Despite an already strong run, Shanghai Rongtai Health Technology Corporation Limited (SHSE:603579) shares have been powering on, with a gain of 27% in the last thirty days. Looking further back, the 21% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

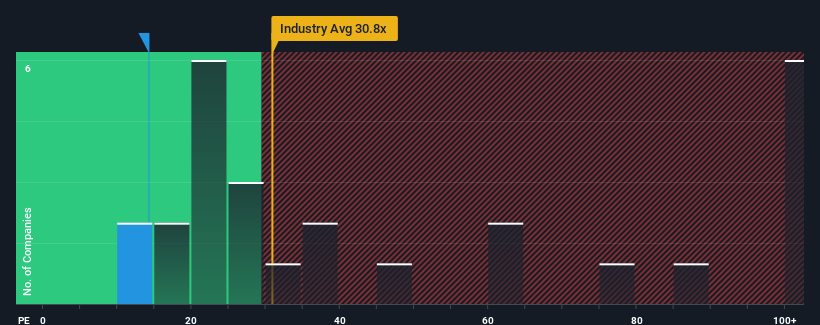

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 33x, you may still consider Shanghai Rongtai Health Technology as a highly attractive investment with its 14.2x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Shanghai Rongtai Health Technology has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Shanghai Rongtai Health Technology's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 59%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 8.9% each year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the market is forecast to expand by 25% per year, which is noticeably more attractive.

With this information, we can see why Shanghai Rongtai Health Technology is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Shanghai Rongtai Health Technology's P/E

Shanghai Rongtai Health Technology's recent share price jump still sees its P/E sitting firmly flat on the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shanghai Rongtai Health Technology maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Shanghai Rongtai Health Technology that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.