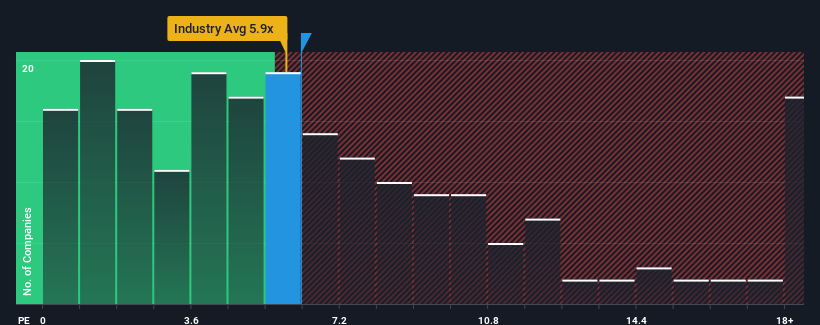

There wouldn't be many who think Bestechnic (Shanghai) Co., Ltd.'s (SHSE:688608) price-to-sales (or "P/S") ratio of 6.3x is worth a mention when the median P/S for the Semiconductor industry in China is similar at about 5.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Has Bestechnic (Shanghai) Performed Recently?

Recent times have been advantageous for Bestechnic (Shanghai) as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Bestechnic (Shanghai)'s future stacks up against the industry? In that case, our free report is a great place to start.How Is Bestechnic (Shanghai)'s Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Bestechnic (Shanghai)'s is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 55% gain to the company's top line. Pleasingly, revenue has also lifted 100% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 23% during the coming year according to the nine analysts following the company. That's shaping up to be materially lower than the 36% growth forecast for the broader industry.

With this in mind, we find it intriguing that Bestechnic (Shanghai)'s P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given that Bestechnic (Shanghai)'s revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Bestechnic (Shanghai) with six simple checks.

If these risks are making you reconsider your opinion on Bestechnic (Shanghai), explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.