Northeast Securities pointed out that the current imbalance between supply and demand in the overseas transformer market provides broad entry space for domestic manufacturers with high cost performance and sufficient production capacity; domestic meters are relatively independent, small in size, and large in quantity, making it easy to form large-scale exports.

The wave of AI investment is rolling in, and the global power grid is facing huge demand for access to new energy sources and intelligent upgrades. Chinese power equipment manufacturers are seizing this opportunity to accelerate expansion into overseas markets.

Han Jincheng, an analyst at Northeast Securities, released a research report on Wednesday saying that the global power equipment market has broad demand space, China's power equipment has huge potential to go overseas, and transformers and meters will be the two winning trump cards.

Northeast Securities pointed out that the current imbalance between supply and demand in the overseas transformer market provides broad entry space for domestic manufacturers with high cost performance and sufficient production capacity; domestic meters are relatively independent, small in size, and large in quantity, making it easy to form large-scale exports.

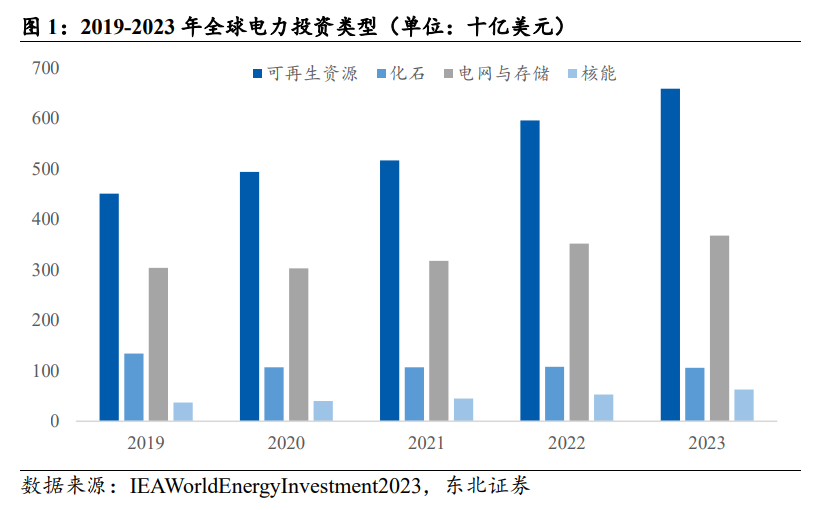

Global electricity investment is growing steadily, and the power equipment market demand space is broad

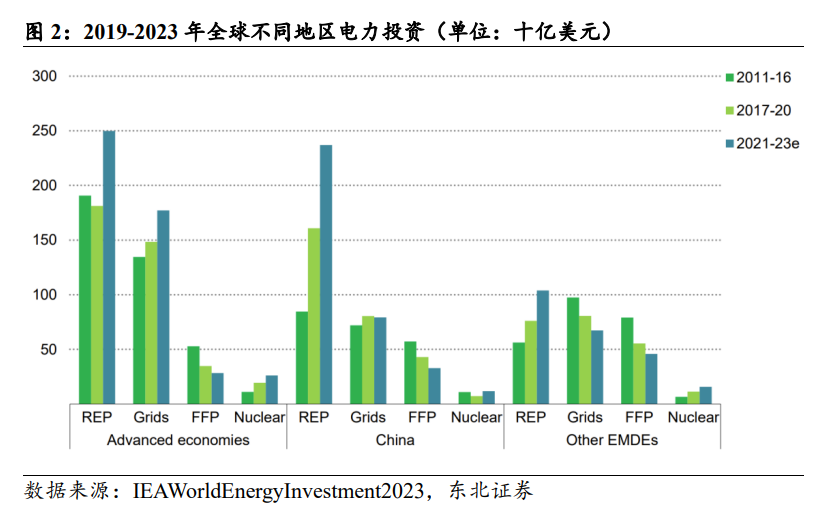

According to the International Energy Agency (IEA), investment in the electricity sector reached 1.1 trillion US dollars in 2022, and is expected to further grow to close to 1.2 trillion US dollars by 2023, mainly in developed economies and China.

Electricity investment demand mainly comes from the three aspects of power generation side, transmission side, and electricity consumption side.

Electricity investment demand mainly comes from the three aspects of power generation side, transmission side, and electricity consumption side.

On the power generation side, in the context of zero-carbon transformation, global renewable energy is driving a high increase in demand for supporting power equipment and an increase in the installed capacity of renewable electricity.

According to data disclosed by the IEA, the increase in global renewable electricity installed capacity is expected to reach 507 GW in 2023, an increase of nearly 50% over the previous year, and is expected to reach 730 GW by 2028.

New energy sources have a stronger driving effect on the construction demand for power grids. Along with the global energy transition process, the share of new energy generation in total power generation continues to increase. According to IEA estimates, over the next three years, renewable energy and nuclear energy will lead the growth of global electricity supply. On average, both will meet more than 90% of the new demand.

Electricity investment demand on the transmission side mainly comes from the upgrading of aging lines in the power grid and the construction of new lines.

The electrification process in developed economies was earlier. Some developed country grids have been running for 40 years or more, and are now facing aging problems. Currently, the US and the European Union have launched funding programs to promote grid modernization. New energy sources accelerate grid construction due to high requirements for power generation sites.

Electricity demand continues to grow due to economic developments on the electricity side. Global electricity demand has almost doubled since 2000. According to International Energy Agency estimates, it reached 28,510 TWh in 2022, and is expected to continue growing until 2050, and may increase by more than 75% to 120% compared to 2022.

Overseas, Northeast Securities pointed out that European wind and photovoltaic construction is in full swing, grid-connected demand is driving power grid transformation, US carbon reduction targets are driving energy transformation, manufacturing and data center demand is driving grid investment, Southeast Asia's economy is developing rapidly, demand for power facilities is strong, population growth and industrial expansion in the Middle East are driving long-term energy demand growth, and wind power development potential is high; power grid coverage is low in Africa, and there is high infrastructure demand, and photovoltaic power generation helps solve power supply problems.

Global demand for transformers is growing rapidly, and overseas supply restrictions have opened the door to overseas

As an important device that directly affects the operating efficiency, economy and reliability of power grids, demand for transformers is growing rapidly, driven by factors such as power infrastructure, new energy grid connections, and aging circuits in overseas markets. According to GMI forecasts, the global transformer market space will grow to US$109.5 billion in 2024-2032, with a CAGR of 7%.

Corresponding to the high demand is insufficient overseas transformer production capacity. The average delivery period for transformer orders in the US has been extended from 75 weeks to 100 weeks in the past year, and prices have increased by 60% to 70%. Furthermore, due to rising prices of silicon steel and copper as the main raw materials, and the long return on investment cycle of transformer production line expansion, major overseas manufacturers are less willing to expand production.

Northeast Securities pointed out that the current imbalance between supply and demand in the overseas transformer market provides broad entry space for domestic manufacturers with high cost performance and sufficient production capacity. The scale of China's transformer exports has increased by 58% in the past 5 years.

In particular, domestic manufacturers with supply chain advantages and cost advantages have sufficient competitiveness in overseas markets. Northeast Securities anticipates that, benefiting from the imbalance between overseas supply and demand, the scale of China's transformer exports is expected to grow further.

The meter industry is gradually becoming intelligent and competitive when going overseas

As one of the core devices of smart grids, smart meters have intelligent functions such as communication and measurement. They are the general trend of circuit innovation, and the prospects for domestic and foreign markets are broad.

According to ResearchAndMarkets and Statista, the global smart meter market was around $11.8 billion in 2022 and is expected to reach $16 billion by 2027, with a compound annual growth rate of 6.3%.

Northeast Securities pointed out that domestic meter companies have formed a strong advantage in competition. Electricity meters are relatively independent, small in size, and large in quantity, making it easy to form large-scale exports.

According to data from the General Administration of Customs, total electricity meter exports reached 9,927 billion yuan in 2023, with single-phase and three-phase electronic meters dominating.

In terms of overseas markets, Northeast Securities said that Asia, which has large stocks, and Europe and Africa, which are growing rapidly, are currently the main regions where electricity meters go overseas. They are the basic market for domestic manufacturers in overseas markets, and the export scale is expected to continue to increase. Currently, the North American market is mainly occupied by overseas manufacturers, and the export scale is relatively small; while the South American region is speeding up the deployment of smart meters, demand growth is increasing. Domestic manufacturers with excellent cost performance are favored by local power grid companies, and some domestic manufacturers have set up local factories to supply them.

The main opinion of this article comes from Northeast Securities. Original author: Han Jincheng, title: “Heavy Snow in Changpo, Firmly Optimistic About Power Equipment Going Overseas”

Han Jincheng Practice Certificate Number: S0550521120001