On Tuesday, May 14, Qiaoshui, the world's largest hedge fund, released its 13F quarterly position report. The characteristics of its holdings in the first quarter were significant increases in Google, Nvidia, Apple, Meta, and Microsoft, and new positions were opened to expand Amazon and AMD, giving the greatest weight to increase their holdings in technology stocks.

In the first quarter of 2024 up to March 31, Qiaoshui disclosed that the market value of 677 positions held with listed companies increased 11% from the previous quarter to about US$19.8 billion, and the concentration of the top ten positions rose slightly from 31.40% to 31.87%. As of the end of March, the hedge fund had 91 clients and managed more than US$171.7 billion in discretionary assets.

Among them, Amazon bought nearly 1.05 million shares worth US$189 million in Qiaoshui in the first quarter. The second largest new individual stock to open long positions is chipmaker AMD, which bought nearly 680,000 shares worth US$123 million.

Qiaoshui also opened a position to buy 680,000 shares of medtech leader Medtronic (Medtronic), 870,000 shares of iShares Korea ETF, and S&P Global, a leading credit rating company with more than 80,000 shares.

During the quarter, Qiaoshui significantly increased its holdings in major US technology stocks. In particular, Apple increased its holdings by 1,8410.45 million shares to a total holdings of 1,8421.54 million shares worth US$316 million, which is equivalent to holding only 1,109 shares at the end of last year.

In addition, Qiaoshui also increased its holdings of Google Class A shares by 3.32 million shares, to a total holding of nearly 5.37 million shares, worth more than 800 million US dollars; increased its holdings of Nvidia by 436,000 shares to a total holdings of 705,000 shares worth US$637 million; and increased its holdings of Microsoft by 382,000 shares to a total holdings of nearly 580,000 shares worth 244 million US dollars, all doubling its holdings from the end of the previous quarter. The holding of Meta Class A shares was increased by 328,000 shares to a total holdings of 994,000 shares worth US$483 million.

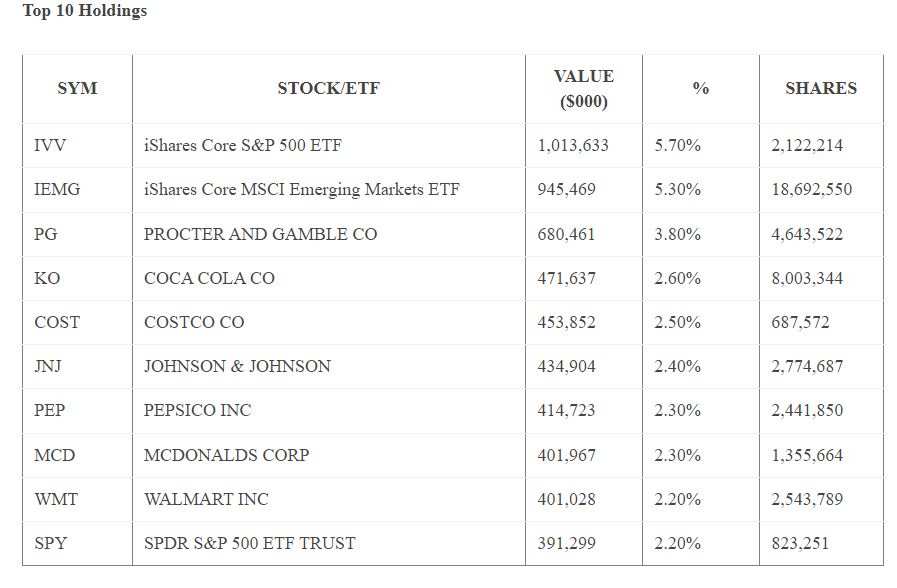

As a result, Google Class A shares, Nvidia, and Meta ranked third, fifth, and sixth respectively in Qiaoshui's largest holdings in the first quarter. The size of Coca Cola and Costco's holdings were pushed out of the top five, which means that Qiaoshui favors technology stocks more, and enthusiasm for consumer stocks has waned.

In the fourth quarter of last year, Hashimizu significantly increased its holdings at Nvidia and Eli Lilly, and their positions both increased more than four times, and were viewed as “optimistic about AI and diet pills.”

Meanwhile, after the iShares core S&P 500 ETF was slightly reduced by 25,000 shares, it still ranked at the top of Qiaoshui's largest holdings in the first quarter with nearly 2.1 million shares worth 1.1 billion US dollars, accounting for 5.6% of the disclosed assets. The second largest holdings are still iShares' core MSCs Emerging Markets ETF. The fourth largest holding is Procter & Gamble, but it has been reduced for many consecutive seasons.

In the same period, Qiaoshui also reduced its holdings of the Chinese e-commerce company Pinduoduo on a large scale, which reduced its holdings by 892,200 shares or 1/3. The total holdings shrunk to 1,544,500 shares worth US$180 million, and also reduced its holdings of 2.87 million iShares China large-cap ETF, or 70%.

Qiaoshui reduced its holdings of Buffett's favorite Coca Cola by more than 1.71 million shares, with a remaining holdings of nearly 6.29 million shares worth US$385 million; it reduced its holdings of Costco, which Munger liked, by more than 150,000 shares, with a remaining holdings of 530,000 shares worth US$392 million, all of which reduced its holdings by 20%.

Qiaoshui also drastically reduced its holdings of network solution hardware vendor Cisco (Cisco) by 1.8 million, or nearly 94%. The remaining holdings were less than 120,000 shares worth less than $6 million.

Qiaoshui's holdings in the essential consumer goods sector declined the most during the season. Bunge Global SA (Bunge Global SA) and US Foods Holding Corp. (US Foods Holding Corp.), known as one of the world's top four food merchants, were all cleared in this sector.

In addition, nearly 160,000 shares worth 17.8 million US dollars of financial services company Discover Financial, nearly 100,000 shares of CME Group worth 20.7 million US dollars, and 110,000 shares worth 16.3 million US dollars of Albemarle (Albemarle), the world's largest lithium miner, were all liquidated.