With L3Harris Technologies, Inc. (NYSE:LHX) It Looks Like You'll Get What You Pay For

With L3Harris Technologies, Inc. (NYSE:LHX) It Looks Like You'll Get What You Pay For

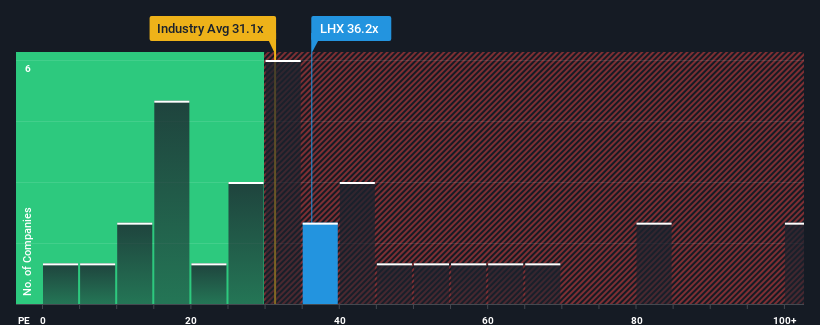

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider L3Harris Technologies, Inc. (NYSE:LHX) as a stock to avoid entirely with its 36.2x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

當將近一半的美國公司的市盈率(或 “市盈率”)低於17倍時,你可以將L3Harris Technologies, Inc.(紐約證券交易所代碼:LHX)視爲股票,以其36.2倍的市盈率完全避免。但是,市盈率可能相當高是有原因的,需要進一步調查以確定其是否合理。

With its earnings growth in positive territory compared to the declining earnings of most other companies, L3Harris Technologies has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors' willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

與大多數其他公司的收益下降相比,L3Harris Technologies的收益增長處於正值區間,最近表現良好。看來許多人預計該公司將繼續克服更廣泛的市場逆境,這增加了投資者購買股票的意願。你真的希望如此,否則你會無緣無故地付出相當大的代價。

NYSE:LHX Price to Earnings Ratio vs Industry May 21st 2024

紐約證券交易所:LHX 與行業的市盈率 2024 年 5 月 21 日

Want the full picture on analyst estimates for the company? Then our free report on L3Harris Technologies will help you uncover what's on the horizon.

想全面了解分析師對公司的估計嗎?那麼我們關於L3Harris Technologies的免費報告將幫助你發現即將發生的事情。

What Are Growth Metrics Telling Us About The High P/E?

關於高市盈率,增長指標告訴我們什麼?

The only time you'd be truly comfortable seeing a P/E as steep as L3Harris Technologies' is when the company's growth is on track to outshine the market decidedly.

只有當公司的增長有望明顯超過市場時,你才能真正放心地看到像L3Harris Technologies一樣高的市盈率。

Taking a look back first, we see that the company grew earnings per share by an impressive 28% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 4.7% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

首先回顧一下,我們發現該公司去年的每股收益增長了令人印象深刻的28%。但是,這還不夠,因爲在最近三年中,每股收益總共下降了4.7%,非常令人不快。因此,不幸的是,我們必須承認,在這段時間內,該公司在增加收益方面做得不好。

Looking ahead now, EPS is anticipated to climb by 27% each year during the coming three years according to the analysts following the company. With the market only predicted to deliver 10% per annum, the company is positioned for a stronger earnings result.

根據關注該公司的分析師的說法,展望未來,預計未來三年每股收益將每年增長27%。由於預計市場每年僅實現10%的收益,該公司有望實現更強勁的盈利業績。

In light of this, it's understandable that L3Harris Technologies' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

有鑑於此,L3Harris Technologies的市盈率高於其他大多數公司是可以理解的。看來大多數投資者都在期待這種強勁的未來增長,並願意爲該股支付更多費用。

What We Can Learn From L3Harris Technologies' P/E?

我們可以從L3Harris Technologies的市盈率中學到什麼?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

我們可以說,市盈率的力量主要不是作爲估值工具,而是衡量當前投資者情緒和未來預期。

As we suspected, our examination of L3Harris Technologies' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

正如我們所懷疑的那樣,我們對L3Harris Technologies分析師預測的審查顯示,其優異的盈利前景是其高市盈率的原因。在現階段,投資者認爲,收益惡化的可能性不足以證明降低市盈率是合理的。除非這些條件發生變化,否則它們將繼續爲股價提供強有力的支撐。

We don't want to rain on the parade too much, but we did also find 3 warning signs for L3Harris Technologies (1 can't be ignored!) that you need to be mindful of.

我們不想在遊行隊伍中下太多雨,但我們還發現了 L3Harris Technologies 的 3 個警告標誌(1 個不容忽視!)你需要注意的。

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

當然,通過尋找一些優秀的候選人,你可能會找到一筆不錯的投資。因此,來看看這份增長記錄強勁、市盈率低的公司的免費名單吧。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接聯繫我們。或者,也可以發送電子郵件至編輯團隊 (at) simplywallst.com。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。