Apple announced the largest share buyback of 110 billion US dollars in the company's history. Cook said that at the launch of the new iPad next week and the June Global Developers Conference, “major plans” will be announced from an “artificial intelligence perspective.” In the second fiscal quarter, Apple EPS did not decline but rose and hit a new high for the quarter, with service revenue reaching new highs for five consecutive quarters. iPhone sales fell 10% year over year, and sales in Greater China fell 8%, all better than the market's worst imagination.

After the US stock market on Thursday May 2, consumer electronics and technology giant Apple released the results for the second fiscal quarter of the 2024 fiscal year (that is, the financial report for the first quarter of the 2024 natural year), ending the earnings season for large technology stocks.

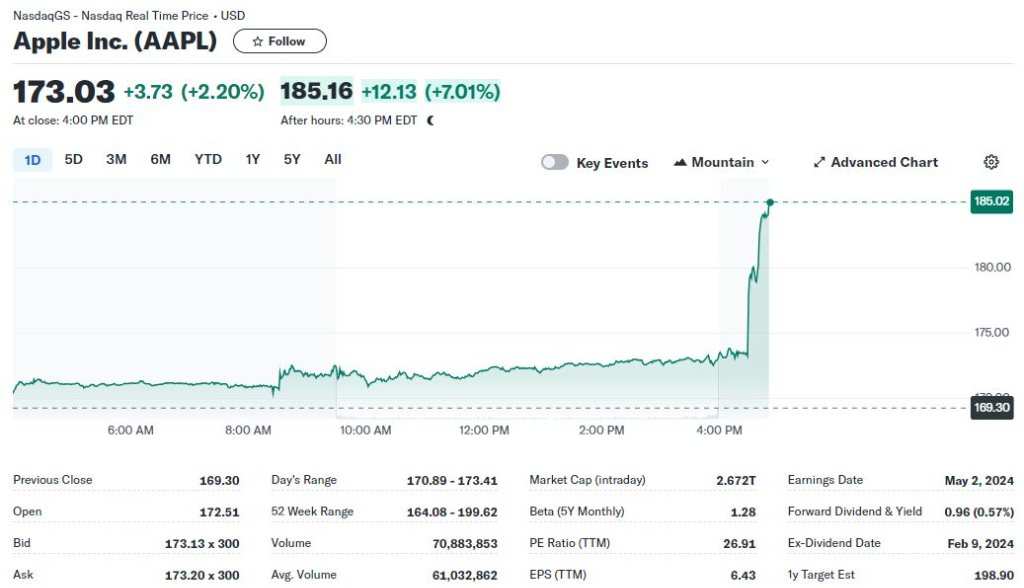

Apple announced the largest share repurchase plan of 110 billion US dollars in the company's history, with earnings of 1.53 US dollars per share. At the same time, iPhone revenue for the second fiscal quarter fell 10% year on year, and overall revenue fell 4% year on year, all slightly better than market expectations. Revenue in Greater China fell 8% year on year, significantly better than the double-digit percentage decline expected by the market. The stock price rose 7% after the market.

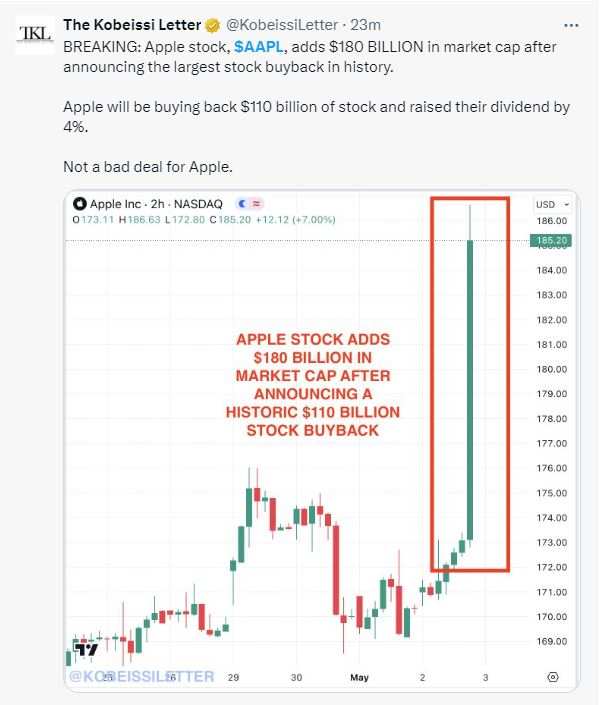

Some commentators say that after announcing the $110 billion share repurchase plan, Apple's market value increased by 180 billion US dollars after the market.

Apple CEO Cook revealed during the earnings call that total revenue for the June quarter may show a low single-digit percentage increase. Both service and iPad revenue are expected to increase by double digits, and he still has a positive view on the long-term prospects of the Chinese business. iPhone sales increased in mainland China. He also reiterated that the company is making major investments in generative artificial intelligence:

“Look forward to next week's exciting product launch, and next month's incredible Global Developers Conference.”

Apple closed up 2.2% on Thursday, breaking away from a one-week low. Due to weak iPhone sales in the important Greater China region and the lack of significant progress in Apple's overall artificial intelligence technology deployment, Apple's stock price has fallen 10% since this year, the second-worst performance among the seven major US tech giants (Magnificent 7), second only to Tesla, which has fallen by nearly 28%.

Over the past year, Apple's stock price has risen by more than 3%, while high-profile rivals Meta, which is entering AI, have surged 86%, Google has climbed 58%, and Microsoft has climbed nearly 31%. Apple also relinquished the crown of the world's largest company by market capitalization to Microsoft.

Wall Street's consensus expectation for Apple is a “moderate buy,” with 18 analysts rated “buy,” 11 rated “hold,” and 2 suggested “sell.” The average target price of $200.37 indicates that there is still room for an increase of about 16%.

Apple's total revenue fell 4% but was better than expected. EPS did not fall but rose to a new high for the quarter, authorizing the highest stock repurchase in history

According to financial reports, Apple's total revenue for the second fiscal quarter fell 4.3% year-on-year to US$94.75 billion from US$94.84 billion in the same period last year, better than market expectations of US$90.33 billion or 4.8%. The latter would have been the biggest decline in a year since the first quarter of 2023.

In the same period last year, Apple's total revenue fell 3% year over year. Revenue for the first fiscal quarter (that is, the important year-end holiday shopping period in the fourth quarter of 2023) returned to growth for the first time in a year after three consecutive quarters of decline, up 2% year over year to US$119.58 billion, mainly due to a 3% year-on-year increase in iPhone sales.

According to some analysts, Apple's total revenue declined year-on-year for five out of six quarters, which seems to indicate that the lack of AI highlights cannot effectively boost demand.

Adjusted earnings per share for the second fiscal quarter were 1.53 US dollars, a record high in the March quarter, a slight increase from 1.52 US dollars in the same period last year. The market had expected a year-on-year decline to 1.50 US dollars, but it was significantly weaker than the record high of 2.18 US dollars set in the first fiscal quarter. At that time, it had an increase of 16% year over year.

Net profit for the quarter was US$23.636 billion, higher than market expectations of US$23.17 billion, down 2.2% year on year from US$24.16 billion in the same period last year. Net profit for the previous quarter increased 13% year over year to US$33.92 billion, the highest in at least two years. Gross margin increased by 2 percentage points to 46.6% year over year, in line with market expectations and higher than 45.9% in the previous quarter.

CFO Luca Maestri said that due to very high levels of customer satisfaction and loyalty, the company's active equipment installation base across all products and geographical segments reached a record high.

As a result, Apple's board of directors authorized an additional $110 billion in share repurchases, the highest in the company's history, and a 22% increase over the previous authorized repurchase amount of 90 billion US dollars, exceeding market expectations. Apple has also increased its quarterly dividend for 12 consecutive years, and this time it has increased 4% to pay a cash dividend of $0.25 per share.

Some analysts criticize that large buybacks will artificially boost Apple's earnings per share and price-earnings ratio. This is a strategy to make up for stagnant sales until new developments related to artificial intelligence can be introduced:

“It appears that Apple clearly lacks long-term investment and innovation vision. They burn a lot of money in VR and have no thought leadership in the AI field.”

After the pandemic, Apple no longer gave performance guidelines. Cook revealed that overall sales for the June quarter may grow at a lower single-digit percentage. The market forecast is US$83.23 billion. In the second quarter of the natural year of 2023, Apple's revenue fell 1% year on year to US$81.8 billion.

In addition, Apple's R&D expenditure for the quarter increased 6% year over year to 7.9 billion US dollars, capital expenditure decreased 34% year over year to 4.4 billion US dollars, and operating cash flow remained flat at 62.6 billion US dollars year over year.

Service revenue reached a record high for five consecutive quarters. iPhone sales fell 10% year over year. New iPad and AI news will be released next week

By business, sales of the “fist product” iPhone in the second fiscal quarter, which accounts for 60% of Apple's total revenue, fell 10.5% year on year or decreased by 5.37 billion US dollars to 45.96 billion US dollars. There was no year-on-year increase for three consecutive quarters, but it was slightly better than the market's forecast of 45.76 billion US dollars. There was an unexpected increase of 1.5% to $51.33 billion in the same period last year, setting a new record for mobile phone revenue for the second fiscal quarter in history.

According to some analysts, this may indicate weak demand for the iPhone 15 series released in September last year.

Service revenue, which has the highest profit margin and accounts for 20% of total revenue, increased 14.2% year over year to US$23.87 billion, higher than market expectations of US$23.28 billion, and reached a record high for five consecutive quarters. In the same period last year, it grew by about 5.5% to US$20.91 billion, the highest in history.

This also means that service revenue recorded single-digit percentage growth for four consecutive quarters before the third quarter of the 2023 natural year, and has returned to a high double-digit percentage growth rate for three consecutive quarters from the third quarter of the 2023 calendar year to now. Company executives expect service revenue growth to maintain double-digit percentages over the next two quarters.

Services include the App Store app store, audio and video streaming Apple Music and Apple TV+, iCloud storage, AppleCare warranty, advertising revenue from a search engine license agreement with Google, and payment fees for Apple Pay and other products. After the iPhone has become a more mature product, service is an important area of diversification of Apple's business, reflecting consumer demand trends even earlier.

Among other hardware, which accounts for the remaining 20% of Apple's total revenue, iPad tablet revenue fell 16.7% year on year to 5.56 billion US dollars, lower than market expectations of 5.91 billion US dollars; Mac computer revenue increased 3.9% year over year to 7.451 billion US dollars, and the market originally expected a 5% decline; and revenue from wearables, home furnishings and accessories fell 9.6% year over year to 7.913 billion US dollars, which is less than the 5% decline expected by the market.

In the same period last year, Mac revenue plummeted 31% year over year to 7.168 billion US dollars, iPad revenue fell 13% year over year to 6.67 billion US dollars, and wearable device revenue fell 1% year over year to 8.757 billion US dollars.

Cook said the unexpected increase in Mac sales was driven by a new MacBook Air model equipped with an upgraded M3 chip. Apple hasn't updated the iPad since 2022, which has dragged down sales, but it will release a new iPad on May 7, or revive demand. The company's CFO expects iPad revenue to grow by a double-digit percentage year over year in the June quarter.

Cook also said that Apple will announce “major plans” from an “artificial intelligence perspective” when launching the iPad next week and at the annual developer conference in June. Investors are excited about this.

Previously, Bank of America expected Apple's Vision Pro mixed reality headset sales revenue of 1 billion US dollars in the second fiscal quarter, which is still in the niche. Apple did not release specific sales data for this product line in its latest earnings report.

Revenue in Greater China fell 8% better than expected. Only European revenue increased year-on-year. Cook is concerned about the long-term prospects of the Chinese market

By region, revenue from Greater China, which contributed about 20% of Apple's revenue, fell 8.1% year on year to US$16.37 billion, which was better than the double-digit percentage decline expected by the market. Wall Street thought it would drop 11% year over year to US$15.87 billion, and there was even pessimistic expectations that it would drop sharply by 28% year on year.

Greater China is Apple's third-largest sales market after North America and Europe. As the core business with sales volume far exceeding other hardware products, the health level of iPhones, especially sales trends in Greater China, will attract particular attention.

Last quarter's revenue fell nearly 13% to US$20.82 billion, the worst quarterly performance in December since the beginning of 2020, and fell 2.9% to US$17.81 billion in the same period last year. Poor iPhone sales have caused revenue in Greater China to decline year-on-year for several consecutive quarters.

Cook told the media:

“I feel very good about China (the market's performance), and I'm thinking more about long-term performance than next week. In fact, iPhone sales in China increased in the second fiscal quarter, which may come as a surprise to some.”

In addition, revenue in the American region, the largest market, fell 1.4% year on year to US$37.27 billion, a sharp drop of 26% month on month. The previous quarter had an increase of more than 2% year over year and nearly 23% month on month to US$50.43 billion. Revenue in Europe, the second-largest market, increased slightly by 0.7% year over year to US$24.12 billion, but fell by more than 20% month-on-month. Japan's revenue fell nearly 13% year over year to US$6.26 billion, down 19% month over month. Revenue in other Asia Pacific regions fell 17% year over year to US$6.723 billion, down nearly 34% from month to month.

Why is it important?

First, its huge market capitalization makes Apple account for about 7% of the weight of the S&P 500 index, and changes in its stock price are enough to affect market performance. As a 3C consumer goods giant, Apple's performance can also reflect overall economic health and provide clues about consumer spending intentions.

Second, Apple has suffered a series of hits this year. iPhone sales declined in the Chinese market due to extended user switching cycles and incentives for local competition, losing the title of the best-selling smartphone manufacturer in China, and relinquishing the top position in the global smartphone market to Samsung. In February of this year, the company abandoned its decade-long electric vehicle project, and is also facing stricter anti-monopoly scrutiny and punishment from European and American regulators.

Most importantly, there is no shortage of investors and analysts who believe that Apple lags behind competitors in the field of artificial intelligence. Given that “almost all of the excitement and growth points in the current market are driven by artificial intelligence,” people are eager to learn “when and if” the company will fully invest in AI technology from Apple's latest earnings report, thereby driving sales of products equipped with AI functions back to accelerated growth.

What are you most concerned about? Whether to comment on AI progress

Apple management's comments on generative artificial intelligence will be the absolute focus and influence stock price movements. Investors are concerned about whether Apple will introduce generative AI into popular hardware such as iPhones and Mac computers to counter the fact that sales are falling.

Two weeks ago, it was reported that Apple will use artificial intelligence chips to fully upgrade the Mac product line, which helped increase the company's market value by more than 110 billion US dollars a day. The biggest increase in the stock price in nearly a year is greater than the promotion of mixed reality headsets with a price of 3,500 US dollars in February. This shows that people have high expectations for AI strategies, and they are very keen to follow any sign of Apple moving towards AI.

Apple has yet to make high-profile announcements about integrating generative AI into core products and services, nor has it “caused a stir” in popular fields such as chatbots, even though CEO Cook “shouted” many times this year in an attempt to assure shareholders that the company is committed to artificial intelligence innovation.

Cook has hinted that Apple has been quietly working on artificial intelligence projects. “We are doing a lot of internal work, investing a lot in this field, and there are some things we are very excited about, which we will discuss later this year.” He acknowledged that generative artificial intelligence will bring huge opportunities to Apple, has incredible “breakthrough potential”, and will unlock “transformative opportunities” for users.

Other analysts believe that Apple may provide details of the March media claiming that it acquired Canadian AI startup Darwin AI. Meanwhile, Apple's annual global developer conference will be held from June 10 to 14, and the market consensus is that major AI developments will be announced.

According to the latest report this week, Apple tends to hunt down former Google employees to form artificial intelligence teams, which also confirms the importance it attaches to AI strategy. Allegedly, Apple is developing a series of artificial intelligence models called MM1, which can generate answers in response to user text and image input.

In addition, analysts are also focusing on growth indicators in the traditional sense, such as the sales volume of the core business iPhone, the service business with the second largest contributor to revenue — service is the only area where Apple achieved revenue growth in 2023, and capital return plans. Many brokerage firms expect Apple to announce a new $90 billion share repurchase and a dividend increase of about 5%, which will have a positive impact on investment sentiment.

What do you think of Wall Street?

There are reports that Apple is in talks with OpenAI and Google to integrate generative artificial intelligence functionality into the next iPhone 16 model to be launched this fall, but no agreement has been reached. Analysts emphasized that AI may accelerate the iPhone switching cycle and activate growth.

According to IDC statistics, global smartphone shipments grew for the third consecutive quarter. The year-on-year increase in the first quarter of this year was 7.8%, indicating a rebound in the entire industry, but Apple experienced negative growth. Global iPhone shipments may have dropped by nearly 10%. Perhaps AI can save Apple.

Morgan Stanley predicts that the next iPhone “may become a voice-activated smart personal assistant, dominated by upgraded Siri. For example, it can interact with all apps on the phone through voice control, changing the rules of the game for ordinary consumers.”

Other media also revealed that Apple has been secretly building a household robot to become the next innovative product line. It can follow user movements or make a more advanced intelligent display robot that imitates human head movements, but some people think it is more appealing than AI news.

Broker Bernstein pointed out that the weakness experienced by Apple in the Chinese market is more cyclical than structural. Generative artificial intelligence functions and the promotion of mobile phone upgrade cycles may lay a good foundation for the iPhone 16 switching cycle.

Goldman Sachs believes that investors have fully understood the risks of Apple stock, and the focus should shift from profit to growth catalysts for the second half of the year, including the release of new products such as iPhone 16, iPad, and Mac. “The June quarter may mark a turning point in market sentiment. The next catalyst is the Apple Global Developers Conference in June, which will discuss new operating systems and generative AI features.”

J.P. Morgan said that this financial report will reveal cyclical challenges brought about by consumer spending pressure, but Apple's “cyclical headwind” may soon become an “artificial intelligence tailwind.” Investors' expectations are so low that the stock price may improve after the earnings report, “because even the worse financial reports are better than market expectations.”

The Bank of America predicts that next year Apple may benefit from the acceleration of the iPhone upgrade cycle driven by artificial intelligence, so it is not afraid of a “weak demand environment” and the stock price may rise 36% as the “2024 Preferred Stock”:

“There are four potential catalysts that will help boost Apple's stock price between now and the end of the year: increased return on capital to shareholders, exciting artificial intelligence announcements at the June WWDC conference, the next iPhone 16 that supports endside generative artificial intelligence, and profit margins still have considerable room to rise.

All 4 of the latest iPhone models released this fall are likely to be equipped with the same application processor, A18, to improve artificial intelligence/machine learning performance. “Developing in-house chips, reducing component costs, reducing reliance on public cloud providers, and the service business is expected to achieve strong revenue growth, all of which will strongly boost profit margins.”

However, Barclays, which “reduced” Apple's rating and has room for a nearly 7% drop in the target price of $158, pointed out that the increase in Mac and iPad sales will offset the weakness of the iPhone, but it is not expected that the iPhone 16 will have major design changes: “Any differentiated generative AI application on the iPhone may not be launched until 2025 at the earliest, and the year-on-year increase in iPhone 16 sales will temporarily stagnate.”