Investors with significant funds have taken a bullish position in Nike (NYSE:NKE), a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in NKE usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 8 options transactions for Nike. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 62% being bullish and 0% bearish. Of all the options we discovered, 7 are puts, valued at $509,057, and there was a single call, worth $91,350.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $80.0 to $105.0 for Nike during the past quarter.

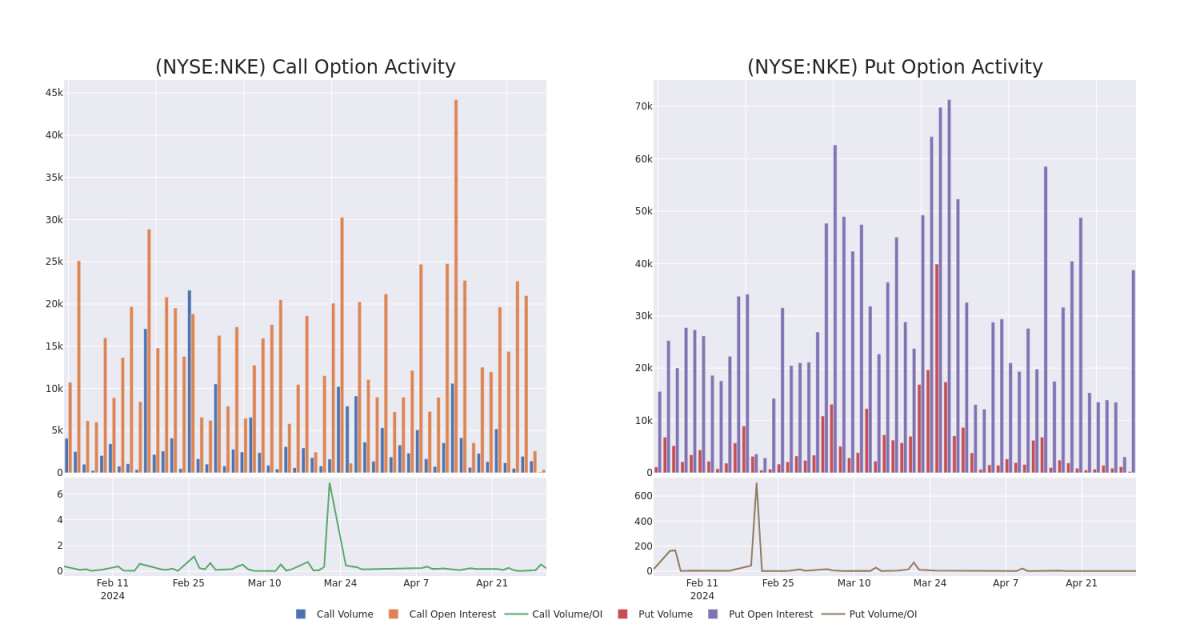

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Nike's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Nike's substantial trades, within a strike price spectrum from $80.0 to $105.0 over the preceding 30 days.

Nike Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NKE | PUT | TRADE | BULLISH | 01/17/25 | $7.45 | $7.35 | $7.35 | $90.00 | $294.0K | 10.5K | 7 |

| NKE | CALL | TRADE | BULLISH | 09/20/24 | $10.15 | $10.0 | $10.15 | $85.00 | $91.3K | 384 | 90 |

| NKE | PUT | TRADE | NEUTRAL | 01/17/25 | $12.8 | $12.55 | $12.67 | $100.00 | $63.3K | 6.4K | 50 |

| NKE | PUT | TRADE | NEUTRAL | 01/17/25 | $3.65 | $3.55 | $3.6 | $80.00 | $36.0K | 8.5K | 0 |

| NKE | PUT | SWEEP | BULLISH | 06/21/24 | $5.55 | $5.5 | $5.5 | $95.00 | $30.2K | 8.8K | 85 |

About Nike

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan, and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

After a thorough review of the options trading surrounding Nike, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Nike

- With a trading volume of 1,640,730, the price of NKE is down by -1.75%, reaching $90.65.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 57 days from now.

What Analysts Are Saying About Nike

2 market experts have recently issued ratings for this stock, with a consensus target price of $114.0.

- Reflecting concerns, an analyst from Wedbush lowers its rating to Outperform with a new price target of $115.

- In a positive move, an analyst from B of A Securities has upgraded their rating to Buy and adjusted the price target to $113.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Nike with Benzinga Pro for real-time alerts.