A Closer Look at Nu Holdings's Options Market Dynamics

A Closer Look at Nu Holdings's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bullish stance on Nu Holdings.

有大量資金可以花的鯨魚對Nu Holdings採取了明顯的看漲立場。

Looking at options history for Nu Holdings (NYSE:NU) we detected 16 trades.

查看Nu Holdings(紐約證券交易所代碼:NU)的期權歷史記錄,我們發現了16筆交易。

If we consider the specifics of each trade, it is accurate to state that 75% of the investors opened trades with bullish expectations and 12% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,75%的投資者以看漲的預期開啓交易,12%的投資者持看跌預期。

From the overall spotted trades, 3 are puts, for a total amount of $166,413 and 13, calls, for a total amount of $669,546.

在已發現的全部交易中,有3筆是看跌期權,總額爲166,413美元,13筆是看漲期權,總額爲669,546美元。

What's The Price Target?

目標價格是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.0 to $14.0 for Nu Holdings during the past quarter.

分析這些合約的交易量和未平倉合約,大型企業似乎一直在關注Nu Holdings在過去一個季度的價格範圍從7.0美元到14.0美元不等。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

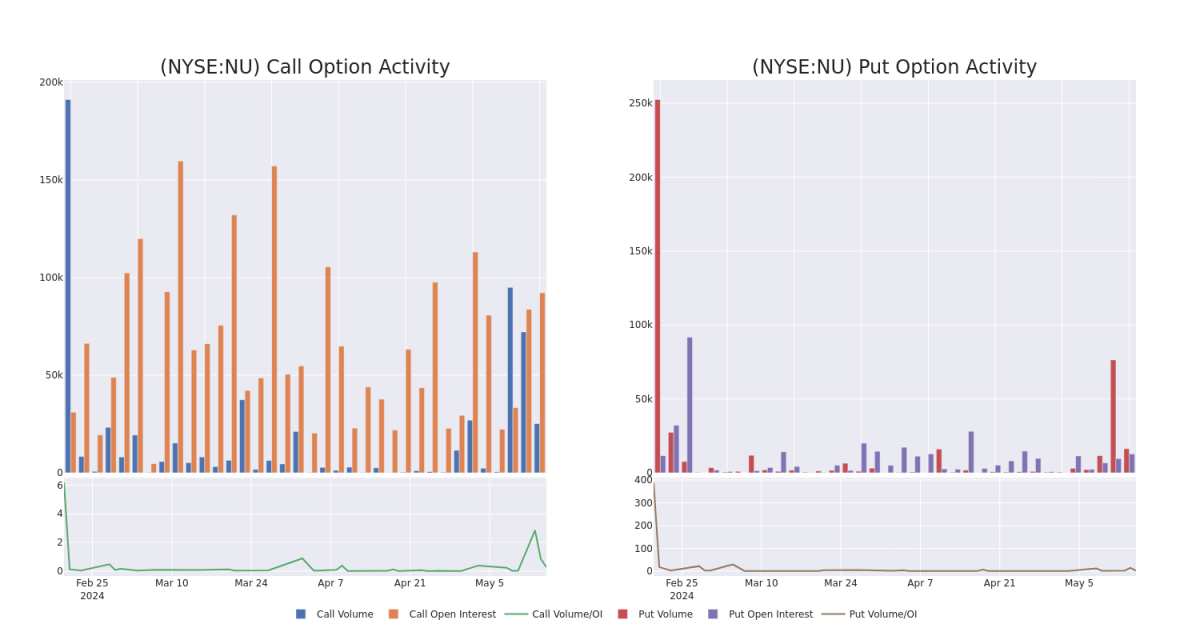

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Nu Holdings's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Nu Holdings's significant trades, within a strike price range of $7.0 to $14.0, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量Nu Holdings期權在特定行使價下的流動性和利息水平的關鍵。下面,我們概述了過去一個月Nu Holdings在7.0美元至14.0美元行使價區間內的重要交易的看漲期權和未平倉合約的交易量和未平倉合約的趨勢。

Nu Holdings Option Activity Analysis: Last 30 Days

Nu Holdings期權活動分析:過去 30 天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NU | CALL | SWEEP | BULLISH | 08/16/24 | $1.05 | $0.87 | $0.89 | $12.00 | $102.1K | 18.5K | 3.6K |

| NU | CALL | SWEEP | NEUTRAL | 01/17/25 | $1.08 | $1.06 | $1.07 | $14.00 | $80.5K | 24 | 779 |

| NU | CALL | TRADE | BULLISH | 01/17/25 | $5.5 | $4.6 | $5.5 | $7.00 | $60.5K | 9.6K | 121 |

| NU | PUT | SWEEP | BULLISH | 05/17/24 | $0.26 | $0.23 | $0.23 | $12.00 | $60.4K | 9.9K | 7.5K |

| NU | CALL | SWEEP | BULLISH | 08/16/24 | $1.21 | $1.1 | $1.18 | $12.00 | $58.7K | 18.5K | 1.7K |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 不是 | 打電話 | 掃 | 看漲 | 08/16/24 | 1.05 美元 | 0.87 美元 | 0.89 美元 | 12.00 美元 | 102.1 萬美元 | 18.5K | 3.6K |

| 不是 | 打電話 | 掃 | 中立 | 01/17/25 | 1.08 | 1.06 | 1.07 | 14.00 美元 | 80.5 萬美元 | 24 | 779 |

| 不是 | 打電話 | 貿易 | 看漲 | 01/17/25 | 5.5 美元 | 4.6 美元 | 5.5 美元 | 7.00 美元 | 60.5 萬美元 | 9.6K | 121 |

| 不是 | 放 | 掃 | 看漲 | 05/17/24 | 0.26 美元 | 0.23 美元 | 0.23 美元 | 12.00 美元 | 60.4 萬美元 | 9.9K | 7.5K |

| 不是 | 打電話 | 掃 | 看漲 | 08/16/24 | 1.21 美元 | 1.1 美元 | 1.18 | 12.00 美元 | 58.7 萬美元 | 18.5K | 1.7K |

About Nu Holdings

關於 Nu 控股

Nu Holdings Ltd is engaged in providing digital banking services. It offers several financial services such as Credit cards, Personal Account, Investments, Personal Loans, Insurance, Mobile payments, Business Accounts, and Rewards. The company earns the majority of its revenue in Brazil.

Nu Holdings Ltd從事提供數字銀行服務。它提供多種金融服務,例如信用卡、個人賬戶、投資、個人貸款、保險、移動支付、企業賬戶和獎勵。該公司的大部分收入來自巴西。

After a thorough review of the options trading surrounding Nu Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在全面審查了圍繞Nu Holdings的期權交易之後,我們將對該公司進行更詳細的審查。這包括評估其當前的市場狀況和表現。

Where Is Nu Holdings Standing Right Now?

Nu Holdings 現在的立場如何?

- Trading volume stands at 43,292,092, with NU's price up by 3.51%, positioned at $11.96.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 90 days.

- 交易量爲43,292,092美元,NU的價格上漲了3.51%,爲11.96美元。

- RSI指標顯示該股可能接近超買。

- 預計將在90天后公佈業績。

What The Experts Say On Nu Holdings

專家對Nu Holdings的看法

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $13.5.

在過去的一個月中,兩位行業分析師分享了他們對該股的見解,提出平均目標價爲13.5美元。

- Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Nu Holdings with a target price of $13.

- Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for Nu Holdings, targeting a price of $14.

- Keybanc的一位分析師在評估中保持了對Nu Holdings的增持評級,目標價爲13美元。

- 薩斯奎哈納的一位分析師保持立場,繼續對Nu Holdings給予正面評級,目標價格爲14美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Nu Holdings with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解Nu Holdings的最新期權交易,以獲取實時提醒。