Vistra Unusual Options Activity For May 14

Vistra Unusual Options Activity For May 14

Whales with a lot of money to spend have taken a noticeably bullish stance on Vistra.

有大量資金可以花的鯨魚對瑞致達採取了明顯的看漲立場。

Looking at options history for Vistra (NYSE:VST) we detected 23 trades.

查看瑞致達(紐約證券交易所代碼:VST)的期權歷史記錄,我們發現了23筆交易。

If we consider the specifics of each trade, it is accurate to state that 52% of the investors opened trades with bullish expectations and 39% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,有52%的投資者以看漲的預期開盤,39%的投資者持看跌預期。

From the overall spotted trades, 6 are puts, for a total amount of $334,283 and 17, calls, for a total amount of $904,009.

在已發現的全部交易中,有6筆是看跌期權,總額爲334,283美元,17筆看漲期權,總額爲904,009美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $120.0 for Vistra over the recent three months.

根據交易活動,看來重要投資者的目標是在最近三個月中將瑞致達的價格範圍從70.0美元擴大到120.0美元。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

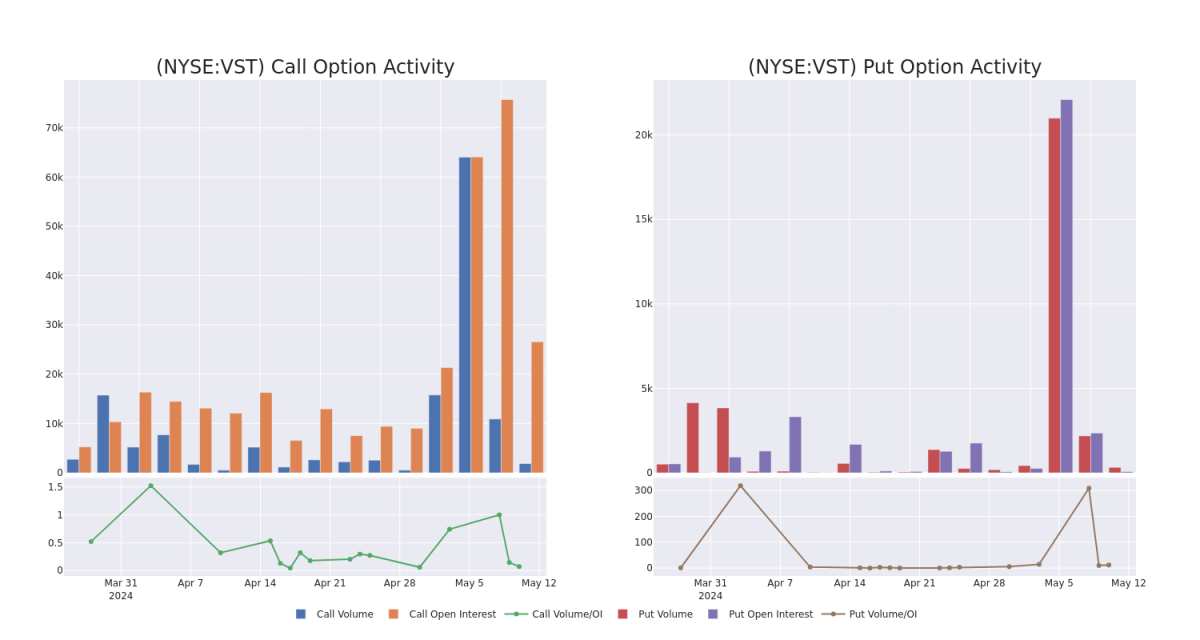

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平倉合約是一種對股票進行盡職調查的有見地的方法。

This data can help you track the liquidity and interest for Vistra's options for a given strike price.

這些數據可以幫助您跟蹤瑞致達期權在給定行使價下的流動性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Vistra's whale activity within a strike price range from $70.0 to $120.0 in the last 30 days.

下面,我們可以分別觀察過去30天瑞致達所有鯨魚活動的看漲期權和未平倉合約的變化,其行使價範圍爲70.0美元至120.0美元。

Vistra Call and Put Volume: 30-Day Overview

瑞致達看漲和看跌交易量:30 天概覽

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VST | CALL | SWEEP | BULLISH | 12/20/24 | $18.4 | $18.2 | $18.4 | $82.50 | $150.8K | 42 | 1 |

| VST | PUT | SWEEP | BEARISH | 01/17/25 | $17.3 | $17.1 | $17.3 | $100.00 | $119.3K | 3 | 70 |

| VST | CALL | SWEEP | BULLISH | 01/17/25 | $5.3 | $5.0 | $5.3 | $120.00 | $79.5K | 529 | 150 |

| VST | CALL | SWEEP | BEARISH | 08/16/24 | $7.3 | $7.2 | $7.2 | $95.00 | $72.0K | 3.7K | 114 |

| VST | CALL | SWEEP | BEARISH | 08/16/24 | $4.5 | $4.2 | $4.5 | $100.00 | $67.5K | 7.8K | 172 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 增值稅的 | 打電話 | 掃 | 看漲 | 12/20/24 | 18.4 美元 | 18.2 美元 | 18.4 美元 | 82.50 美元 | 150.8 萬美元 | 42 | 1 |

| 增值稅的 | 放 | 掃 | 粗魯的 | 01/17/25 | 17.3 美元 | 17.1 美元 | 17.3 美元 | 100.00 美元 | 119.3 萬美元 | 3 | 70 |

| 增值稅的 | 打電話 | 掃 | 看漲 | 01/17/25 | 5.3 美元 | 5.0 美元 | 5.3 美元 | 120.00 美元 | 79.5 萬美元 | 529 | 150 |

| 增值稅的 | 打電話 | 掃 | 粗魯的 | 08/16/24 | 7.3 美元 | 7.2 美元 | 7.2 美元 | 95.00 美元 | 72.0 萬美元 | 3.7K | 114 |

| 增值稅的 | 打電話 | 掃 | 粗魯的 | 08/16/24 | 4.5 美元 | 4.2 美元 | 4.5 美元 | 100.00 美元 | 67.5 萬美元 | 7.8K | 172 |

About Vistra

關於瑞致達

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 5 million customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

瑞致達能源是美國最大的電力生產商和零售能源提供商之一。繼2024年收購能源港之後,瑞致達擁有41千兆瓦的核能、煤炭、天然氣和太陽能發電,以及世界上最大的公用事業規模電池項目之一。其零售電力業務爲20個州的500萬客戶提供服務,其中包括德克薩斯州所有電力消費者的近三分之一。瑞致達於2016年作爲獨立實體從能源未來控股公司的破產中脫穎而出。它於2018年收購了戴尼基。

After a thorough review of the options trading surrounding Vistra, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對瑞致達的期權交易進行了全面審查之後,我們將對該公司進行更詳細的審查。這包括評估其當前的市場狀況和表現。

Where Is Vistra Standing Right Now?

瑞致達現在的立場如何?

- With a trading volume of 3,612,119, the price of VST is up by 0.96%, reaching $91.04.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 85 days from now.

- 增值稅的交易量爲3,612,119美元,價格上漲了0.96%,達到91.04美元。

- 當前的RSI值表明該股可能已被超買。

- 下一份收益報告定於85天后發佈。

What Analysts Are Saying About Vistra

分析師對瑞致達的看法

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $100.33333333333333.

在過去的30天中,共有3位專業分析師對該股發表了看法,將平均目標股價定爲100.3333333333333333美元。

- Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Vistra, targeting a price of $110.

- An analyst from BMO Capital persists with their Outperform rating on Vistra, maintaining a target price of $109.

- Reflecting concerns, an analyst from Janney Montgomery Scott lowers its rating to Buy with a new price target of $82.

- 瑞銀的一位分析師保持立場,繼續維持瑞致達的買入評級,目標價爲110美元。

- BMO Capital的一位分析師堅持對瑞致達的跑贏大盤評級,將目標價維持在109美元。

- 詹尼·蒙哥馬利·斯科特的一位分析師將其評級下調至買入,新的目標股價爲82美元,這反映了人們的擔憂。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。