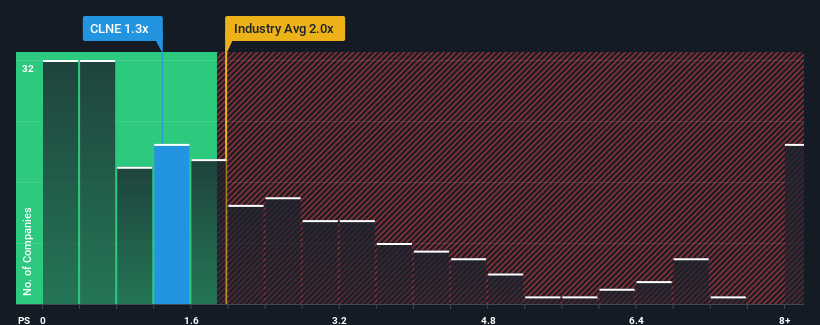

You may think that with a price-to-sales (or "P/S") ratio of 1.3x Clean Energy Fuels Corp. (NASDAQ:CLNE) is a stock worth checking out, seeing as almost half of all the Oil and Gas companies in the United States have P/S ratios greater than 2x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Clean Energy Fuels Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Clean Energy Fuels has been doing quite well of late. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. Those who are bullish on Clean Energy Fuels will be hoping that this isn't the case and the company continues to beat out the industry.

Keen to find out how analysts think Clean Energy Fuels' future stacks up against the industry? In that case, our free report is a great place to start.How Is Clean Energy Fuels' Revenue Growth Trending?

In order to justify its P/S ratio, Clean Energy Fuels would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 46% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 12% each year during the coming three years according to the eight analysts following the company. That's shaping up to be materially higher than the 3.0% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that Clean Energy Fuels' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Clean Energy Fuels' P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Clean Energy Fuels' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Clean Energy Fuels that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.