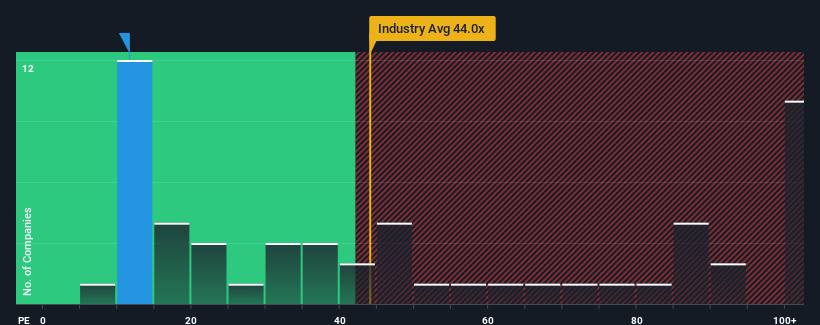

Chinese Universe Publishing and Media Group Co., Ltd.'s (SHSE:600373) price-to-earnings (or "P/E") ratio of 11.6x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 33x and even P/E's above 61x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent earnings growth for Chinese Universe Publishing and Media Group has been in line with the market. It might be that many expect the mediocre earnings performance to degrade, which has repressed the P/E. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Chinese Universe Publishing and Media Group's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Regardless, EPS has managed to lift by a handy 9.1% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 12% over the next year. With the market predicted to deliver 38% growth , the company is positioned for a weaker earnings result.

With this information, we can see why Chinese Universe Publishing and Media Group is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Chinese Universe Publishing and Media Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Chinese Universe Publishing and Media Group that you should be aware of.

If these risks are making you reconsider your opinion on Chinese Universe Publishing and Media Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.