A Closer Look at Phillips 66's Options Market Dynamics

A Closer Look at Phillips 66's Options Market Dynamics

High-rolling investors have positioned themselves bullish on Phillips 66 (NYSE:PSX), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in PSX often signals that someone has privileged information.

高額投資者已將自己定位爲看好菲利普斯66(紐約證券交易所代碼:PSX),散戶交易者注意這一點很重要。\ 這項活動今天通過Benzinga對公開期權數據的追蹤引起了我們的注意。這些投資者的身份尚不確定,但是PSX的如此重大變動通常表明有人擁有特權信息。

Today, Benzinga's options scanner spotted 10 options trades for Phillips 66. This is not a typical pattern.

今天,本辛加的期權掃描儀發現了菲利普斯66的10筆期權交易。這不是典型的模式。

The sentiment among these major traders is split, with 50% bullish and 40% bearish. Among all the options we identified, there was one put, amounting to $41,860, and 9 calls, totaling $471,137.

這些主要交易者的情緒分歧,50%看漲,40%看跌。在我們確定的所有期權中,有一個看跌期權,金額爲41,860美元,還有9個看漲期權,總額爲471,137美元。

What's The Price Target?

目標價格是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $70.0 and $165.0 for Phillips 66, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要市場走勢者將注意力集中在飛利浦66在過去三個月的70.0美元至165.0美元之間的價格區間上。

Volume & Open Interest Development

交易量和未平倉合約的發展

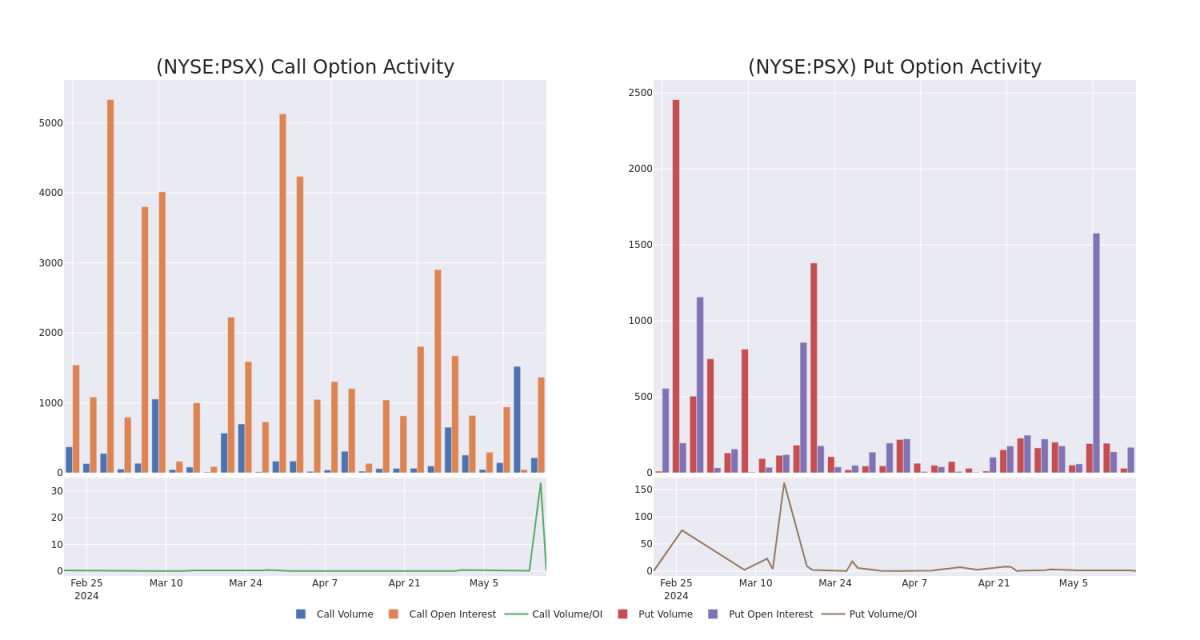

In terms of liquidity and interest, the mean open interest for Phillips 66 options trades today is 170.44 with a total volume of 246.00.

就流動性和利息而言,今天菲利普斯66期權交易的平均未平倉合約爲170.44,總交易量爲246.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Phillips 66's big money trades within a strike price range of $70.0 to $165.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天飛利浦66在70.0美元至165.0美元行使價區間內的大額資金交易的看漲和看跌期權交易量和未平倉合約的變化。

Phillips 66 Option Activity Analysis: Last 30 Days

Phillips 66 期權活動分析:過去 30 天

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PSX | CALL | TRADE | NEUTRAL | 01/17/25 | $78.5 | $74.7 | $76.45 | $70.00 | $91.7K | 26 | 0 |

| PSX | CALL | TRADE | BULLISH | 01/16/26 | $36.5 | $35.2 | $36.5 | $120.00 | $73.0K | 104 | 20 |

| PSX | CALL | TRADE | BULLISH | 06/21/24 | $17.2 | $15.4 | $16.7 | $130.00 | $66.8K | 608 | 40 |

| PSX | CALL | TRADE | BEARISH | 08/16/24 | $11.4 | $11.2 | $11.2 | $140.00 | $63.8K | 124 | 57 |

| PSX | CALL | SWEEP | BEARISH | 01/16/26 | $22.9 | $22.4 | $22.4 | $145.00 | $47.0K | 173 | 46 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PSX | 打電話 | 貿易 | 中立 | 01/17/25 | 78.5 美元 | 74.7 美元 | 76.45 美元 | 70.00 美元 | 91.7 萬美元 | 26 | 0 |

| PSX | 打電話 | 貿易 | 看漲 | 01/16/26 | 36.5 美元 | 35.2 美元 | 36.5 美元 | 120.00 美元 | 73.0 萬美元 | 104 | 20 |

| PSX | 打電話 | 貿易 | 看漲 | 06/21/24 | 17.2 美元 | 15.4 美元 | 16.7 美元 | 130.00 美元 | 66.8 萬美元 | 608 | 40 |

| PSX | 打電話 | 貿易 | 粗魯的 | 08/16/24 | 11.4 美元 | 11.2 | 11.2 | 140.00 美元 | 63.8 萬美元 | 124 | 57 |

| PSX | 打電話 | 掃 | 粗魯的 | 01/16/26 | 22.9 美元 | 22.4 美元 | 22.4 美元 | 145.00 美元 | 47.0 萬美元 | 173 | 46 |

About Phillips 66

關於菲利普斯 66

Phillips 66 is an independent refiner with 12 refineries that have a total crude throughput capacity of 1.8 million barrels per day, or mmb/d. In 2023, the Rodeo, California, facility ceased operations and be converted to produce renewable diesel. The midstream segment comprises extensive transportation and NGL processing assets and includes DCP Midstream, which holds 600 mbd of NGL fractionation and 22,000 miles of pipeline. Its CPChem chemical joint venture operates facilities in the United States and the Middle East and primarily produces olefins and polyolefins.

菲利普斯66是一家獨立煉油廠,擁有12家煉油廠,每天的原油總吞吐量爲180萬桶,合百萬桶/日。2023年,加利福尼亞州羅迪歐的工廠停止運營,改爲生產可再生柴油。中游部分包括大量的運輸和液化天然氣加工資產,包括DCP Midstream,該公司擁有600mbd的液化天然氣分餾和22,000英里的管道。其 CPChem 化學合資企業在美國和中東運營工廠,主要生產烯烴和聚烯烴。

Current Position of Phillips 66

菲利普斯 66 的現狀

- Trading volume stands at 850,344, with PSX's price down by -0.16%, positioned at $145.98.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 76 days.

- 交易量爲850,344美元,PSX的價格下跌了-0.16%,爲145.98美元。

- RSI指標顯示,該股目前在超買和超賣之間處於中立狀態。

- 預計將在76天后公佈業績。

What Analysts Are Saying About Phillips 66

分析師對飛利浦66的看法

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $157.33333333333334.

在過去的一個月中,3位行業分析師分享了他們對該股的見解,提出的平均目標價格爲157.33333333333334美元。

- Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for Phillips 66, targeting a price of $147.

- An analyst from Piper Sandler has decided to maintain their Overweight rating on Phillips 66, which currently sits at a price target of $170.

- An analyst from Barclays persists with their Equal-Weight rating on Phillips 66, maintaining a target price of $155.

- 巴克萊銀行的一位分析師保持立場,繼續對菲利普斯66維持同等權重評級,目標價格爲147美元。

- 派珀·桑德勒的一位分析師決定維持對菲利普斯66的增持評級,目前的目標股價爲170美元。

- 巴克萊銀行的一位分析師堅持對菲利普斯66的等權評級,維持155美元的目標價。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Phillips 66 with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解飛利浦66的最新期權交易,以獲取實時提醒。