Market Whales and Their Recent Bets on GOLD Options

Market Whales and Their Recent Bets on GOLD Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Barrick Gold.

有大量資金可以花的鯨魚對巴里克黃金採取了明顯的看漲立場。

Looking at options history for Barrick Gold (NYSE:GOLD) we detected 10 trades.

查看巴里克黃金(紐約證券交易所代碼:GOLD)的期權歷史記錄,我們發現了10筆交易。

If we consider the specifics of each trade, it is accurate to state that 60% of the investors opened trades with bullish expectations and 30% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,60%的投資者以看漲的預期開啓交易,30%的投資者持看跌預期。

From the overall spotted trades, 5 are puts, for a total amount of $930,769 and 5, calls, for a total amount of $380,314.

在所有已發現的交易中,有5筆是看跌期權,總額爲930,769美元,5筆是看漲期權,總額爲380,314美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $13.0 to $37.0 for Barrick Gold over the recent three months.

根據交易活動,看來主要投資者的目標是在最近三個月中將巴里克黃金的價格範圍從13.0美元擴大到37.0美元。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

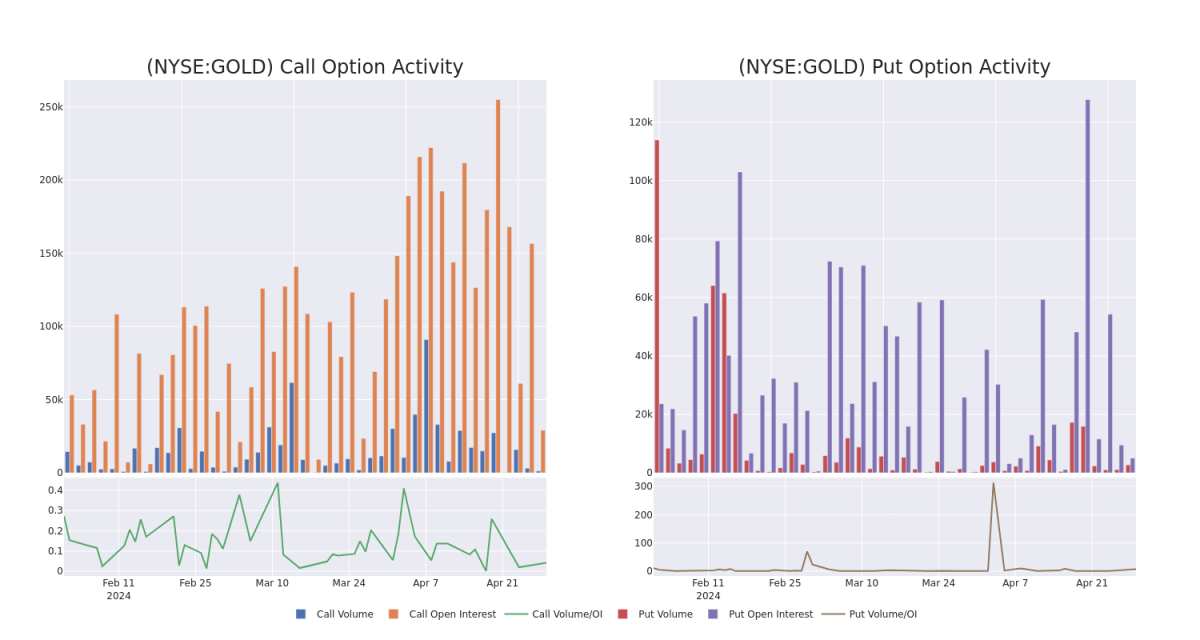

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Barrick Gold's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Barrick Gold's whale trades within a strike price range from $13.0 to $37.0 in the last 30 days.

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤給定行使價下Barrick Gold期權的流動性和利息。下面,我們可以觀察過去30天內Barrick Gold所有鯨魚交易的看漲和看跌期權交易量和未平倉合約的分別變化,其行使價在13.0美元至37.0美元之間。

Barrick Gold Option Activity Analysis: Last 30 Days

巴里克黃金期權活動分析:過去 30 天

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOLD | PUT | SWEEP | BULLISH | 02/21/25 | $8.15 | $7.95 | $7.95 | $25.00 | $238.5K | 377 | 601 |

| GOLD | PUT | SWEEP | BULLISH | 02/21/25 | $8.0 | $7.9 | $7.9 | $25.00 | $237.0K | 377 | 605 |

| GOLD | PUT | SWEEP | BULLISH | 02/21/25 | $8.05 | $7.95 | $7.95 | $25.00 | $232.1K | 377 | 301 |

| GOLD | PUT | SWEEP | BULLISH | 02/21/25 | $7.9 | $7.8 | $7.8 | $25.00 | $190.3K | 377 | 905 |

| GOLD | CALL | TRADE | NEUTRAL | 01/16/26 | $4.5 | $4.4 | $4.45 | $15.00 | $178.0K | 14.6K | 42 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 黃金 | 放 | 掃 | 看漲 | 02/21/25 | 8.15 美元 | 7.95 美元 | 7.95 美元 | 25.00 美元 | 238.5 萬美元 | 377 | 601 |

| 黃金 | 放 | 掃 | 看漲 | 02/21/25 | 8.0 美元 | 7.9 美元 | 7.9 美元 | 25.00 美元 | 237.0K | 377 | 605 |

| 黃金 | 放 | 掃 | 看漲 | 02/21/25 | 8.05 美元 | 7.95 美元 | 7.95 美元 | 25.00 美元 | 232.1 萬美元 | 377 | 301 |

| 黃金 | 放 | 掃 | 看漲 | 02/21/25 | 7.9 美元 | 7.8 美元 | 7.8 美元 | 25.00 美元 | 190.3 萬美元 | 377 | 905 |

| 黃金 | 打電話 | 貿易 | 中立 | 01/16/26 | 4.5 美元 | 4.4 美元 | 4.45 美元 | 15.00 美元 | 178.0 萬美元 | 14.6K | 42 |

About Barrick Gold

關於 Barrick Gold

Based in Toronto, Barrick Gold is one of the world's largest gold miners. In 2023, the firm produced nearly 4.1 million attributable ounces of gold and about 420 million pounds of copper. At end 2023, Barrick had about two decades of gold reserves along with significant copper reserves. After buying Randgold in 2019 and combining its Nevada mines in a joint venture with competitor Newmont later that year, it operates mines in 19 countries in the Americas, Africa, the Middle East, and Asia. The company also has growing copper exposure. Its potential Reko Diq project in Pakistan, if developed, could double copper production by the end of the decade.

總部位於多倫多的Barrick Gold是世界上最大的黃金礦商之一。2023年,該公司生產了近410萬盎司的黃金和約4.2億磅的銅。到2023年底,巴里克擁有大約二十年的黃金儲備以及大量的銅儲量。在2019年收購了Randgold,並於當年晚些時候與競爭對手紐蒙特合資將其內華達州的礦山合併爲一家合資企業之後,該公司在美洲、非洲、中東和亞洲的19個國家經營礦山。該公司的銅敞口也越來越大。其在巴基斯坦潛在的Reko Diq項目如果得到開發,到本世紀末,銅產量可能會翻一番。

Having examined the options trading patterns of Barrick Gold, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了巴里克黃金的期權交易模式之後,我們的注意力現在直接轉向了該公司。這種轉變使我們能夠深入研究其目前的市場地位和表現

Where Is Barrick Gold Standing Right Now?

Barrick Gold 現在處於什麼位置?

- Currently trading with a volume of 9,541,209, the GOLD's price is up by 0.29%, now at $17.14.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 2 days.

- 黃金目前的交易量爲9541,209美元,價格上漲了0.29%,目前爲17.14美元。

- RSI讀數表明,該股目前可能接近超買。

- 預計業績將在2天后發佈。

Professional Analyst Ratings for Barrick Gold

巴里克黃金專業分析師評級

1 market experts have recently issued ratings for this stock, with a consensus target price of $26.0.

1位市場專家最近發佈了該股的評級,共識目標價爲26.0美元。

- An analyst from BMO Capital has decided to maintain their Outperform rating on Barrick Gold, which currently sits at a price target of $26.

- BMO Capital的一位分析師已決定維持對巴里克黃金的跑贏大盤評級,目前的目標股價爲26美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Barrick Gold options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。通過Benzinga Pro的實時提醒,隨時了解最新的巴里克黃金期權交易。