Mr. Xie Zhikun, founder of Zhongzhi Enterprise Group, died at 09:40 in Beijing on December 18 at the age of 61, according to an obituary posted on the official website of Zhongzhi Enterprise Group on the evening of December 18.

According to public data, Xie Zhikun, who was born in 1961, founded Zhongzhi Group in Beijing in 1995 and has worked in finance for nearly 20 years. From April 1995 to June 2000, he served as chairman of Zhongzhi Enterprise Group Co., Ltd., and served as chairman of the board of directors of Zhongzhi Group from June 2006 to June 2015.

"trillion" medium plant system

At present, Zhongzhi Enterprise Group has formed a dual-main business model of "industry and finance", and has gradually developed into a comprehensive enterprise group covering real industry, asset management, financial services, wealth management and other fields, with assets of more than one trillion yuan.

Because of the large number of controlled enterprises and involving a number of listed companies and licensed financial institutions, the market refers to the enterprises controlled by Zhongzhi Enterprise Group as "Zhongzhu system".

In the industrial sector, Zhongzhi Enterprise Group relies on ten listed companies and unicorn cultivation platform, vigorously develop semiconductor, big data, big consumption, big health, early childhood education, new energy vehicles, ecological environmental protection, enterprise outsourcing services and other industry leaders. In Inner Mongolia, Shanxi, Guizhou, Yunnan and other provinces (regions), there have been proved coal reserves of 4.5 billion tons, involving more than 30 mining and exploration rights, including main coking coal, coking coal, anthracite, etc., with a design production capacity of more than 20 million tons per year. Metal and non-metallic minerals are found in 12 provinces in China, with a potential value of more than 1200 billion yuan, including gold, silver, copper, iron, tungsten, manganese, lithium, sand aggregate and so on.

In the financial sector, Zhongzhi Group strategically holds or participates in six licensed financial institutions, including Zhongrong Trust, Zhongrong Fund, Hengqin Life Insurance, Hengbang property Insurance, Zhongrong Credit Futures and Tiankejia Pawnshop. Holding or participating in five asset management companies, including China Shipping, Zhongzhi International, Zhongxin Rongchuang, Zhongzhi Capital and Shoutuo Rongsheng, covering real estate management, distressed asset management, mixed reform of state-owned enterprises, mergers and acquisitions and private equity investment. Holding or participating in four wealth management companies, namely Hengtian Wealth, New Lake Wealth, Datang Wealth and Gao Sheng Wealth.

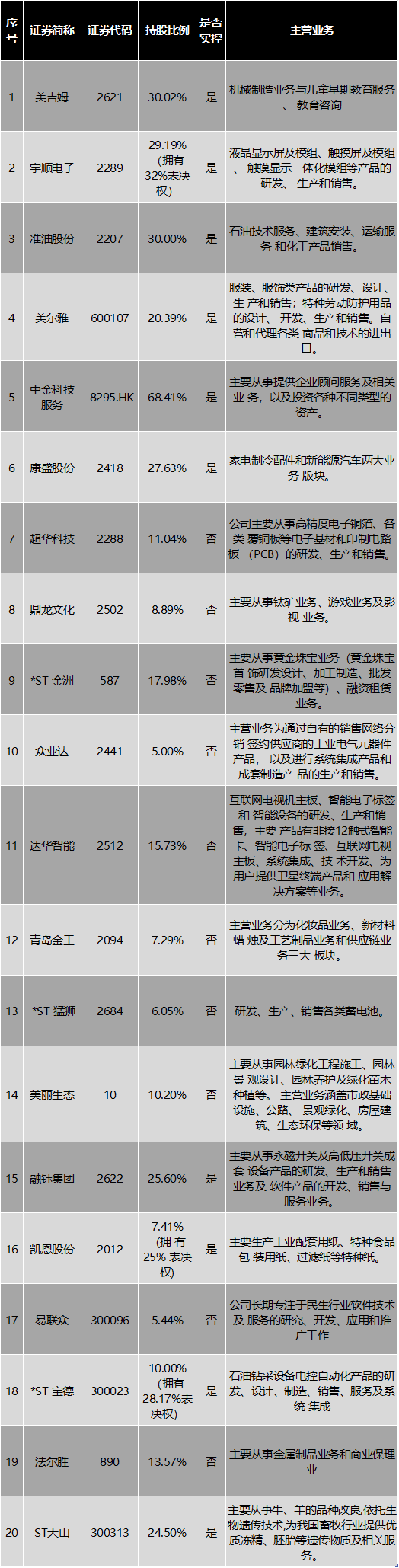

Xie Zhikun controls 10 listed companies

The reporter consulted the detailed rights and interests change report issued by ST Tianshan in September this year. The report claims that the company's new actual controller, Xie Zhikun, has interests in domestic and overseas listed companies up to or more than 5% of the company's issued shares, among which the A-share listed companies actually controlled include Kane shares, MeiJim, Mel Ya, Yushun Electronics, quasi-Oil shares, Kangsheng shares, Rongyu Group, * ST Baode. Listed companies in Hong Kong include CICC Technology Services (formerly known as Zhongzhi Capital International).

In addition, in September this year, "Zhongzhan" also won the real control of ST Tianshan through judicial auction.

In 2021, Xie Zhikun ranked 241st on the Hurun Rich list with a net worth of 26 billion.

Form: listed companies that Jie Zhikun actually controls and invests

Form: financial institutions that Zhikun actually controls and invests

Edit / Ray