Market Whales and Their Recent Bets on FICO Options

Market Whales and Their Recent Bets on FICO Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Fair Isaac.

有大量資金可以花的鯨魚對費爾·艾薩克採取了明顯的看漲立場。

Looking at options history for Fair Isaac (NYSE:FICO) we detected 8 trades.

查看Fair Isaac(紐約證券交易所代碼:FICO)的期權歷史記錄,我們發現了8筆交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 12% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,50%的投資者以看漲的預期開啓交易,12%的投資者持看跌預期。

From the overall spotted trades, 5 are puts, for a total amount of $615,625 and 3, calls, for a total amount of $119,300.

在所有已發現的交易中,有5筆是看跌期權,總額爲615,625美元,3筆是看漲期權,總額爲119,300美元。

Predicted Price Range

預測的價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $1000.0 to $1320.0 for Fair Isaac over the recent three months.

根據交易活動,看來重要投資者的目標是在最近三個月中將Fair Isaac的價格範圍從1000美元擴大到1320.0美元。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

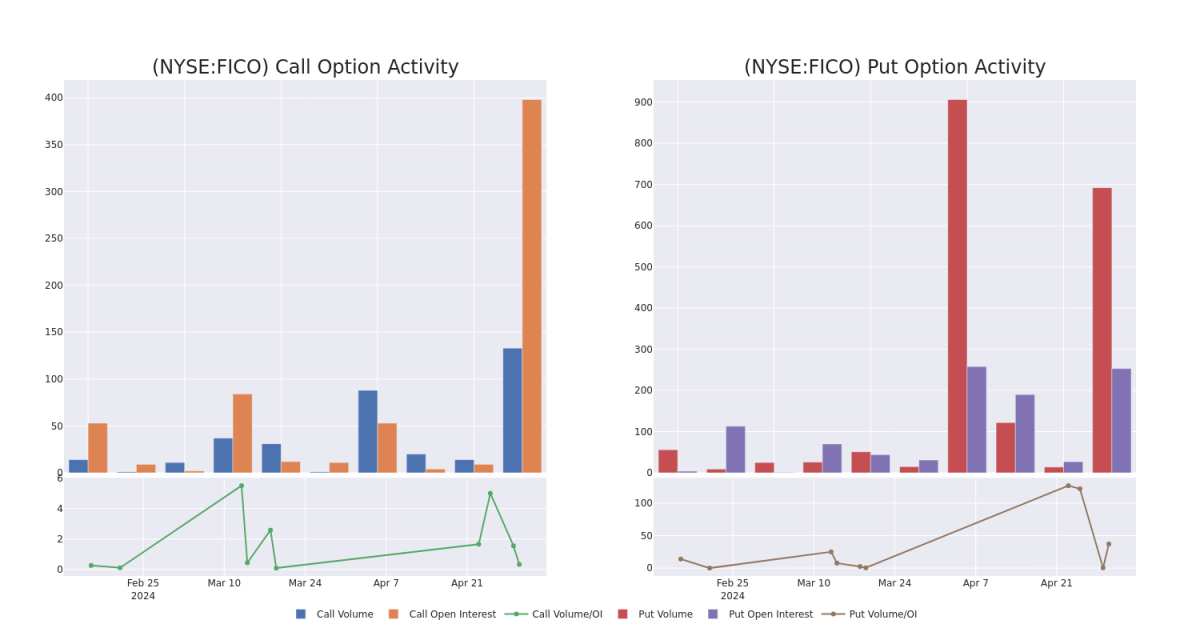

In today's trading context, the average open interest for options of Fair Isaac stands at 27.33, with a total volume reaching 72.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Fair Isaac, situated within the strike price corridor from $1000.0 to $1320.0, throughout the last 30 days.

在當今的交易背景下,Fair Isaac期權的平均未平倉合約爲27.33,總成交量達到72.00。隨附的圖表描繪了過去30天內Fair Isaac高價值交易的看漲期權和看跌期權交易量以及未平倉合約的變化情況,行使價走勢從1000美元到1320.0美元不等。

Fair Isaac Option Volume And Open Interest Over Last 30 Days

過去 30 天的公平艾薩克期權交易量和未平倉合約

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FICO | PUT | SWEEP | BULLISH | 12/20/24 | $54.9 | $53.3 | $53.3 | $1150.00 | $298.4K | 88 | 56 |

| FICO | PUT | TRADE | NEUTRAL | 10/18/24 | $95.4 | $88.0 | $92.4 | $1320.00 | $120.1K | 0 | 0 |

| FICO | PUT | TRADE | BULLISH | 10/18/24 | $80.9 | $75.8 | $76.9 | $1290.00 | $92.2K | 2 | 0 |

| FICO | PUT | SWEEP | BULLISH | 10/18/24 | $48.3 | $43.3 | $48.2 | $1200.00 | $57.8K | 56 | 12 |

| FICO | CALL | SWEEP | BEARISH | 06/21/24 | $108.8 | $104.6 | $104.6 | $1280.00 | $52.3K | 13 | 1 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FICO | 放 | 掃 | 看漲 | 12/20/24 | 54.9 美元 | 53.3 美元 | 53.3 美元 | 1150.00 美元 | 298.4 萬美元 | 88 | 56 |

| FICO | 放 | 貿易 | 中立 | 10/18/24 | 95.4 美元 | 88.0 美元 | 92.4 美元 | 1320.00 美元 | 120.1 萬美元 | 0 | 0 |

| FICO | 放 | 貿易 | 看漲 | 10/18/24 | 80.9 美元 | 75.8 美元 | 76.9 美元 | 1290.00 美元 | 92.2 萬美元 | 2 | 0 |

| FICO | 放 | 掃 | 看漲 | 10/18/24 | 48.3 美元 | 43.3 美元 | 48.2 美元 | 1200.00 美元 | 57.8 萬美元 | 56 | 12 |

| FICO | 打電話 | 掃 | 粗魯的 | 06/21/24 | 108.8 美元 | 104.6 美元 | 104.6 美元 | 1280.00 美元 | 52.3 萬美元 | 13 | 1 |

About Fair Isaac

關於費爾·艾薩克

Founded in 1956, Fair Isaac Corporation is a leading applied analytics company. Fair Isaac is primarily known for its FICO credit scores, which is a widely used industry benchmark to determine the creditworthiness of an individual consumer. The firm's credit scores business accounts for most of the firm's profits and consists of business-to-business and business-to-consumer services. In addition to scores, Fair Isaac also sells software primarily to financial institutions for areas such as analytics, decision-making, customer workflows, and fraud.

費爾艾薩克公司成立於1956年,是一家領先的應用分析公司。Fair Isaac主要以其FICO信用評分而聞名,該評分是確定個人消費者信譽的廣泛使用的行業基準。該公司的信用評分業務佔公司利潤的大部分,包括企業對企業和企業對消費者的服務。除分數外,Fair Isaac還主要向金融機構銷售分析、決策、客戶工作流程和欺詐等領域的軟件。

In light of the recent options history for Fair Isaac, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於Fair Isaac最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Fair Isaac's Current Market Status

費爾·艾薩克的當前市場狀況

- Currently trading with a volume of 205,451, the FICO's price is up by 5.18%, now at $1353.46.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 82 days.

- FICO目前的交易量爲205,451美元,價格上漲了5.18%,目前爲1353.46美元。

- RSI讀數表明該股目前可能處於超買狀態。

- 預計收益將在82天后發佈。

What Analysts Are Saying About Fair Isaac

分析師對費爾·艾薩克的看法

In the last month, 4 experts released ratings on this stock with an average target price of $1382.75.

上個月,4位專家發佈了該股的評級,平均目標價爲1382.75美元。

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $1500.

- Reflecting concerns, an analyst from Redburn Atlantic lowers its rating to Neutral with a new price target of $1113.

- In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $1500.

- An analyst from Raymond James persists with their Outperform rating on Fair Isaac, maintaining a target price of $1418.

- 尼德姆的一位分析師已將其評級下調至買入,將目標股價調整爲1500美元。

- 雷德本大西洋的一位分析師將其評級下調至中性,新的目標股價爲1113美元,這反映了人們的擔憂。

- 尼德姆的一位分析師謹慎地將其評級下調至買入,將目標股價定爲1500美元。

- 雷蒙德·詹姆斯的一位分析師堅持對費爾·艾薩克的跑贏大盤評級,維持1418美元的目標價。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Fair Isaac options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。藉助Benzinga Pro的實時提醒,隨時了解最新的Fair Isaac期權交易。