Market Whales and Their Recent Bets on CVS Options

Market Whales and Their Recent Bets on CVS Options

Financial giants have made a conspicuous bearish move on CVS Health. Our analysis of options history for CVS Health (NYSE:CVS) revealed 12 unusual trades.

金融巨頭對CVS Health採取了明顯的看跌舉動。我們對CVS Health(紐約證券交易所代碼:CVS)期權歷史的分析顯示了12筆不尋常的交易。

Delving into the details, we found 41% of traders were bullish, while 58% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $332,688, and 7 were calls, valued at $331,767.

深入研究細節,我們發現41%的交易者看漲,而58%的交易者表現出看跌趨勢。在我們發現的所有交易中,有5筆是看跌期權,價值爲332,688美元,7筆是看漲期權,價值331,767美元。

Predicted Price Range

預測的價格區間

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $57.5 for CVS Health during the past quarter.

分析這些合約的交易量和未平倉合約,大型企業似乎一直在考慮在過去一個季度中將CVS Health的價格範圍從40.0美元到57.5美元不等。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

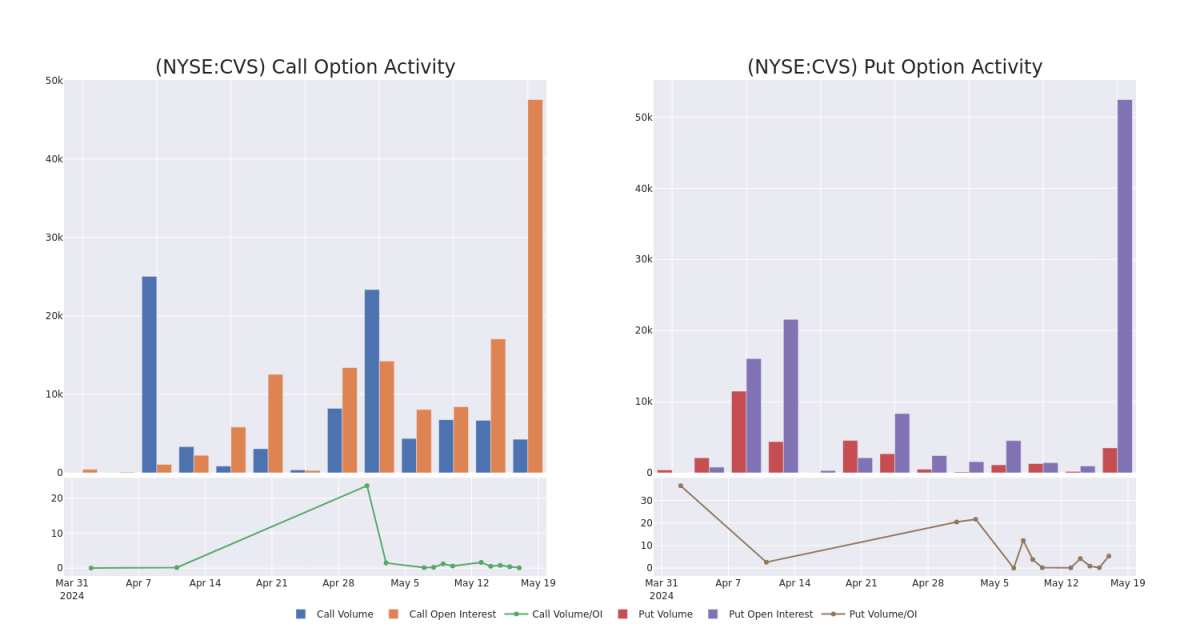

In today's trading context, the average open interest for options of CVS Health stands at 10003.1, with a total volume reaching 7,782.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in CVS Health, situated within the strike price corridor from $40.0 to $57.5, throughout the last 30 days.

在當今的交易背景下,CVS Health期權的平均未平倉合約爲10003.1,總交易量達到7,782.00。隨附的圖表描繪了過去30天CVS Health高價值交易的看漲和看跌期權交易量以及未平倉合約的變化,行使價走勢從40.0美元到57.5美元不等。

CVS Health Call and Put Volume: 30-Day Overview

CVS 健康電話和看跌交易量:30 天概述

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVS | CALL | SWEEP | BULLISH | 06/20/25 | $11.25 | $10.5 | $10.5 | $50.00 | $105.0K | 164 | 103 |

| CVS | PUT | SWEEP | BEARISH | 06/20/25 | $6.55 | $6.4 | $6.55 | $57.50 | $98.9K | 69 | 151 |

| CVS | PUT | TRADE | BEARISH | 09/19/25 | $1.66 | $1.36 | $1.6 | $40.00 | $96.0K | 223 | 620 |

| CVS | PUT | TRADE | BEARISH | 06/21/24 | $0.56 | $0.54 | $0.56 | $55.00 | $84.0K | 48.9K | 1.6K |

| CVS | CALL | SWEEP | BULLISH | 07/19/24 | $5.65 | $5.45 | $5.65 | $52.50 | $67.2K | 141 | 127 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVS | 打電話 | 掃 | 看漲 | 06/20/25 | 11.25 美元 | 10.5 美元 | 10.5 美元 | 50.00 美元 | 105.0 萬美元 | 164 | 103 |

| CVS | 放 | 掃 | 粗魯的 | 06/20/25 | 6.55 美元 | 6.4 美元 | 6.55 美元 | 57.50 美元 | 98.9 萬美元 | 69 | 151 |

| CVS | 放 | 貿易 | 粗魯的 | 09/19/25 | 1.66 美元 | 1.36 | 1.6 美元 | 40.00 美元 | 96.0 萬美元 | 223 | 620 |

| CVS | 放 | 貿易 | 粗魯的 | 06/21/24 | 0.56 美元 | 0.54 美元 | 0.56 美元 | 55.00 美元 | 84.0 萬美元 | 48.9 萬 | 1.6K |

| CVS | 打電話 | 掃 | 看漲 | 07/19/24 | 5.65 美元 | 5.45 美元 | 5.65 美元 | 52.50 美元 | 67.2 萬美元 | 141 | 127 |

About CVS Health

關於 CVS Health

CVS Health offers a diverse set of healthcare services. Its roots are in its retail pharmacy operations, where it operates over 9,000 stores primarily in the us. CVS is also a large pharmacy benefit manager (acquired through Caremark), processing about 2 billion adjusted claims annually. It also operates a top-tier health insurer (acquired through Aetna) where it serves about 26 million medical members. The company's recent acquisition of Oak Street adds primary care services to the mix, which could have significant synergies with all its existing business lines.

CVS Health提供一系列多樣化的醫療保健服務。它的根源在於其零售藥房業務,主要在美國經營9,000多家門店。CVS還是一家大型藥房福利管理公司(通過Caremark收購),每年處理約20億份調整後的索賠。它還經營一家頂級健康保險公司(通過安泰收購),爲約2600萬醫療會員提供服務。該公司最近對橡樹街的收購增加了初級保健服務,這可能會與其所有現有業務領域產生顯著的協同效應。

In light of the recent options history for CVS Health, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於CVS Health最近的期權歷史,現在應該專注於公司本身。我們的目標是探索其目前的表現。

CVS Health's Current Market Status

CVS Health 的當前市場地位

- With a volume of 6,262,208, the price of CVS is down -0.24% at $57.38.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 75 days.

- CVS的交易量爲6,262,208美元,價格下跌了0.24%,至57.38美元。

- RSI 指標暗示標的股票可能被超賣。

- 下一份收益預計將在75天后公佈。

Professional Analyst Ratings for CVS Health

CVS Health 的專業分析師評級

5 market experts have recently issued ratings for this stock, with a consensus target price of $66.0.

5位市場專家最近對該股發佈了評級,共識目標價爲66.0美元。

- An analyst from Truist Securities downgraded its action to Buy with a price target of $66.

- Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on CVS Health with a target price of $74.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for CVS Health, targeting a price of $60.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Neutral with a new price target of $58.

- An analyst from Mizuho has decided to maintain their Buy rating on CVS Health, which currently sits at a price target of $72.

- Truist Securities的一位分析師將其股票評級下調至買入,目標股價爲66美元。

- 高盛的一位分析師在評估中保持對CVS Health的買入評級,目標價爲74美元。

- 富國銀行的一位分析師保持立場,繼續對CVS Health持有同等權重評級,目標價格爲60美元。

- 坎託·菲茨傑拉德的一位分析師將其評級下調至中性,新的目標股價爲58美元,這反映了人們的擔憂。

- 瑞穗的一位分析師已決定維持對CVS Health的買入評級,目前的目標股價爲72美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for CVS Health with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了獲得更高利潤的可能性。精明的交易者通過持續的教育、戰略交易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解CVS Health的最新期權交易情況,獲取實時提醒。