Louisiana-Pacific Corporation (NYSE:LPX) Looks Just Right With A 27% Price Jump

Louisiana-Pacific Corporation (NYSE:LPX) Looks Just Right With A 27% Price Jump

Despite an already strong run, Louisiana-Pacific Corporation (NYSE:LPX) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days bring the annual gain to a very sharp 50%.

儘管已經表現強勁,但路易斯安那太平洋公司(紐約證券交易所代碼:LPX)的股價一直在上漲,在過去三十天中上漲了27%。過去30天使年增長率達到非常大幅的50%。

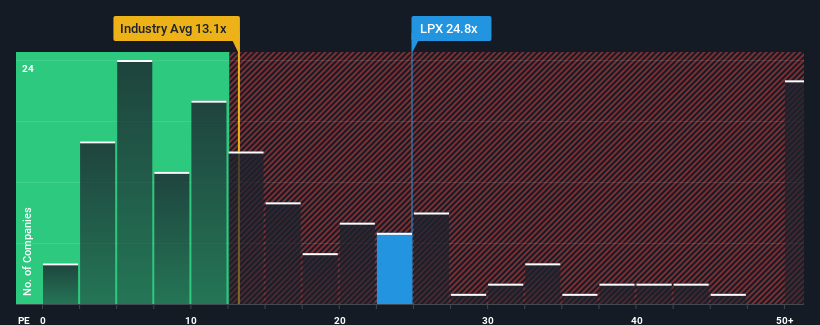

Since its price has surged higher, given around half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider Louisiana-Pacific as a stock to potentially avoid with its 24.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

由於其價格飆升,鑑於美國約有一半的公司的市盈率(或 “市盈率”)低於17倍,您可以將路易斯安那太平洋公司的市盈率視爲可能避開的股票,其市盈率爲24.8倍。但是,僅按面值計算市盈率是不明智的,因爲可以解釋爲什麼市盈率如此之高。

Recent times haven't been advantageous for Louisiana-Pacific as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

最近對路易斯安那太平洋公司來說並不是有利的,因爲其收益的下降速度比大多數其他公司快。許多人可能預計,慘淡的收益表現將大幅恢復,這阻止了市盈率的暴跌。你真的希望如此,否則你會無緣無故地付出相當大的代價。

NYSE:LPX Price to Earnings Ratio vs Industry May 21st 2024

紐約證券交易所:LPX 與行業的市盈率 2024 年 5 月 21 日

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Louisiana-Pacific.

如果你想了解分析師對未來的預測,你應該查看我們關於路易斯安那-太平洋的免費報告。

Does Growth Match The High P/E?

增長與高市盈率相匹配嗎?

The only time you'd be truly comfortable seeing a P/E as high as Louisiana-Pacific's is when the company's growth is on track to outshine the market.

只有當公司的增長有望超越市場時,你才能真正放心地看到像路易斯安那太平洋公司一樣高的市盈率。

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 44%. As a result, earnings from three years ago have also fallen 48% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

首先回顧一下,該公司去年的每股收益增長並不令人興奮,因爲它公佈了令人失望的44%的跌幅。結果,三年前的總體收益也下降了48%。因此,可以公平地說,最近的收益增長對公司來說是不可取的。

Looking ahead now, EPS is anticipated to climb by 19% per year during the coming three years according to the eleven analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 10% per annum, which is noticeably less attractive.

根據關注該公司的11位分析師的說法,展望未來,預計未來三年每股收益將每年增長19%。同時,預計其餘市場每年僅增長10%,這明顯降低了吸引力。

In light of this, it's understandable that Louisiana-Pacific's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

有鑑於此,路易斯安那太平洋的市盈率高於其他大多數公司是可以理解的。看來大多數投資者都在期待這種強勁的未來增長,並願意爲該股支付更多費用。

The Final Word

最後一句話

Louisiana-Pacific shares have received a push in the right direction, but its P/E is elevated too. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

路易斯安那太平洋的股票已經朝着正確的方向發展,但其市盈率也有所上升。通常,我們的傾向是將市盈率的使用限制在確定市場對公司整體健康狀況的看法上。

We've established that Louisiana-Pacific maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

我們已經確定,路易斯安那太平洋保持高市盈率,原因是其預期的增長將高於整個市場。在現階段,投資者認爲,收益惡化的可能性不足以證明降低市盈率是合理的。在這種情況下,很難看到股價在不久的將來會強勁下跌。

We don't want to rain on the parade too much, but we did also find 2 warning signs for Louisiana-Pacific that you need to be mindful of.

我們不想在遊行隊伍中下太多雨,但我們也確實發現了路易斯安那太平洋地區的兩個警示標誌,你需要注意。

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

重要的是要確保你尋找一家優秀的公司,而不僅僅是你遇到的第一個想法。因此,來看看這份免費名單,列出了最近收益增長強勁(市盈率低)的有趣公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接聯繫我們。或者,也可以發送電子郵件至編輯團隊 (at) simplywallst.com。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。