Vertex Pharmaceuticals's Options Frenzy: What You Need to Know

Vertex Pharmaceuticals's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bearish stance on Vertex Pharmaceuticals.

有大量資金可以花的鯨魚對Vertex Pharmicals採取了明顯的看跌立場。

Looking at options history for Vertex Pharmaceuticals (NASDAQ:VRTX) we detected 15 trades.

從Vertex Pharmicals(納斯達克股票代碼:VRTX)的期權歷史來看,我們發現了15筆交易。

If we consider the specifics of each trade, it is accurate to state that 26% of the investors opened trades with bullish expectations and 46% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,26%的投資者以看漲的預期開啓交易,46%的投資者持看跌預期。

From the overall spotted trades, 6 are puts, for a total amount of $334,455 and 9, calls, for a total amount of $522,634.

在已發現的全部交易中,有6筆是看跌期權,總額爲334,455美元,9筆看漲期權,總額爲522,634美元。

What's The Price Target?

目標價格是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $350.0 and $500.0 for Vertex Pharmaceuticals, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要市場走勢者正在關注過去三個月中Vertex Pharmicals在350.0美元至500.0美元之間的價格區間。

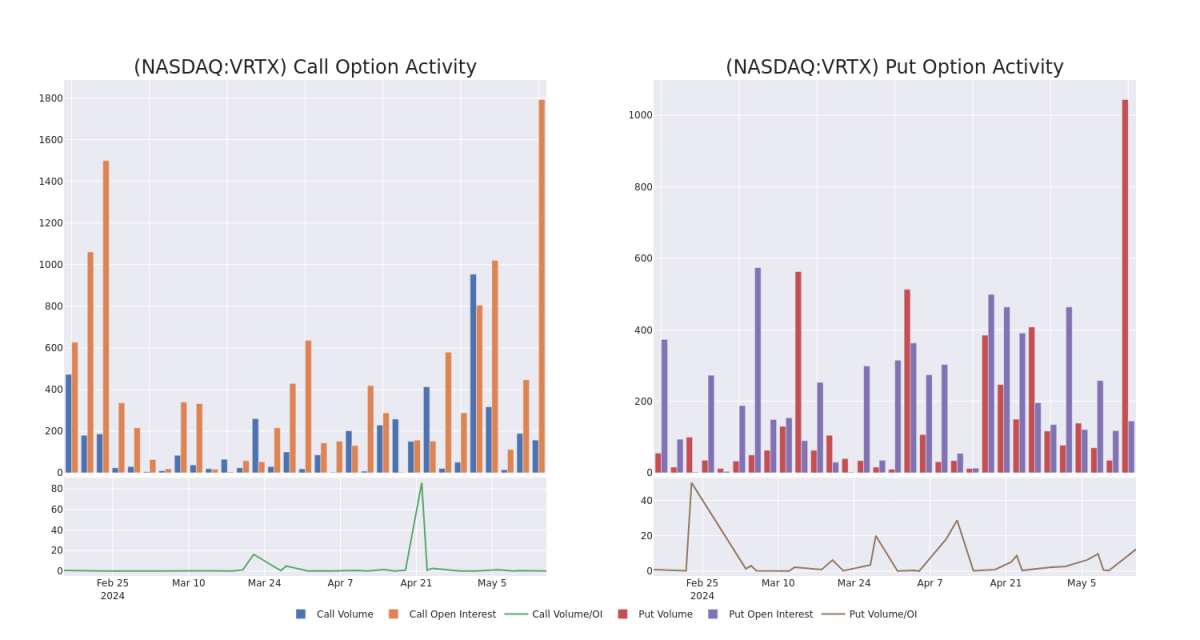

Volume & Open Interest Trends

交易量和未平倉合約趨勢

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Vertex Pharmaceuticals's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Vertex Pharmaceuticals's substantial trades, within a strike price spectrum from $350.0 to $500.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了Vertex Pharmicals在指定行使價下期權的流動性和投資者對該期權的興趣。即將發佈的數據可視化了與Vertex Pharmicals大量交易相關的看漲期權和未平倉合約的交易量和未平倉合約的波動,在過去30天內,行使價範圍從350.0美元到500.0美元不等。

Vertex Pharmaceuticals 30-Day Option Volume & Interest Snapshot

Vertex Pharmicals 30 天期權交易量和利息

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRTX | CALL | SWEEP | BULLISH | 06/21/24 | $80.9 | $75.0 | $79.0 | $360.00 | $134.3K | 212 | 20 |

| VRTX | CALL | TRADE | BEARISH | 06/14/24 | $68.5 | $61.9 | $64.5 | $375.00 | $129.0K | 0 | 20 |

| VRTX | PUT | SWEEP | BEARISH | 06/21/24 | $6.3 | $5.9 | $6.2 | $430.00 | $114.5K | 103 | 199 |

| VRTX | PUT | SWEEP | BEARISH | 06/21/24 | $6.5 | $6.4 | $6.4 | $430.00 | $96.6K | 103 | 385 |

| VRTX | CALL | SWEEP | BULLISH | 06/21/24 | $10.0 | $9.7 | $10.0 | $440.00 | $48.0K | 434 | 77 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRTX | 打電話 | 掃 | 看漲 | 06/21/24 | 80.9 美元 | 75.0 美元 | 79.0 美元 | 360.00 美元 | 134.3 萬美元 | 212 | 20 |

| VRTX | 打電話 | 貿易 | 粗魯的 | 06/14/24 | 68.5 美元 | 61.9 美元 | 64.5 美元 | 375.00 美元 | 129.0K | 0 | 20 |

| VRTX | 放 | 掃 | 粗魯的 | 06/21/24 | 6.3 美元 | 5.9 美元 | 6.2 美元 | 430.00 美元 | 114.5 萬美元 | 103 | 199 |

| VRTX | 放 | 掃 | 粗魯的 | 06/21/24 | 6.5 美元 | 6.4 美元 | 6.4 美元 | 430.00 美元 | 96.6 萬美元 | 103 | 385 |

| VRTX | 打電話 | 掃 | 看漲 | 06/21/24 | 10.0 美元 | 9.7 美元 | 10.0 美元 | 440.00 美元 | 48.0 萬美元 | 434 | 77 |

About Vertex Pharmaceuticals

關於 Vertex 製藥

Vertex Pharmaceuticals is a global biotechnology company that discovers and develops small-molecule drugs for the treatment of serious diseases. Its key drugs are Kalydeco, Orkambi, Symdeko, and Trikafta/Kaftrio for cystic fibrosis, where Vertex therapies remain the standard of care globally. Vertex has diversified its portfolio through Casgevy, a gene-editing therapy for beta thalassemia and sickle-cell disease. Additionally, Vertex is evaluating small-molecule inhibitors targeting acute and chronic pain using nonopioid treatments, and small-molecule inhibitors of APOL1-mediated kidney diseases. Vertex is also investigating cell therapies to deliver a potential functional cure for type 1 diabetes.

Vertex Pharmaceuticals是一家全球生物技術公司,致力於發現和開發用於治療嚴重疾病的小分子藥物。其主要藥物是治療囊性纖維化的Kalydeco、Orkambi、Symdeko和Trikafta/Kaftrio,其中Vertex療法仍然是全球的護理標準。Vertex通過Casgevy實現了其產品組合的多元化,Casgevy是一種治療β地中海貧血和鐮狀細胞病的基因編輯療法。此外,Vertex正在評估使用非阿片類藥物治療的針對急性和慢性疼痛的小分子抑制劑,以及針對APOL1介導的腎臟疾病的小分子抑制劑。Vertex還在研究細胞療法,爲1型糖尿病提供潛在的功能性治療方法。

In light of the recent options history for Vertex Pharmaceuticals, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於Vertex Pharmicals最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Present Market Standing of Vertex Pharmaceuticals

Vertex 製藥目前的市場地位

- With a volume of 1,057,724, the price of VRTX is up 2.08% at $437.49.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 76 days.

- VRTX的交易量爲1,057,724美元,上漲2.08%,至437.49美元。

- RSI 指標暗示標的股票可能處於超買狀態。

- 下一份業績預計將在76天后公佈。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Vertex Pharmaceuticals options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。藉助Benzinga Pro的實時警報,隨時了解最新的Vertex Pharmicals期權交易。