Paramount Global's Options: A Look at What the Big Money Is Thinking

Paramount Global's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bearish stance on Paramount Global.

有很多錢可以花的鯨魚對派拉蒙環球採取了明顯的看跌立場。

Looking at options history for Paramount Global (NASDAQ:PARA) we detected 17 trades.

查看派拉蒙環球(納斯達克股票代碼:PARA)的期權歷史記錄,我們發現了17筆交易。

If we consider the specifics of each trade, it is accurate to state that 29% of the investors opened trades with bullish expectations and 64% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,29%的投資者以看漲的預期開盤,64%的投資者持看跌預期。

From the overall spotted trades, 8 are puts, for a total amount of $245,388 and 9, calls, for a total amount of $556,810.

在已發現的全部交易中,有8筆是看跌期權,總額爲245,388美元,9筆看漲期權,總額爲556,810美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $17.5 for Paramount Global over the recent three months.

根據交易活動,看來主要投資者的目標是在最近三個月中將派拉蒙環球的價格區間從10.0美元擴大到17.5美元。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

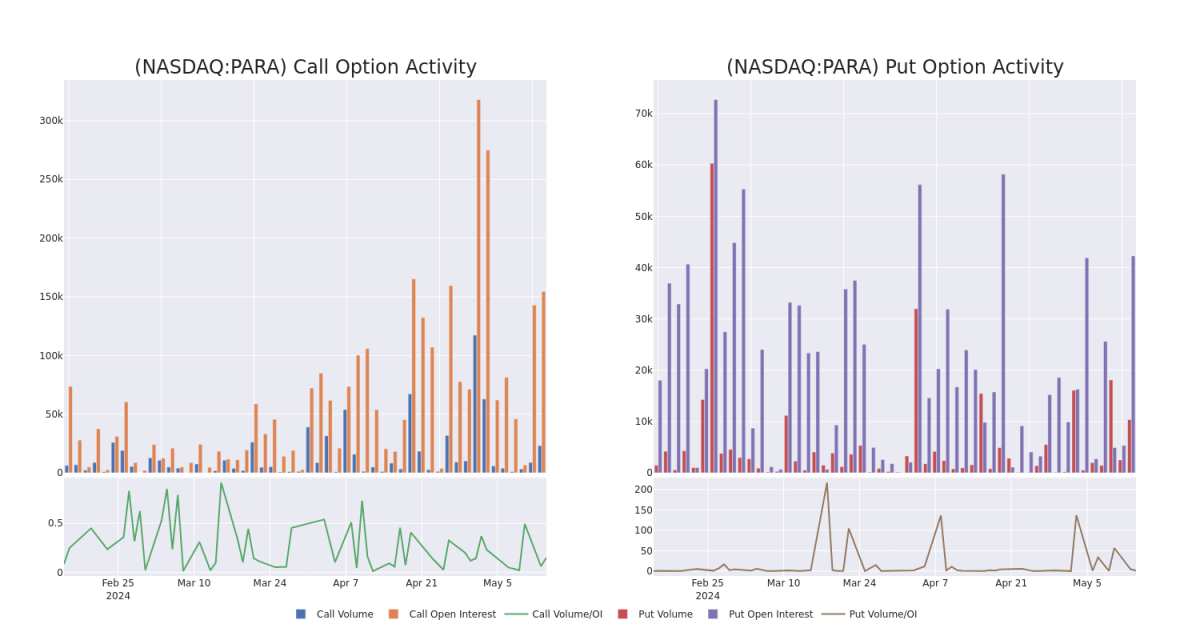

In terms of liquidity and interest, the mean open interest for Paramount Global options trades today is 19680.9 with a total volume of 33,505.00.

就流動性和利息而言,今天派拉蒙環球期權交易的平均未平倉合約爲19680.9,總交易量爲33,505.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Paramount Global's big money trades within a strike price range of $10.0 to $17.5 over the last 30 days.

在下圖中,我們可以跟蹤過去30天派拉蒙環球在10.0美元至17.5美元行使價區間內的大額資金交易的看漲和看跌期權交易量和未平倉合約的變化。

Paramount Global Option Activity Analysis: Last 30 Days

派拉蒙全球期權活動分析:過去 30 天

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PARA | CALL | TRADE | BEARISH | 06/21/24 | $0.46 | $0.42 | $0.43 | $14.00 | $215.0K | 29.9K | 6.0K |

| PARA | CALL | SWEEP | BEARISH | 06/21/24 | $3.45 | $3.25 | $3.31 | $10.00 | $79.4K | 9.6K | 788 |

| PARA | CALL | TRADE | BEARISH | 01/17/25 | $1.24 | $1.01 | $1.1 | $15.00 | $55.0K | 26.4K | 564 |

| PARA | CALL | SWEEP | BULLISH | 05/17/24 | $0.44 | $0.41 | $0.41 | $13.00 | $38.2K | 17.5K | 1.6K |

| PARA | PUT | SWEEP | BULLISH | 01/17/25 | $0.95 | $0.74 | $0.74 | $10.00 | $37.4K | 12.8K | 500 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 帕拉 | 打電話 | 貿易 | 粗魯的 | 06/21/24 | 0.46 美元 | 0.42 美元 | 0.43 美元 | 14.00 美元 | 215.0 萬美元 | 29.9K | 6.0K |

| 帕拉 | 打電話 | 掃 | 粗魯的 | 06/21/24 | 3.45 美元 | 3.25 | 3.31 | 10.00 美元 | 79.4 萬美元 | 9.6K | 788 |

| 帕拉 | 打電話 | 貿易 | 粗魯的 | 01/17/25 | 1.24 美元 | 1.01 | 1.1 美元 | 15.00 美元 | 55.0 萬美元 | 26.4K | 564 |

| 帕拉 | 打電話 | 掃 | 看漲 | 05/17/24 | 0.44 美元 | 0.41 美元 | 0.41 美元 | 13.00 美元 | 38.2 萬美元 | 17.5K | 1.6K |

| 帕拉 | 放 | 掃 | 看漲 | 01/17/25 | 0.95 美元 | 0.74 美元 | 0.74 美元 | 10.00 美元 | 37.4 萬美元 | 12.8K | 500 |

About Paramount Global

關於派拉蒙環球

Paramount Global operates in three global business segments: TV media, filmed entertainment, and direct to consumer. The TV media business includes television production studios and various broadcast and cable networks, including CBS, 15 owned CBS affiliates, Paramount, Nickelodeon, MTV, BET, and VH1. Filmed entertainment consists multiple film studios, most importantly Paramount Pictures. The film studios produce and distribute movies that they license to movie theaters and other media outlets. Direct to consumer includes multiple streaming platforms, including Paramount+, which now includes Showtime, Pluto TV, and BET+. Much of the content on Paramount's streaming platforms is created by the production studios housed within the firm's other two business segments.

派拉蒙環球在三個全球業務領域開展業務:電視媒體、電影娛樂和直接面向消費者。電視媒體業務包括電視製作工作室和各種廣播和有線電視網絡,包括哥倫比亞廣播公司、哥倫比亞廣播公司旗下的15家附屬公司、派拉蒙、尼克國際兒童頻道、MTV、BET和VH1。電影娛樂包括多個電影製片廠,最重要的是派拉蒙影業。電影製片廠製作和發行他們許可給電影院和其他媒體的電影。直接面向消費者包括多個流媒體平台,包括派拉蒙+,該平台現在包括Showtime、Pluto TV和BET+。派拉蒙流媒體平台上的許多內容都是由該公司其他兩個業務部門的製作工作室創作的。

In light of the recent options history for Paramount Global, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於派拉蒙環球最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Current Position of Paramount Global

派拉蒙環球的現狀

- With a volume of 23,281,647, the price of PARA is down -4.96% at $12.37.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 83 days.

- PARA的交易量爲23,281,647美元,下跌了-4.96%,至12.37美元。

- RSI指標暗示標的股票可能接近超買。

- 下一份業績預計將在83天后公佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。