For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Amphenol (NYSE:APH). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is Amphenol Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Amphenol grew its EPS by 16% per year. That's a pretty good rate, if the company can sustain it.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It was a year of stability for Amphenol as both revenue and EBIT margins remained have been flat over the past year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

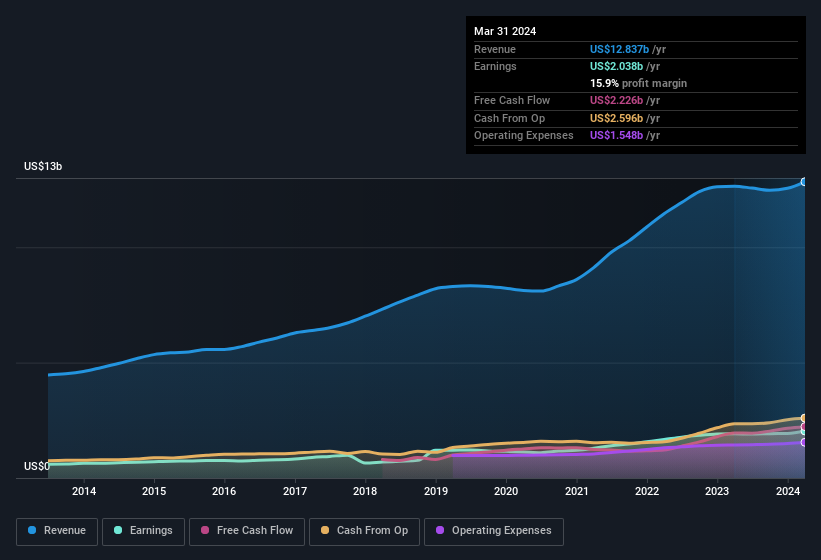

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Amphenol's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Amphenol Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for Amphenol, in the last year, is that a certain insider has buying shares with ample enthusiasm. In other words, the Independent Director, Robert Livingston, acquired US$1.0m worth of shares over the previous 12 months at an average price of around US$84.81. It doesn't get much better than that, in terms of large investments from insiders.

Along with the insider buying, another encouraging sign for Amphenol is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth US$437m. While that is a lot of skin in the game, we note this holding only totals to 0.6% of the business, which is a result of the company being so large. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Richard Norwitt is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations over US$8.0b, like Amphenol, the median CEO pay is around US$14m.

The Amphenol CEO received US$11m in compensation for the year ending December 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Amphenol To Your Watchlist?

As previously touched on, Amphenol is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Amphenol is trading on a high P/E or a low P/E, relative to its industry.

The good news is that Amphenol is not the only growth stock with insider buying. Here's a list of growth-focused companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.