed that its even shakier outlook against the market isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook, we suspect the share price is at risk of declining, sending the moderate P/E lower. In addition, we would be concerned whether the company can even maintain this level of performance under these tough market conditions. Unless the company's prospects improve, it's challenging to accept these prices as being reasonable.

我們對第一保薦人集團的分析師預測進行了研究,結果顯示,該公司對市場前景的不穩定對其本益比的影響並不像我們之前預測的那麼大。當我們看到疲弱的盈利前景時,我們懷疑股價有下跌的風險,導致溫和的本益比下降。此外,我們會擔心該公司能否在這些艱難的市場條件下保持這樣的業績水準。除非公司的前景有所改善,否則很難接受這些價格是合理的。

Plus, you should also learn about these 4 warning signs we've spotted with First Sponsor Group (including 2 which shouldn't be ignored).

另外,你還應該瞭解這些我們在First贊助商集團發現了4個警告信號(包括不可忽視的2個)。

If these risks are making you reconsider your opinion on First Sponsor Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果這些風險讓你重新考慮對First贊助商集團的看法,探索我們的高質量股票互動列表,以瞭解還有什麼。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫。或者,也可以給編輯組發電子郵件,地址是implywallst.com。

本文由Simply Wall St.撰寫,具有概括性。我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議。它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況。我們的目標是為您帶來由基本面數據驅動的長期重點分析。請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內。Simply Wall St.對上述任何一隻股票都沒有持倉。