Full of impetus

Domestic pig prices have “risen sharply” since mid-May. The price of pigs in many parts of the country rose to 8 yuan, and the average price also rose to 15.77 yuan/kg. Compared with the increase of about 1 yuan at the beginning of the month, the increase was as high as 6.34%.

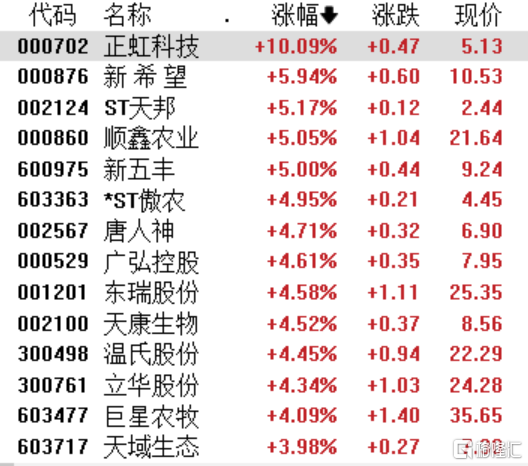

Today, the A-share pork sector is also showing impressive gains. Zhenghong Technology has risen and stopped; New Hope, ST Tianbang, and Xinwufeng have risen more than 5%; Tang Renshen, Dongrui shares, *ST Aonong, and Wen's shares have risen by more than 4%, while Muyuan shares, Jin Xinnong, and Huatong shares have risen one after another.

In addition to this, in April of this year, the Ministry of Agriculture and Rural Affairs stated thatThe supply and demand relationship in the pig market will further improve in the second quarter of this year, and pig farming may turn losses into profits.Against all kinds of backgrounds, is the “Two Brothers” about to take off?

A number of pig companies disclosed sales data for April

Recently, many listed pig companies, including Makihara, Dabeinong, Wen's Co., Ltd., and New Hope, have successively disclosed their April sales reports. Among them, the average sales prices of many companies are rising month-on-month, which is also seen by the industry as a sign that the pig market is improving.

Let's take a look specifically:

withMakihara Co., Ltd.For example, 5.45 million pigs were sold in April, including 4.33 million commercial pigs, 1.05 million piglets, 70,000 breeding pigs, and sales revenue of 9.153 billion yuan. In addition, the company's commercial pig price increased in April compared to March 2024. The average sales price of commercial pigs was 14.80 yuan/kg, up 3.93% from March 2024.

A New HopeIn April, sales of 1.476,200 pigs were sold, a decrease of 3.23% from the previous month and a decrease of 6.21% from the previous year. It is worth mentioning that after hitting a new low in December last year, the average sales price of New Hope's commercial pigs has continued to improve since 2024. In April of this year, it has risen to 15.13 yuan/kg, up 5.51% from the previous month, up 6.55% year on year. This is also the first time this year that the average sales price of the company's commercial pigs reached 15 yuan/kg.

Shennong GroupA total of 171,100 pigs were sold in April, including 158,700 commercial pigs, generating revenue of 301 million yuan; at the same time, the company sold 34,600 pigs to slaughter companies within the group. The data shows that the company has a stable position in the field of pig breeding and sales, and has strong adaptability to changes in the market. Furthermore, by selling pigs to internal slaughter companies, the company has effectively increased the added value of products and enhanced the profitability of the enterprise.

Zhenghong TechnologyThe number of pig heads sold in April reached 5,300, an increase of 50.73% over the previous month. Although pig sales decreased by 80.64% compared to the same period last year, Zhenghong Technology's business strategy has paid off, and sales revenue has bucked the trend. Specifically, pig sales revenue in April 2024 was 7.5069 million yuan, an increase of 7.50% over the previous month.

Pig market “at full power”

Judging from now on, China's pig industry has ushered in clear signs of recovery.

Recently, the National Bureau of Statistics announced the consumer price index (CPI) for 31 provinces for April 2024. The CPI of 23 provinces increased year on year. According to data, CPI rose 0.3% year on year in April and 0.1% month on month. One important reason for the recovery in the year-on-year increase is the increase in pork prices over the same period last year.

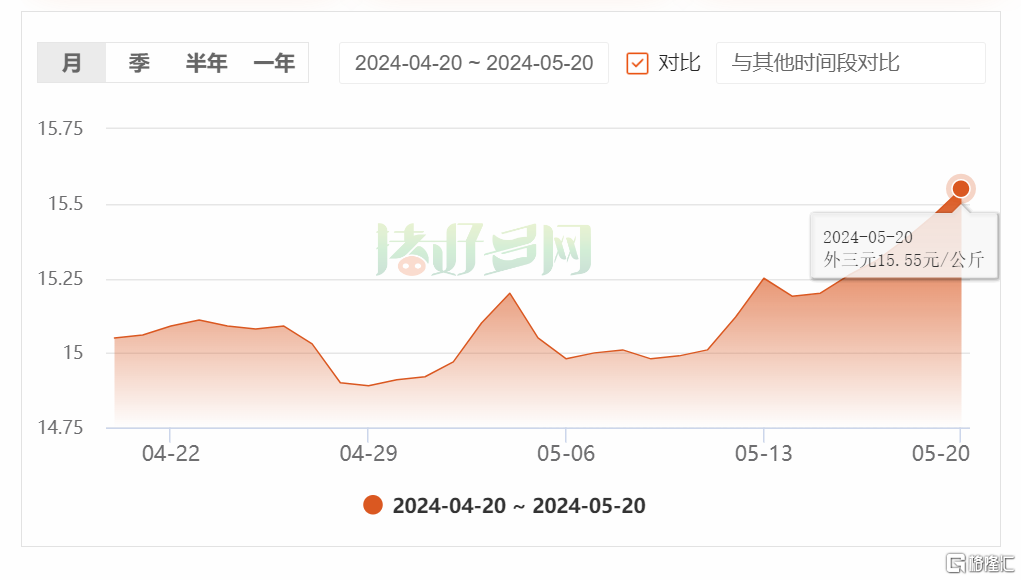

According to statistics from Pig Hao Duo Network, the price of foreign three-yuan pigs has risen sharply. As of May 20, the national average price of pigs (plus three yuan) was 15.55 yuan/kg, a weekly increase of nearly 2%.

Among the provinces, cities, and autonomous regions that can be monitored across the country, only four regions of Inner Mongolia, Gansu, Zhejiang, and Hainan showed declines; pig prices in most other regions have risen to varying degrees.

At the same time, the process of removing production capacity in the pig industry is also accelerating. By the end of the first quarter, the country had 408.5 million pigs, a year-on-year decrease of 5.2%; the number of pigs released in the first quarter was 194.55 million, a decrease of 2.2%. At the end of the first quarter, there were 39.92 million breeding sows, a year-on-year decrease of 3.14 million, a decrease of 7.3%; a year-on-month decrease of 1.5 million heads, a decrease of 3.6%. Industry insiders pointed out that looking back at the pig cycle over time, when pig prices, piglets, and the number of sows that can breed fall to new lows simultaneously, it also means a sign that appears at the bottom of the cycle.

On April 19, Lei Liugong, director of the Marketing and Information Technology Department of the Ministry of Agriculture and Rural Affairs, said at the press conference that pig prices have continued to rise and breeding losses have been reduced. Currently, the effect of removing production capacity from raw pigs is gradually showing a downward trend. The number of breeding sows, the number of medium and large pigs kept, and the number of newborn piglets are all showing a downward trend. The supply and demand relationship in the pig market will improve further in the second quarter, and pig farming may turn losses into profits.

Looking ahead, Guojin Securities pointed out that recently there has been a high level of bullish sentiment in the industry, and pig prices have risen markedly. Prices for small-label pigs in many regions are higher than those for standard pigs, reflecting the relatively positive entry into secondary fattening, and pig prices are expected to rise in trend.

Currently, there are few entities in the industry that can significantly supplement production capacity. In April, when pig prices picked up, the industry's production capacity continued to decline. Against the backdrop of the industry's high debt, the industry's production capacity is expected to continue to decline, thus extending the duration of this cycle. Pig production capacity has been lost for 15 months, pig production capacity is already at a low level since 2021, and the pig cycle is expected to reverse in the second half of the year.

Fangzheng Securities also said that judging from a further decline in feed data in April compared to the same period, it confirms the results of the reduction in production capacity in the previous period. Next, the supply trend will decline, and an upward trend in pig prices may occur. According to data from Yongyi Consulting, the average weight of commercial pigs released and the inventory rate of frozen products have gradually declined recently, and supply-side consumption may help the rise in pig prices in the later stages. Pig prices may rise in a slow bullish trend. Whether pig prices did not fall under the pressure of the previous decline or the recent sudden jump, it all reflects that the fundamentals of pig supply and demand are gradually easing, and pig prices will rise in the future. Under the influence of no extreme sentiment, pig prices will show a slow upward trend in May and June. They are expected to rise to nearly 16 yuan/kg by the end of May, continue to rise in June, and ushered in a sharp rise in the third quarter.