Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Ningbo CixingLtd (SZSE:300307), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Ningbo CixingLtd's Improving Profits

Ningbo CixingLtd has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Ningbo CixingLtd's EPS catapulted from CN¥0.13 to CN¥0.38, over the last year. It's not often a company can achieve year-on-year growth of 195%.

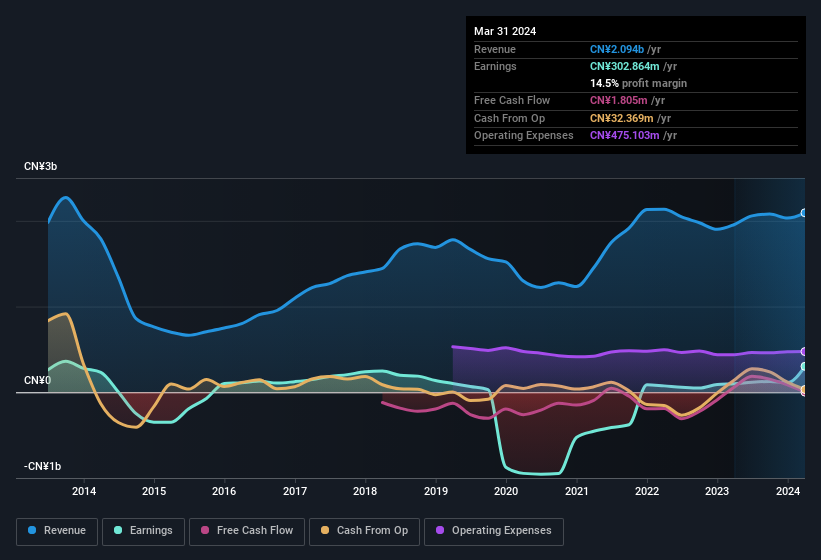

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Ningbo CixingLtd's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While we note Ningbo CixingLtd achieved similar EBIT margins to last year, revenue grew by a solid 7.0% to CN¥2.1b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Ningbo CixingLtd Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Ningbo CixingLtd insiders have a significant amount of capital invested in the stock. Given insiders own a significant chunk of shares, currently valued at CN¥530m, they have plenty of motivation to push the business to succeed. Amounting to 10% of the outstanding shares, indicating that insiders are also significantly impacted by the decisions they make on the behalf of the business.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Ningbo CixingLtd with market caps between CN¥2.9b and CN¥12b is about CN¥918k.

Ningbo CixingLtd offered total compensation worth CN¥610k to its CEO in the year to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Ningbo CixingLtd Deserve A Spot On Your Watchlist?

Ningbo CixingLtd's earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The sharp increase in earnings could signal good business momentum. Ningbo CixingLtd is certainly doing some things right and is well worth investigating. Still, you should learn about the 1 warning sign we've spotted with Ningbo CixingLtd.

Although Ningbo CixingLtd certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.