Is Now The Time To Put Westamerica Bancorporation (NASDAQ:WABC) On Your Watchlist?

Is Now The Time To Put Westamerica Bancorporation (NASDAQ:WABC) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Westamerica Bancorporation (NASDAQ:WABC). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Westamerica Bancorporation with the means to add long-term value to shareholders.

How Fast Is Westamerica Bancorporation Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Westamerica Bancorporation has managed to grow EPS by 24% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

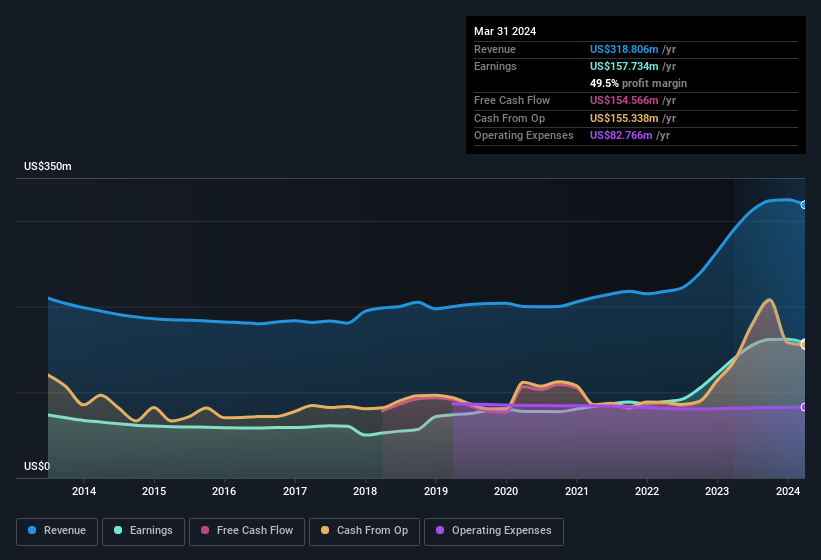

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Westamerica Bancorporation's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note Westamerica Bancorporation achieved similar EBIT margins to last year, revenue grew by a solid 9.8% to US$319m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Westamerica Bancorporation's forecast profits?

Are Westamerica Bancorporation Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Westamerica Bancorporation insiders have a significant amount of capital invested in the stock. With a whopping US$60m worth of shares as a group, insiders have plenty riding on the company's success. This would indicate that the goals of shareholders and management are one and the same.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Westamerica Bancorporation with market caps between US$1.0b and US$3.2b is about US$5.7m.

The Westamerica Bancorporation CEO received total compensation of just US$759k in the year to December 2023. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Westamerica Bancorporation Deserve A Spot On Your Watchlist?

You can't deny that Westamerica Bancorporation has grown its earnings per share at a very impressive rate. That's attractive. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. The overarching message here is that Westamerica Bancorporation has underlying strengths that make it worth a look at. It is worth noting though that we have found 1 warning sign for Westamerica Bancorporation that you need to take into consideration.

Although Westamerica Bancorporation certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.