Shareholders May Be More Conservative With Zijin Mining Group Company Limited's (HKG:2899) CEO Compensation For Now

Shareholders May Be More Conservative With Zijin Mining Group Company Limited's (HKG:2899) CEO Compensation For Now

Key Insights

關鍵見解

- Zijin Mining Group's Annual General Meeting to take place on 17th of May

- Salary of CN¥3.00m is part of CEO Laichang Zou's total remuneration

- The overall pay is 150% above the industry average

- Zijin Mining Group's EPS grew by 40% over the past three years while total shareholder return over the past three years was 65%

- 紫金礦業集團年度股東大會將於5月17日舉行

- 300萬元人民幣的薪水是首席執行官鄒來昌總薪酬的一部分

- 總體薪酬比行業平均水平高出150%

- 紫金礦業集團的每股收益在過去三年中增長了40%,而過去三年的股東總回報率爲65%

Performance at Zijin Mining Group Company Limited (HKG:2899) has been reasonably good and CEO Laichang Zou has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 17th of May. However, some shareholders may still want to keep CEO compensation within reason.

紫金礦業集團有限公司(HKG: 2899)的業績相當不錯,首席執行官鄒來昌在引導公司朝着正確的方向前進方面做得不錯。鑑於這種表現,在股東將於5月17日參加股東周年大會之際,首席執行官薪酬可能不會成爲他們的主要關注點。但是,一些股東可能仍希望將首席執行官的薪酬保持在合理範圍內。

How Does Total Compensation For Laichang Zou Compare With Other Companies In The Industry?

鄒來昌的總薪酬與業內其他公司相比如何?

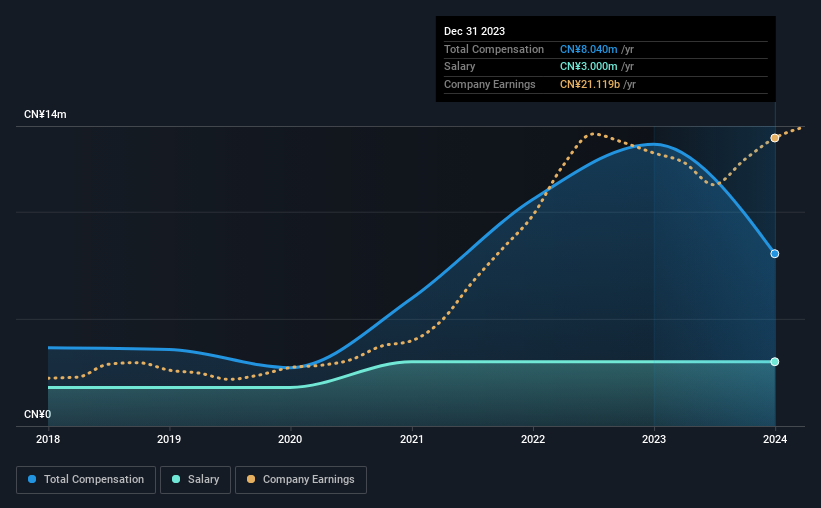

At the time of writing, our data shows that Zijin Mining Group Company Limited has a market capitalization of HK$510b, and reported total annual CEO compensation of CN¥8.0m for the year to December 2023. That's a notable decrease of 39% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at CN¥3.0m.

在撰寫本文時,我們的數據顯示,紫金礦業集團有限公司的市值爲5,100億港元,截至2023年12月的年度首席執行官年薪總額爲800萬元人民幣。這比去年顯著下降了39%。雖然我們總是首先考慮薪酬總額,但我們的分析表明,薪資部分較低,爲300萬元人民幣。

For comparison, other companies in the Hong Kong Metals and Mining industry with market capitalizations above HK$63b, reported a median total CEO compensation of CN¥3.2m. Hence, we can conclude that Laichang Zou is remunerated higher than the industry median. What's more, Laichang Zou holds HK$53m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

相比之下,香港金屬和採礦業其他市值超過630億港元的公司報告稱,首席執行官的總薪酬中位數爲320萬元人民幣。因此,我們可以得出結論,鄒來昌的薪酬高於行業中位數。更重要的是,鄒來昌以自己的名義持有該公司價值5300萬港元的股份,這表明他們在遊戲中擁有大量股份。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥3.0m | CN¥3.0m | 37% |

| Other | CN¥5.0m | CN¥10m | 63% |

| Total Compensation | CN¥8.0m | CN¥13m | 100% |

| 組件 | 2023 | 2022 | 比例 (2023) |

| 工資 | 300 萬元人民幣 | 300 萬元人民幣 | 37% |

| 其他 | 500 萬元人民幣 | 一千萬人民幣 | 63% |

| 總薪酬 | 800 萬元人民幣 | 1300 萬元人民幣 | 100% |

On an industry level, roughly 88% of total compensation represents salary and 12% is other remuneration. It's interesting to note that Zijin Mining Group allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

在行業層面上,總薪酬的大約88%代表工資,12%是其他薪酬。值得注意的是,與整個行業相比,紫金礦業集團將薪酬分配給工資的比例較小。如果非工資薪酬在總薪酬中占主導地位,則表明高管的薪水與公司業績息息相關。

A Look at Zijin Mining Group Company Limited's Growth Numbers

看看紫金礦業集團有限公司的增長數字

Over the past three years, Zijin Mining Group Company Limited has seen its earnings per share (EPS) grow by 40% per year. It achieved revenue growth of 4.5% over the last year.

在過去的三年中,紫金礦業集團有限公司的每股收益(EPS)每年增長40%。去年,它實現了4.5%的收入增長。

Shareholders would be glad to know that the company has improved itself over the last few years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

股東們會很高興得知該公司在過去幾年中有所改善。很高興看到收入略有增長,因爲這表明該業務能夠可持續增長。暫時偏離目前的形式,查看這份對分析師未來預期的免費可視化描述可能很重要。

Has Zijin Mining Group Company Limited Been A Good Investment?

紫金礦業集團有限公司是一項不錯的投資嗎?

Boasting a total shareholder return of 65% over three years, Zijin Mining Group Company Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

紫金礦業集團有限公司在三年內實現了65%的股東總回報率,股東表現良好。因此,有些人可能認爲,首席執行官的薪水應該高於類似規模公司的正常水平。

To Conclude...

總而言之...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

鑑於公司表現不錯,在即將舉行的股東周年大會上,只有少數股東(如果有的話)可能對首席執行官的薪酬有疑問。但是,鑑於首席執行官的薪酬已經高於行業平均水平,任何提高首席執行官薪酬的決定都可能遭到股東的反對。

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Zijin Mining Group that you should be aware of before investing.

儘管首席執行官的薪酬是一個需要注意的重要因素,但投資者還應注意其他領域。這就是爲什麼我們進行了一些挖掘,並確定了紫金礦業集團的一個警告信號,您在投資之前應該注意這一點。

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

可以說,業務質量比首席執行官的薪酬水平重要得多。因此,請查看這份免費清單,列出了股本回報率高、負債率低的有趣公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。