J.P. Morgan believes that Microsoft is gradually increasing its cloud service supply capacity to meet strong market demand, which indicates that there may be more opportunities for growth in the future. J.P. Morgan maintained its buying rating on Microsoft and raised the target price to $470 from the previous $440.

There was a strange phenomenon in the “Seven Sisters of US Stock” earnings report for the first quarter — investors didn't care much about the direct profit situation; instead, they focused all their attention on the company's future investment plans.

Meta, in particular, announced that it will increase AI infrastructure investment by as much as $10 billion this year, causing its stock price to plummet 11%, the biggest one-day decline since October 2022. Microsoft will also continue to invest heavily in the AI field. The stock price was dragged down, but it quickly rebounded after the financial report was announced.

This phenomenon reflects investors' lack of confidence in AI. They are worried that the big model's ability to monetize is insufficient, making it difficult to support the current excessive valuations of technology stocks.

However, Wall Street believes that strong demand will continue to drive AI growth. In the Microsoft financial report analysis released last week, J.P. Morgan analyst Mark R Murphy's team said that the growth rate of Microsoft's Azure business not only met market expectations, but also surpassed certain key indicators. This not only marks a new milestone in the Azure business, but also indicates that the cloud services market may soon enter a new stage of growth.

Based on the optimistic outlook for Azure cloud services, J.P. Morgan maintained its buying rating for Microsoft and raised the target price to $470 from the previous $440. As of press release, Microsoft's stock price is $406, up more than 9% year to date.

Azure cloud services ushered in a new milestone

Financial reports show that Microsoft's core Azure services and Azure AI services are growing at an accelerated pace.

Revenue from Azure and other cloud services increased by 31%, exceeding market expectations of 28.6%. It is worth noting that AI contributed 7 percentage points to Azure revenue this time, which is higher than the 6 percentage point increase in the fourth quarter of last year and the 3 percentage point increase ratio in the third quarter of last year, which indicates that AI is indeed driving the accelerated growth of cloud revenue.

Microsoft notes that in addition to AI services, other parts of Azure's business have shown demand beyond expectations in various industries and customer segments. This means that Azure's growth is not only driven by AI technology, but also has a broader market base.

Microsoft also said that demand for AI services in the short term is slightly higher than Microsoft's current supply capacity. This indicates strong market demand for Azure AI services, but due to limited supply capacity, this strong demand has not fully translated into revenue growth.

In response, J.P. Morgan said that although supply restrictions in the first quarter had a slight negative impact on AI service growth, Microsoft expects this impact to continue in the second quarter, but it is only a “slight impact.” Microsoft is gradually increasing its cloud service supply capacity to meet strong market demand, which indicates that there may be more growth opportunities in the future.

We have reason to question the pervasiveness of cloud migration (businesses moving from traditional platforms to cloud platforms) growth — nonetheless, we think it represents an overall upward trend.

Microsoft is likely to experience an even more significant increase due to its early leadership in the AI field and the high acceptance of its API-driven model of Azure OpenAI services in the market. This “Azure halo effect” may bring Azure an improvement beyond general expectations.

J.P. Morgan said that as demand for cloud services continues to grow and AI technology continues to advance, Azure is standing at a new starting point and preparing for a broader future. For investors, this is certainly a positive sign that Microsoft's leadership in the cloud services market is more stable and is expected to continue growing over the next few years.

Market acceptance of AI collaboration tools continues to increase

J.P. Morgan also highlighted Microsoft's market leadership in AI collaboration tools (such as M365 Copilot) and development platforms (such as GitHub), and how these products attract and retain users through continuous innovation and market expansion.

Microsoft notes that nearly 60% of Fortune 500 companies have begun using M365 Copilot, showing an accelerated trend of adoption across industries and regions.

At least eight well-known large companies (including Amgen, BP, Cognizant, Koch Industries, Moody's, Novo Nordisk, Nvidia, and Tech Mahindra) have purchased more than 10,000 M365 Copilot seats, which shows that large companies are highly appreciating this product.

The total number of paid subscribers to GitHub reached 1.8 million, and growth accelerated to over 35% quarter-on-quarter, GitHub revenue growth increased to over 45% year-on-year, and more than 90% of the Fortune 100 companies are now GitHub customers.

J.P. Morgan wrote:

It's clear that generative AI technology resonates with developers, and we expect this to become more apparent over time.

What is surprising about the increase in capital expenditure?

Microsoft's capital expenditure for the first quarter was $14 billion, higher than the forecast of $13.14 billion. The capital expenditure for the next quarter is expected to increase sharply from month to month, and the capital expenditure for fiscal year 2025 will continue to be higher than in fiscal year 2024.

J.P. Morgan pointed out that Microsoft's increase in capital expenditure shows confidence in future market demand, which will support the further strengthening of cloud and AI product supply capabilities.

Microsoft plans to increase capital expenditure in response to the strong demand signals it has observed in cloud services and AI products. In particular, since customer demand has exceeded expectations, the current supply capacity of AI products has reached its limit.

We believe that the ratio between demand and supply has always been in a “tight” state, but it is worth noting that even with capital expenditure increasing by $2.5 billion to $14 billion in the first quarter, demand still slightly exceeded supply capacity — an indication that market demand is growing rapidly.

Although this may put some pressure on cash flow and profit margins in the short term, in the long run, this investment will provide a solid foundation for Microsoft to maintain its leading position in the competitive cloud market.

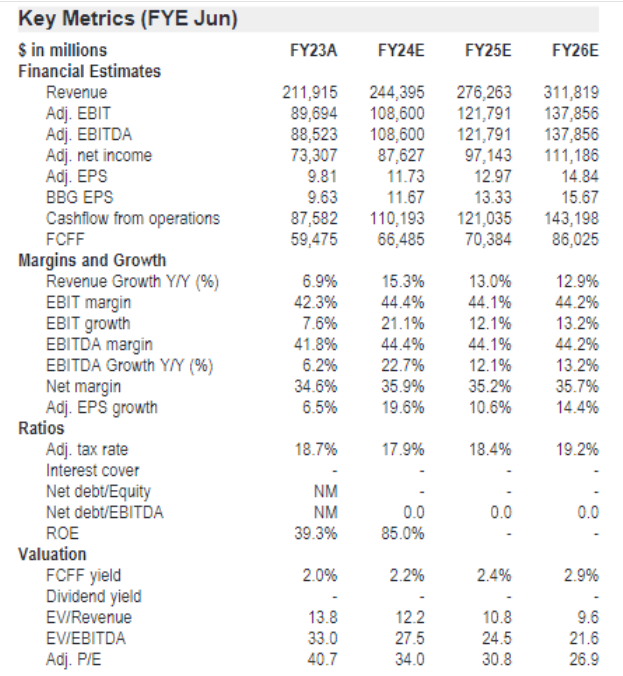

J.P. Morgan predicts that Microsoft's adjusted earnings per share (EPS) for fiscal 2024 and fiscal 2025 will reach $11.73 and $12.97, respectively.