US Treasury To Borrow $243B More This Spring: Dollar Climbs, Stocks Trim Gains

US Treasury To Borrow $243B More This Spring: Dollar Climbs, Stocks Trim Gains

The U.S. Treasury Department has revised its marketable borrowing expectations upward for the April-June quarter of 2023, increasing the figure to $243 billion from an earlier estimate of $202 billion.

美國財政部上調了2023年4月至6月季度的有價借款預期,將這一數字從先前估計的202億美元增加到2430億美元。

This adjustment, driven by lower-than-predicted cash receipts, had sparked some market reactions by the end of the session Monday.

由於現金收入低於預期,這一調整在週一交易日結束時引發了一些市場反應。

What happened: The U.S. Treasury now expects to borrow $243 billion through the issuance of marketable debt securities, according to an official press release on Monday. That marks an increase of $41 billion from the prior estimates.

發生了什麼:根據週一的官方新聞稿,美國財政部現在預計將通過發行有價債務證券借款2430億美元。這標誌着比先前的估計增加了410億美元。

In addition, the department provided an update on its Q1 activities, noting that it borrowed $748 billion in net marketable debt and concluded the quarter with a cash balance of $775 billion. These figures compare favorably to previous forecasts, with the borrowing amount being $12 billion less and the cash balance $15 billion higher than expected at the end of Q4 2023.

此外,該部門提供了其第一季度活動的最新情況,指出其借入了7,480億美元的淨有價債務,本季度末的現金餘額爲7,750億美元。這些數字與先前的預測相比良好,2023年第四季度末的借款金額比預期減少了120億美元,現金餘額增加了150億美元。

Why This Matters: The increase in borrowing requirements, though seemingly minor at $41 billion, hints at potential larger fiscal challenges for the U.S. government.

爲什麼這很重要:借款需求的增加雖然看似微不足道,達到410億美元,但暗示着美國政府可能面臨更大的財政挑戰。

The main concern for markets and policymakers is the impact of a larger fiscal deficit. As the Treasury issues more bonds to cover this deficit, the market must absorb an increased supply at a time when the Federal Reserve is reducing its holdings of U.S. government debt.

市場和決策者最關心的是更大的財政赤字的影響。隨着美國財政部發行更多債券以彌補這一赤字,在聯儲局減少其持有的美國政府債務之際,市場必須吸收增加的供應。

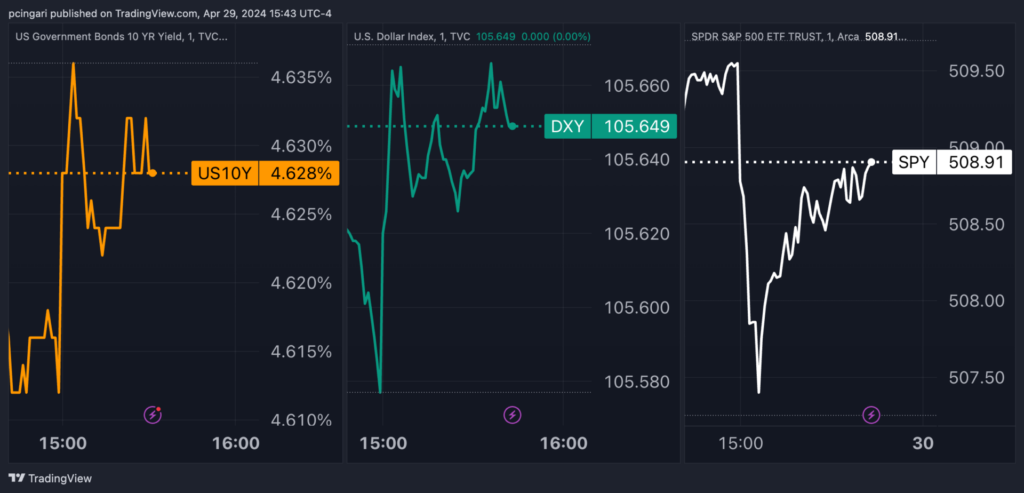

Market reactions: Following the announcement, immediate market reactions included a marginal rise in Treasury yields, a stronger greenback, and a brief decline in stock prices.

市場反應:宣佈之後,立即的市場反應包括美國國債收益率小幅上升、美元走強以及股價短暫下跌。

- The S&P 500, as tracked by the SPDR S&P 500 ETF Trust (NYSE:SPY), saw a quick drop of nearly 25 points shortly after the release, although it later regained some of the losses.

- The U.S. dollar index, as measured by the Invesco DB USD Index Bullish Fund ETF (NYSE:UUP), marginally increased by 0.1%.

- The yield on 10-year Treasury notes also ticked upwards, reflecting heightened concerns over increased supply and borrowing costs.

- SPDR標普500指數ETF信託基金(紐約證券交易所代碼:SPY)追蹤的標準普爾500指數在發佈後不久迅速下跌了近25點,儘管後來收復了部分跌幅。

- 根據景順數據庫美元指數看漲基金ETF(紐約證券交易所代碼:UUP)的衡量,美元指數小幅上漲了0.1%。

- 10年期美國國債的收益率也有所上升,這反映出對供應和借貸成本增加的擔憂加劇。

Read now: Japan Intervenes To Support Struggling Yen: Why Did It Trigger Nikkei 225 Futures Dip? 4 Charts To Watch (CORRECTED)

立即閱讀: 日本進行干預以支持陷入困境的日元:它爲何引發日經225指數期貨下跌?4 張值得關注的圖表(已更正)

Photo: Shutterstock

照片:Shutterstock