A Closer Look at Agnico Eagle Mines's Options Market Dynamics

A Closer Look at Agnico Eagle Mines's Options Market Dynamics

Financial giants have made a conspicuous bullish move on Agnico Eagle Mines. Our analysis of options history for Agnico Eagle Mines (NYSE:AEM) revealed 9 unusual trades.

金融巨頭對Agnico Eagle Mines採取了明顯的看漲舉動。我們對Agnico Eagle Mines(紐約證券交易所代碼:AEM)期權歷史的分析顯示了9筆不尋常的交易。

Delving into the details, we found 55% of traders were bullish, while 22% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $202,981, and 6 were calls, valued at $474,958.

深入研究細節後,我們發現55%的交易者看漲,而22%的交易者表現出看跌趨勢。在我們發現的所有交易中,有3筆是看跌期權,價值爲202,981美元,6筆是看漲期權,價值474,958美元。

What's The Price Target?

目標價格是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $45.0 to $80.0 for Agnico Eagle Mines over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將Agnico Eagle Mines的價格定在45.0美元至80.0美元之間。

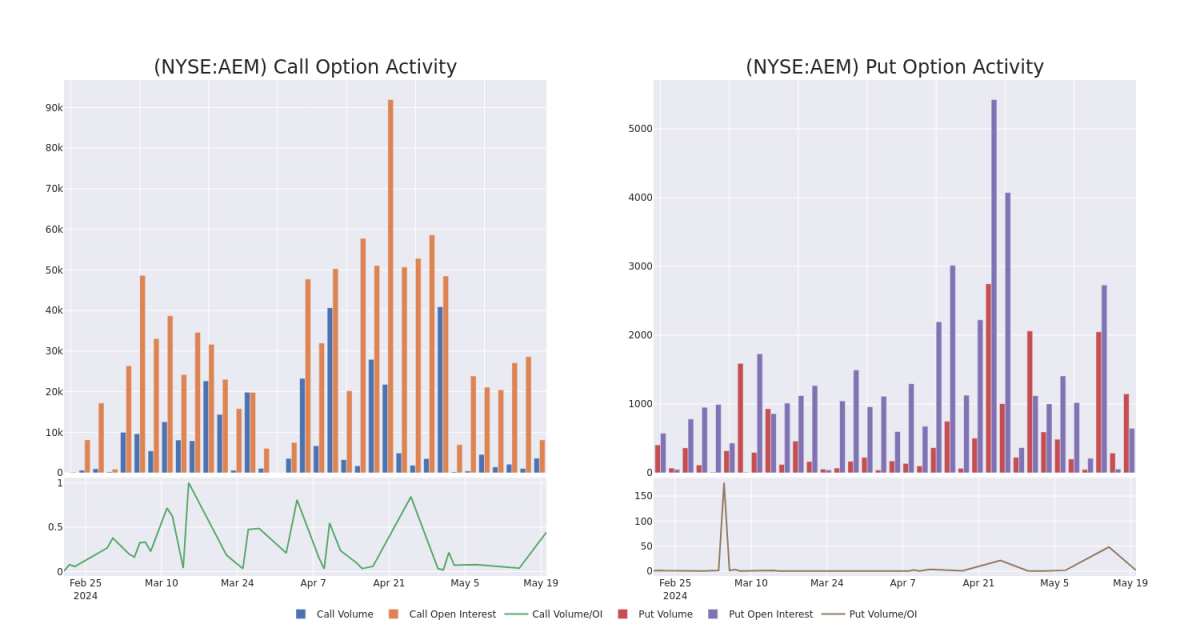

Volume & Open Interest Trends

交易量和未平倉合約趨勢

In today's trading context, the average open interest for options of Agnico Eagle Mines stands at 1753.8, with a total volume reaching 4,752.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Agnico Eagle Mines, situated within the strike price corridor from $45.0 to $80.0, throughout the last 30 days.

在當今的交易背景下,Agnico Eagle Mines期權的平均未平倉合約爲1753.8,總交易量達到4,752.00。隨附的圖表描繪了過去30天Agnico Eagle Mines高價值交易的看漲期權和看跌期權交易量以及未平倉合約的變化,這些交易位於行使價走廊內,從45.0美元到80.0美元。

Agnico Eagle Mines 30-Day Option Volume & Interest Snapshot

Agnico Eagle Mines 30 天期權交易量和利息快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AEM | CALL | SWEEP | BULLISH | 08/16/24 | $1.65 | $1.55 | $1.65 | $80.00 | $165.0K | 1.1K | 1.3K |

| AEM | PUT | SWEEP | BULLISH | 01/17/25 | $5.9 | $5.8 | $5.9 | $70.00 | $125.1K | 646 | 300 |

| AEM | CALL | SWEEP | BULLISH | 11/15/24 | $7.2 | $7.0 | $7.12 | $70.00 | $111.8K | 2.2K | 166 |

| AEM | CALL | TRADE | BEARISH | 06/21/24 | $16.2 | $16.0 | $16.0 | $55.00 | $72.0K | 3.8K | 100 |

| AEM | CALL | SWEEP | BULLISH | 08/16/24 | $1.7 | $1.6 | $1.7 | $80.00 | $62.0K | 1.1K | 1.8K |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AEM | 打電話 | 掃 | 看漲 | 08/16/24 | 1.65 美元 | 1.55 美元 | 1.65 美元 | 80.00 美元 | 165.0K | 1.1K | 1.3K |

| AEM | 放 | 掃 | 看漲 | 01/17/25 | 5.9 美元 | 5.8 美元 | 5.9 美元 | 70.00 美元 | 125.1K | 646 | 300 |

| AEM | 打電話 | 掃 | 看漲 | 11/15/24 | 7.2 美元 | 7.0 美元 | 7.12 美元 | 70.00 美元 | 111.8 萬美元 | 2.2K | 166 |

| AEM | 打電話 | 貿易 | 粗魯的 | 06/21/24 | 16.2 美元 | 16.0 美元 | 16.0 美元 | 55.00 美元 | 72.0 萬美元 | 3.8K | 100 |

| AEM | 打電話 | 掃 | 看漲 | 08/16/24 | 1.7 美元 | 1.6 美元 | 1.7 美元 | 80.00 美元 | 62.0 萬美元 | 1.1K | 1.8K |

About Agnico Eagle Mines

關於 Agnico Eagle Mines

Agnico Eagle is a gold miner with mines in Canada, Mexico, Finland, and Australia. Agnico operated just one mine, LaRonde, as recently as 2008 before bringing its other mines online in rapid succession in the following years. It merged with Kirkland Lake Gold in 2022, acquiring the Detour Lake and Macassa mines in Canada along with the high-grade, low-cost Fosterville mine in Australia. It produced more than 3.4 million gold ounces in 2023 and had about 15 years of gold reserves at end 2023. Agnico Eagle is focused on increasing gold production in lower-risk jurisdictions and bought the remaining 50% of its Canadian Malartic mine along with the Wasamac project and other assets from Yamana Gold in 2023.

Agnico Eagle 是一家金礦開採商,在加拿大、墨西哥、芬蘭和澳大利亞都有礦山。Agnico在2008年僅運營了一座礦山,即LaRonde,然後在接下來的幾年中迅速連續將其其他礦山投入運營。它於2022年與柯克蘭湖黃金公司合併,收購了加拿大的德圖爾湖和馬卡薩礦以及澳大利亞的高品位、低成本的福斯特維爾礦。它在2023年生產了超過340萬盎司的黃金,到2023年底擁有約15年的黃金儲備。Agnico Eagle專注於提高風險較低司法管轄區的黃金產量,並於2023年從雅馬納黃金手中收購了其剩餘的50%加拿大馬拉蒂克礦以及瓦薩馬克項目和其他資產。

Present Market Standing of Agnico Eagle Mines

Agnico Eagle Mines目前的市場地位

- With a trading volume of 1,177,212, the price of AEM is down by -0.16%, reaching $70.0.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 65 days from now.

- AEM的交易量爲1,177,212美元,下跌了-0.16%,至70.0美元。

- 當前的RSI值表明該股可能已被超買。

- 下一份收益報告定於65天后發佈。

Professional Analyst Ratings for Agnico Eagle Mines

Agnico Eagle Mines 的專業分析師評級

1 market experts have recently issued ratings for this stock, with a consensus target price of $80.0.

1位市場專家最近發佈了該股的評級,共識目標價爲80.0美元。

- Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Agnico Eagle Mines with a target price of $80.

- 花旗集團的一位分析師在評估中保持了對Agnico Eagle Mines的買入評級,目標價爲80美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Agnico Eagle Mines with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解Agnico Eagle Mines的最新期權交易,以獲取實時警報。