Midea Real Estate Holding Limited (HKG:3990) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 50% over that time.

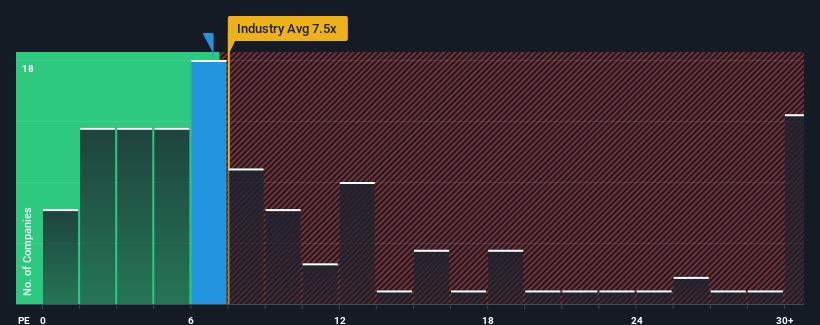

In spite of the firm bounce in price, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may still consider Midea Real Estate Holding as an attractive investment with its 6.9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Midea Real Estate Holding's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Midea Real Estate Holding's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 51%. This means it has also seen a slide in earnings over the longer-term as EPS is down 82% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 1.3% per annum as estimated by the six analysts watching the company. That's shaping up to be materially lower than the 16% each year growth forecast for the broader market.

With this information, we can see why Midea Real Estate Holding is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Midea Real Estate Holding's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Midea Real Estate Holding's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Midea Real Estate Holding (at least 1 which is potentially serious), and understanding them should be part of your investment process.

Of course, you might also be able to find a better stock than Midea Real Estate Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.