Federal Reserve officials have come out again to release “eagles.”

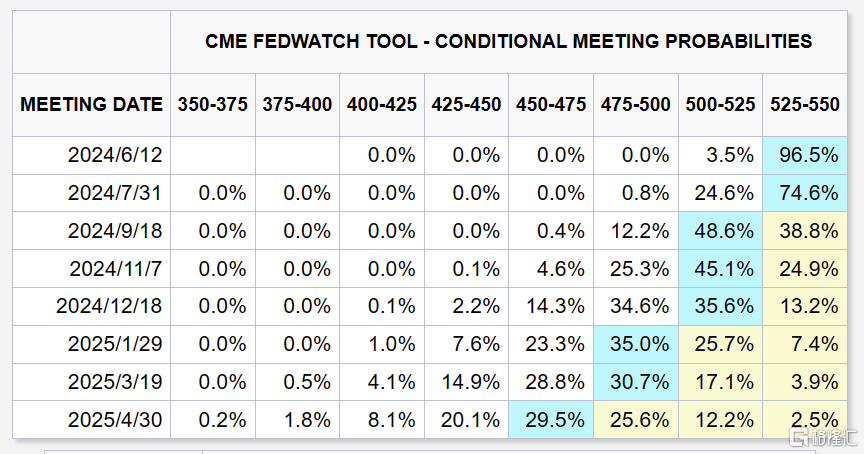

Currently, the market generally expects that the first drop of the Federal Reserve will occur in September, and that interest rates will only be cut once during the year.

Bauman: It's not appropriate to cut interest rates this year

On Friday, Federal Reserve Governor Bauman, who has the right to vote in the Federal Reserve's FOMC, said that he believes it is inappropriate for the Federal Reserve to cut interest rates this year, and pointed out that US inflation continued to be under pressure in the first few months of this year.

In an interview, Bauman said, “Currently, I have not made any interest rate cut predictions for 2024,” referring to the economic forecasts submitted by officials every quarter. “I would like [interest rates] to stay where they are now longer”.

Bauman said that after three or four months of disappointing inflation, it will take a long time for her to be confident that inflation will return to the 2% target, which is a prerequisite for cutting interest rates.

“So my expectation is a few months of progress, and maybe a few more meetings before I'm happy with that,” she said.

Bauman said that the US economy is showing positive momentum, and consumer spending has always been strong.

One of her warnings about interest rate expectations is that if an economic shock occurs, “we will need to resolve this issue through monetary policy.”

“Most importantly, we need to maintain our credibility against inflation by being careful and prudent in achieving the 2% target,” Bauman said.

Bauman also highlighted the risks faced by commercial real estate. “We may see a decline in real estate values, reduced cash flow from rental income, or other conditions that could cause commercial real estate loans or portfolios to be depreciated at certain banks, particularly if those loans mature and refinance at higher interest rates,” she said.

Officials are generally hawkish

This week, a number of Federal Reserve officials spoke out and stated that high interest rates will continue for a longer period of time.

On Friday, Dallas Federal Reserve Chairman Logan said “it is still too early to consider cutting interest rates” given the disappointing inflation data since this year.

Logan said at the conference, “I need to see some uncertainties resolved. We need to be very flexible about policies, and continue to pay attention to upcoming data to see how the financial situation evolves.”

Chicago Federal Reserve Chairman Goulsby said that although recent data showed that inflationary pressure increased at the beginning of the year, he believes that inflation will not be higher than the central bank's target.

He said that monetary policy was “relatively restrictive” and avoided giving any hints as to when interest rate cuts would be appropriate, saying that the decision would depend on upcoming economic data.

He said, “There is no point in binding our hands when we know we are about to obtain a large amount of data, even partially.”

Earlier this week, Boston Federal Reserve Chairman Collins said that it would take “more time than previously thought” to keep inflation down to the central bank's 2% target.

Minneapolis Federal Reserve Chairman Kashkari said that interest rates may “remain high for a long period of time.”

Atlanta Federal Reserve Chairman Bostic said on Thursday that he still believes that inflation may slow down under the current monetary policy. The Federal Reserve will start cutting interest rates this year, but it may only cut interest rates by 25 basis points in the last few months.

San Francisco Federal Reserve Chairman Daly said on Thursday that “neutral” interest rates in the US may rise slightly. In this case, the Federal Reserve's solution is to keep the policy interest rate at the current level for a long time.

She said that even with a high neutral interest rate, “we still have a restrictive policy, which is exactly what we want, but it may take more time... to lower inflation.”

In response, Jeffrey Roach, chief economist at LPL Financial, commented: “The Federal Reserve is walking a tightrope while balancing price stability and economic growth. Although this is not our basic situation, we do see a rise in the risk of stagflation.”