Deep-pocketed investors have adopted a bearish approach towards Super Micro Computer (NASDAQ:SMCI), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SMCI usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 27 extraordinary options activities for Super Micro Computer. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 44% bearish. Among these notable options, 10 are puts, totaling $530,654, and 17 are calls, amounting to $1,286,223.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $200.0 and $1060.0 for Super Micro Computer, spanning the last three months.

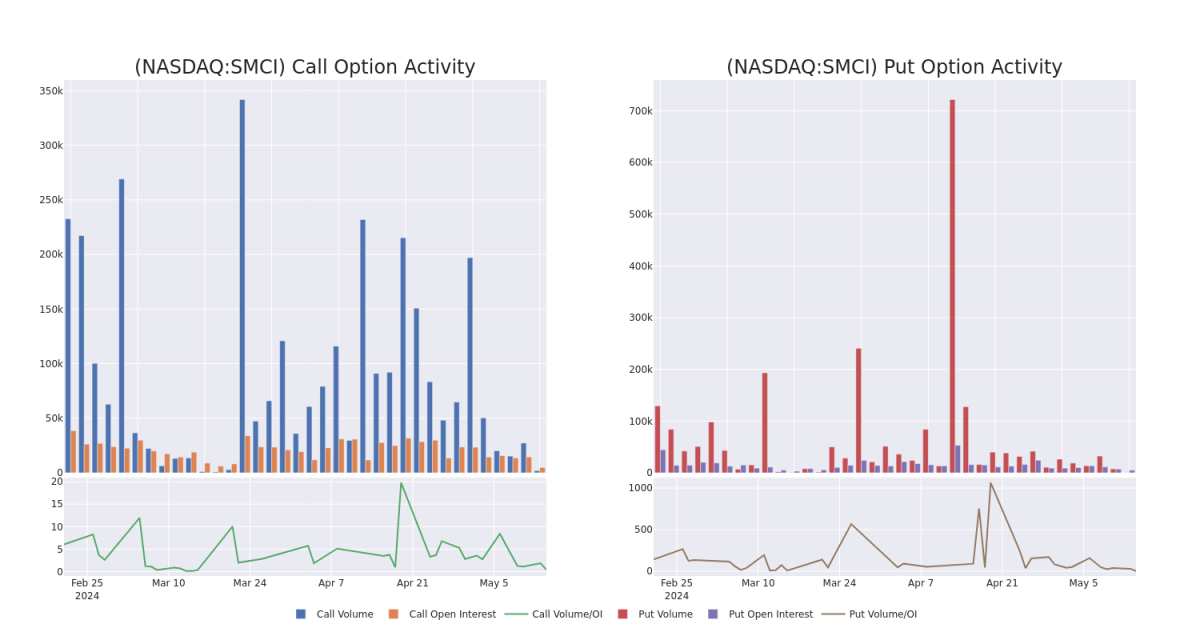

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Super Micro Computer's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Super Micro Computer's substantial trades, within a strike price spectrum from $200.0 to $1060.0 over the preceding 30 days.

Super Micro Computer 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMCI | CALL | TRADE | BULLISH | 09/20/24 | $133.9 | $130.7 | $133.9 | $790.00 | $267.8K | 21 | 24 |

| SMCI | CALL | TRADE | NEUTRAL | 05/31/24 | $183.7 | $174.8 | $179.99 | $600.00 | $179.9K | 16 | 0 |

| SMCI | CALL | SWEEP | BULLISH | 05/17/24 | $17.3 | $16.7 | $16.7 | $800.00 | $172.0K | 2.9K | 1.0K |

| SMCI | PUT | TRADE | BULLISH | 01/17/25 | $3.0 | $2.5 | $2.5 | $200.00 | $94.2K | 1.0K | 0 |

| SMCI | CALL | TRADE | NEUTRAL | 05/31/24 | $187.0 | $178.5 | $182.86 | $600.00 | $91.4K | 16 | 10 |

About Super Micro Computer

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and "Internet of Things" embedded markets. Its solutions include server, storage, blade and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular and open-standard architecture. More than half of the firm's revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

Where Is Super Micro Computer Standing Right Now?

- With a volume of 561,235, the price of SMCI is up 1.21% at $792.2.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 84 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.