What the Options Market Tells Us About Block

What the Options Market Tells Us About Block

Whales with a lot of money to spend have taken a noticeably bullish stance on Block.

有大量資金可以花的鯨魚對Block採取了明顯的看漲立場。

Looking at options history for Block (NYSE:SQ) we detected 24 trades.

查看Block(紐約證券交易所代碼:SQ)的期權歷史記錄,我們發現了24筆交易。

If we consider the specifics of each trade, it is accurate to state that 58% of the investors opened trades with bullish expectations and 33% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,有58%的投資者以看漲的預期開盤,33%的投資者持看跌預期。

From the overall spotted trades, 12 are puts, for a total amount of $780,259 and 12, calls, for a total amount of $495,185.

在所有已發現的交易中,有12筆是看跌期權,總額爲780,259美元,12筆看漲期權,總額爲495,185美元。

What's The Price Target?

目標價格是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $47.5 to $95.0 for Block during the past quarter.

分析這些合約的交易量和未平倉合約,看來大型企業一直在關注Block在上個季度的價格範圍從47.5美元到95.0美元不等。

Volume & Open Interest Development

交易量和未平倉合約的發展

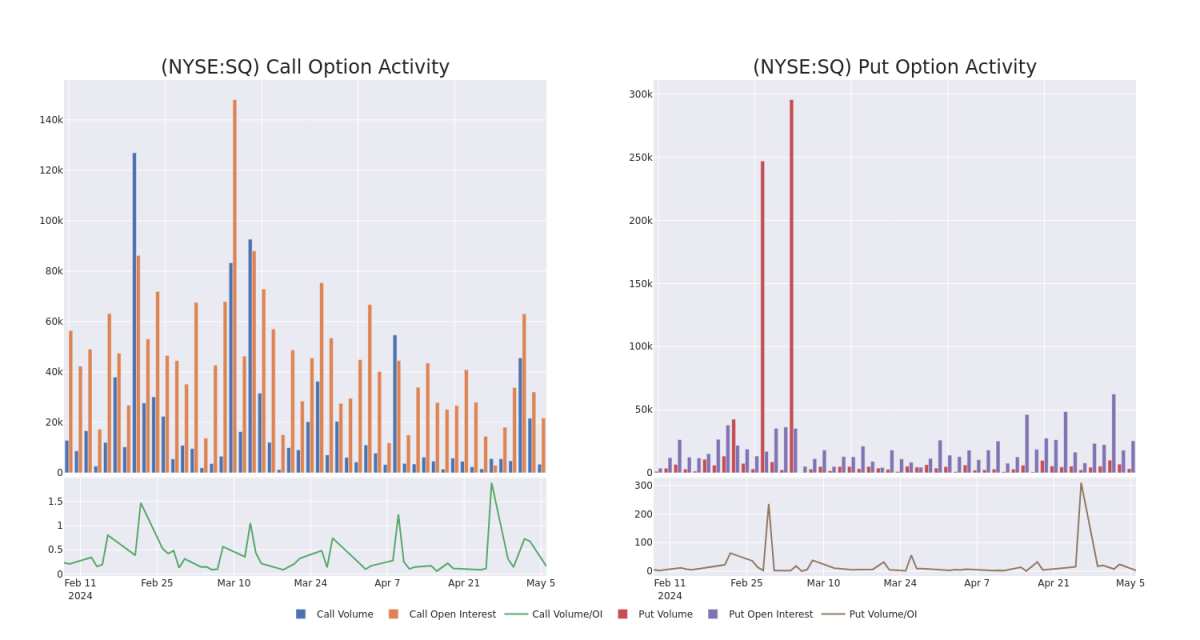

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Block's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Block's substantial trades, within a strike price spectrum from $47.5 to $95.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了指定行使價下Block期權的流動性和投資者對Block期權的興趣。即將發佈的數據可視化了與Block的大量交易相關的看漲期權和看跌期權的交易量和未平倉合約的波動,行使價在前30天從47.5美元到95.0美元不等。

Block Option Volume And Open Interest Over Last 30 Days

過去 30 天的大宗期權交易量和未平倉合約

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | PUT | SWEEP | BULLISH | 09/20/24 | $6.65 | $6.6 | $6.6 | $70.00 | $257.4K | 2.6K | 583 |

| SQ | PUT | SWEEP | BULLISH | 07/19/24 | $6.75 | $6.65 | $6.65 | $75.00 | $99.0K | 1.1K | 309 |

| SQ | CALL | SWEEP | BULLISH | 09/20/24 | $10.55 | $10.4 | $10.5 | $70.00 | $93.4K | 1.4K | 175 |

| SQ | CALL | TRADE | BULLISH | 05/31/24 | $1.75 | $1.69 | $1.75 | $75.00 | $63.3K | 1.0K | 2 |

| SQ | PUT | SWEEP | BULLISH | 09/20/24 | $6.9 | $6.85 | $6.85 | $70.00 | $61.6K | 2.6K | 30 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 平方米 | 放 | 掃 | 看漲 | 09/20/24 | 6.65 美元 | 6.6 美元 | 6.6 美元 | 70.00 美元 | 257.4 萬美元 | 2.6K | 583 |

| 平方米 | 放 | 掃 | 看漲 | 07/19/24 | 6.75 美元 | 6.65 美元 | 6.65 美元 | 75.00 美元 | 99.0K | 1.1K | 309 |

| 平方米 | 打電話 | 掃 | 看漲 | 09/20/24 | 10.55 美元 | 10.4 美元 | 10.5 美元 | 70.00 美元 | 93.4 萬美元 | 1.4K | 175 |

| 平方米 | 打電話 | 貿易 | 看漲 | 05/31/24 | 1.75 美元 | 1.69 美元 | 1.75 美元 | 75.00 美元 | 63.3 萬美元 | 1.0K | 2 |

| 平方米 | 放 | 掃 | 看漲 | 09/20/24 | 6.9 美元 | 6.85 美元 | 6.85 美元 | 70.00 美元 | 61.6 萬美元 | 2.6K | 30 |

About Block

關於區塊

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square's payment volume was a little over $200 million.

Block 成立於 2009 年,爲商家提供支付服務以及相關服務。該公司還推出了Cash App,這是一個人與人之間的支付網絡。2023年,Square的支付額略高於2億美元。

Having examined the options trading patterns of Block, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了Block的期權交易模式之後,我們的注意力現在直接轉向了該公司。這種轉變使我們能夠深入研究其目前的市場地位和表現

Where Is Block Standing Right Now?

Block 現在在哪裏?

- Currently trading with a volume of 6,364,428, the SQ's price is up by 4.45%, now at $72.56.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 87 days.

- 該SQ目前的交易量爲6,364,428美元,價格上漲了4.45%,目前爲72.56美元。

- RSI讀數表明,該股目前在超買和超賣之間處於中立狀態。

- 預計業績將在87天后發佈。

What Analysts Are Saying About Block

分析師對區塊的看法

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $98.2.

在過去的一個月中,5位行業分析師分享了他們對該股的見解,提出平均目標價爲98.2美元。

- An analyst from Baird persists with their Outperform rating on Block, maintaining a target price of $100.

- Maintaining their stance, an analyst from Mizuho continues to hold a Buy rating for Block, targeting a price of $106.

- Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on Block with a target price of $95.

- Consistent in their evaluation, an analyst from Baird keeps a Outperform rating on Block with a target price of $98.

- Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on Block with a target price of $92.

- 貝爾德的一位分析師堅持對Block的跑贏大盤評級,將目標價維持在100美元。

- 瑞穗的一位分析師保持立場,繼續維持Block的買入評級,目標價格爲106美元。

- Canaccord Genuity的一位分析師在評估中保持了對Block的買入評級,目標價爲95美元。

- 貝爾德的一位分析師在評估中保持了對Block跑贏大盤的評級,目標價爲98美元。

- 道明考恩的一位分析師在評估中保持對Block的買入評級,目標價爲92美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Block with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了獲得更高利潤的可能性。精明的交易者通過持續的教育、戰略交易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解Block的最新期權交易,獲取實時提醒。