Here's Why We're Not At All Concerned With QuantumCTek's (SHSE:688027) Cash Burn Situation

Here's Why We're Not At All Concerned With QuantumCTek's (SHSE:688027) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

我們很容易理解爲什麼投資者會被無利可圖的公司所吸引。例如,生物技術和礦業勘探公司通常會虧損多年,然後才能通過新的處理方法或礦物發現獲得成功。儘管如此,只有傻瓜才會忽視虧損公司過快地耗盡現金的風險。

So should QuantumCTek (SHSE:688027) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

那麼,QuantumcTek(上海證券交易所代碼:688027)的股東們應該擔心其現金消耗嗎?就本文而言,現金消耗是無利可圖的公司每年花費現金爲其增長提供資金的比率;其負自由現金流。第一步是將其現金消耗與現金儲備進行比較,爲我們提供 “現金流”。

How Long Is QuantumCTek's Cash Runway?

QuantumcTek 的現金跑道有多長?

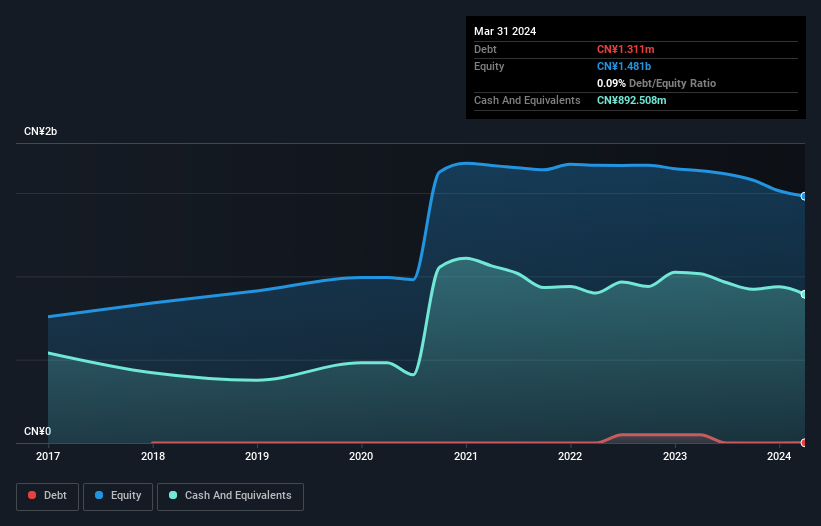

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at March 2024, QuantumCTek had cash of CN¥893m and such minimal debt that we can ignore it for the purposes of this analysis. In the last year, its cash burn was CN¥79m. That means it had a cash runway of very many years as of March 2024. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. The image below shows how its cash balance has been changing over the last few years.

你可以通過將公司的現金金額除以現金的支出率來計算公司的現金流量。截至2024年3月,QuantumCtek的現金爲8.93億元人民幣,債務如此之少,我們可以出於分析目的將其忽略。去年,其現金消耗爲7900萬元人民幣。這意味着截至2024年3月,它的現金流已經持續了很多年。儘管這只是衡量其現金消耗情況的一個指標,但它無疑給我們的印象是持有人不必擔心。下圖顯示了其現金餘額在過去幾年中的變化。

Is QuantumCTek's Revenue Growing?

QuantumcTek 的收入在增長嗎?

Given that QuantumCTek actually had positive free cash flow last year, before burning cash this year, we'll focus on its operating revenue to get a measure of the business trajectory. Regrettably, the company's operating revenue moved in the wrong direction over the last twelve months, declining by 15%. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

鑑於QuantumCtek去年實際上有正的自由現金流,在今年消耗現金之前,我們將重點關注其營業收入以衡量業務軌跡。遺憾的是,該公司的營業收入在過去十二個月中朝着錯誤的方向發展,下降了15%。但是,顯然,關鍵因素是該公司未來是否會發展其業務。因此,你可能想看看該公司在未來幾年預計將增長多少。

Can QuantumCTek Raise More Cash Easily?

QuantumcTek 能否輕鬆籌集更多現金?

Since its revenue growth is moving in the wrong direction, QuantumCTek shareholders may wish to think ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

由於其收入增長正朝着錯誤的方向發展,QuantumcTek的股東們不妨提前考慮公司何時可能需要籌集更多現金。公司可以通過債務或股權籌集資金。上市公司的主要優勢之一是,它們可以向投資者出售股票以籌集現金和爲增長提供資金。我們可以將公司的現金消耗與其市值進行比較,以了解公司必須發行多少新股才能爲一年的運營提供資金。

QuantumCTek's cash burn of CN¥79m is about 0.4% of its CN¥18b market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

QuantumCtek的7900萬元現金消耗約佔其180億元人民幣市值的0.4%。因此,幾乎可以肯定,它可以借一點錢來爲下一年的增長提供資金,或者通過發行幾股股票輕鬆籌集現金。

So, Should We Worry About QuantumCTek's Cash Burn?

那麼,我們應該擔心 QuantumCtek 的現金消耗嗎?

As you can probably tell by now, we're not too worried about QuantumCTek's cash burn. For example, we think its cash runway suggests that the company is on a good path. Although its falling revenue does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 1 warning sign for QuantumCTek that potential shareholders should take into account before putting money into a stock.

正如你現在可能知道的那樣,我們並不太擔心QuantumcTek的現金消耗。例如,我們認爲其現金流表明該公司走上了一條不錯的道路。儘管其收入下降確實使我們有理由停頓一下,但我們在本文中討論的其他指標總體上構成了樂觀的景象。在考慮了本報告中提到的各種指標之後,我們對該公司的現金支出方式感到非常滿意,因爲它似乎有望在中期內滿足其需求。讀者在投資股票之前需要對商業風險有充分的了解,我們已經發現了QuantumCtek的一個警告信號,潛在股東在向股票投入資金之前應考慮這些信號。

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

當然,通過尋找其他地方,你可能會找到一筆不錯的投資。因此,來看看這份內部人士正在買入的公司的免費清單,以及這份成長型股票清單(根據分析師的預測)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。