-

市場

-

產品

-

資訊

-

Moo社區

-

課堂

-

查看更多

-

功能介紹

-

費用費用透明,無最低余額限制

投資選擇、功能介紹、費用相關信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 淺色

Behind the Scenes of Carnival's Latest Options Trends

Behind the Scenes of Carnival's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bearish stance on Carnival.

Looking at options history for Carnival (NYSE:CCL) we detected 17 trades.

If we consider the specifics of each trade, it is accurate to state that 23% of the investors opened trades with bullish expectations and 70% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $112,041 and 14, calls, for a total amount of $468,479.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $13.0 to $20.0 for Carnival over the last 3 months.

Volume & Open Interest Trends

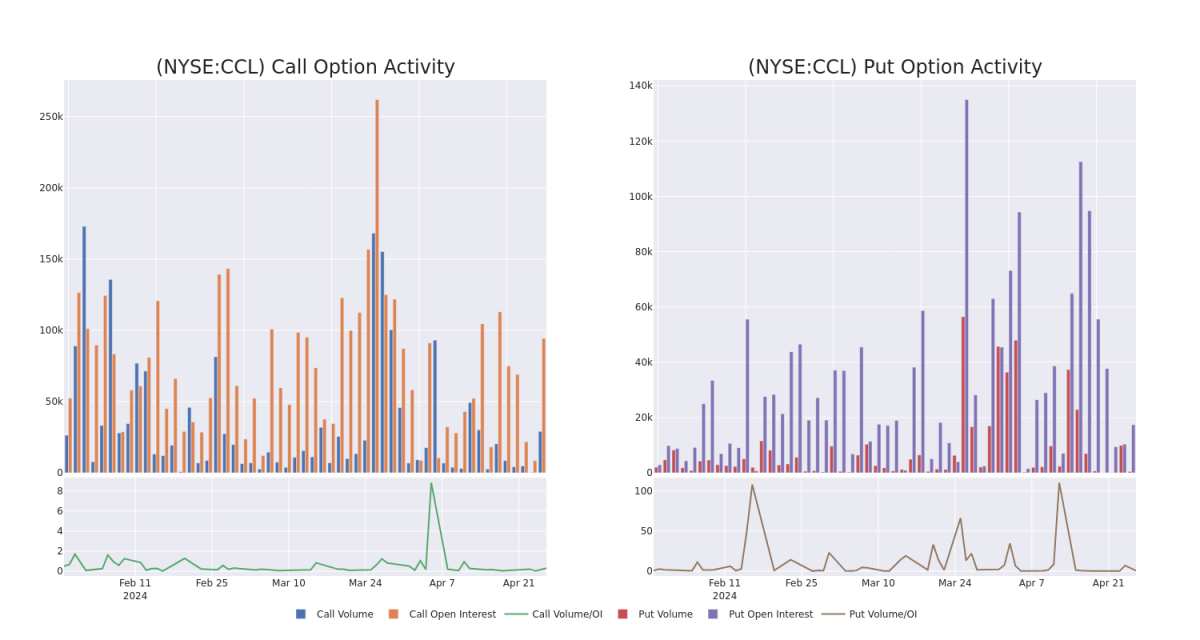

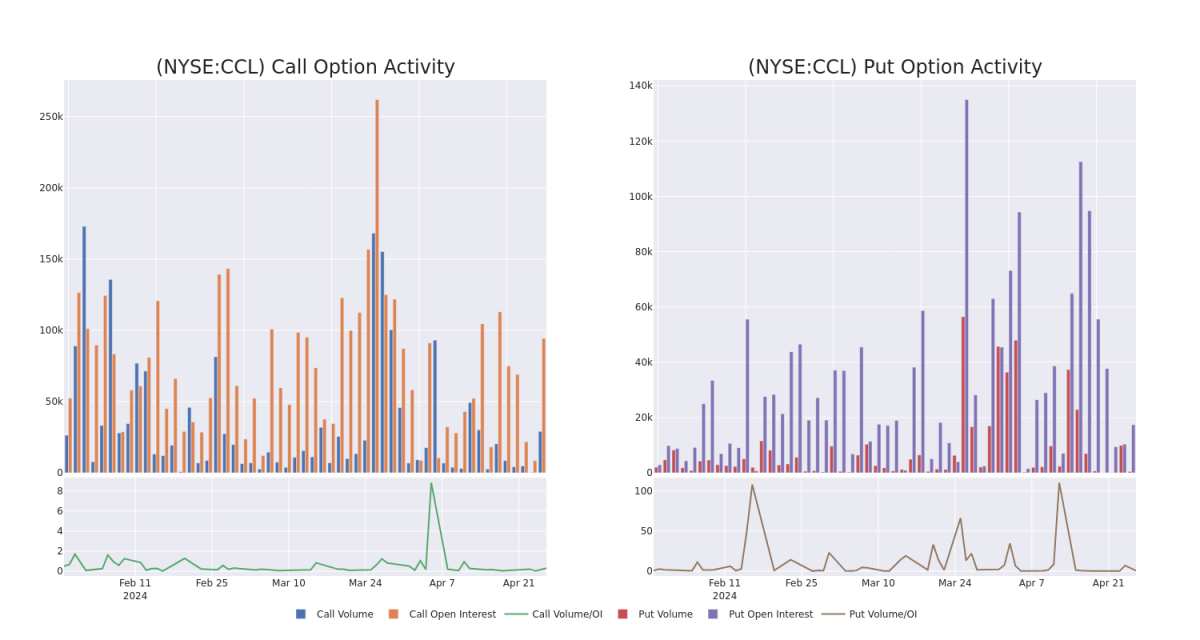

In terms of liquidity and interest, the mean open interest for Carnival options trades today is 13970.25 with a total volume of 29,536.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Carnival's big money trades within a strike price range of $13.0 to $20.0 over the last 30 days.

Carnival Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCL | PUT | SWEEP | BEARISH | 06/20/25 | $3.6 | $3.55 | $3.6 | $17.00 | $57.9K | 1.1K | 286 |

| CCL | CALL | SWEEP | BULLISH | 07/19/24 | $1.31 | $1.29 | $1.31 | $15.00 | $51.3K | 4.8K | 465 |

| CCL | CALL | SWEEP | BEARISH | 01/17/25 | $0.94 | $0.92 | $0.92 | $20.00 | $46.0K | 29.7K | 721 |

| CCL | CALL | SWEEP | BEARISH | 06/21/24 | $1.05 | $1.03 | $1.03 | $15.00 | $41.2K | 26.6K | 767 |

| CCL | CALL | SWEEP | BULLISH | 06/20/25 | $2.47 | $2.37 | $2.47 | $17.00 | $37.5K | 3.9K | 16 |

About Carnival

Carnival is the largest global cruise company, with 92 ships in service at the end of fiscal 2023. Its portfolio of brands includes Carnival Cruise Lines, Holland America, Princess Cruises, and Seabourn in North America; P&O Cruises and Cunard Line in the United Kingdom; Aida in Germany; Costa Cruises in Southern Europe; and P&O Cruises in Australia. Carnival also owns Holland America Princess Alaska Tours in Alaska and the Canadian Yukon. Carnival's brands attracted nearly 13 million guests in 2019, prior to covid-19, a level it reached again in 2023.

In light of the recent options history for Carnival, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Carnival's Current Market Status

- With a volume of 14,396,886, the price of CCL is down -0.95% at $15.04.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 59 days.

Expert Opinions on Carnival

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $24.4.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Carnival, targeting a price of $25.

- Maintaining their stance, an analyst from Tigress Financial continues to hold a Buy rating for Carnival, targeting a price of $25.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Carnival, targeting a price of $23.

- An analyst from Macquarie persists with their Outperform rating on Carnival, maintaining a target price of $24.

- Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on Carnival with a target price of $25.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carnival options trades with real-time alerts from Benzinga Pro.

Whales with a lot of money to spend have taken a noticeably bearish stance on Carnival.

有很多錢可以花的鯨魚對狂歡節採取了明顯的看跌立場。

Looking at options history for Carnival (NYSE:CCL) we detected 17 trades.

查看嘉年華(紐約證券交易所代碼:CCL)的期權歷史記錄,我們發現了17筆交易。

If we consider the specifics of each trade, it is accurate to state that 23% of the investors opened trades with bullish expectations and 70% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,有23%的投資者以看漲的預期開啓交易,70%的投資者持看跌預期。

From the overall spotted trades, 3 are puts, for a total amount of $112,041 and 14, calls, for a total amount of $468,479.

在已發現的全部交易中,有3筆是看跌期權,總額爲112,041美元,14筆是看漲期權,總額爲468,479美元。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $13.0 to $20.0 for Carnival over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將嘉年華的價格定在13.0美元至20.0美元之間。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

In terms of liquidity and interest, the mean open interest for Carnival options trades today is 13970.25 with a total volume of 29,536.00.

就流動性和利息而言,今天嘉年華期權交易的平均未平倉合約爲13970.25,總交易量爲29,536.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Carnival's big money trades within a strike price range of $13.0 to $20.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天嘉年華在13.0美元至20.0美元行使價區間內的看漲期權和看跌期權交易的交易量和未平倉合約的變化。

Carnival Option Activity Analysis: Last 30 Days

嘉年華期權活動分析:過去 30 天

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCL | PUT | SWEEP | BEARISH | 06/20/25 | $3.6 | $3.55 | $3.6 | $17.00 | $57.9K | 1.1K | 286 |

| CCL | CALL | SWEEP | BULLISH | 07/19/24 | $1.31 | $1.29 | $1.31 | $15.00 | $51.3K | 4.8K | 465 |

| CCL | CALL | SWEEP | BEARISH | 01/17/25 | $0.94 | $0.92 | $0.92 | $20.00 | $46.0K | 29.7K | 721 |

| CCL | CALL | SWEEP | BEARISH | 06/21/24 | $1.05 | $1.03 | $1.03 | $15.00 | $41.2K | 26.6K | 767 |

| CCL | CALL | SWEEP | BULLISH | 06/20/25 | $2.47 | $2.37 | $2.47 | $17.00 | $37.5K | 3.9K | 16 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCL | 放 | 掃 | 粗魯的 | 06/20/25 | 3.6 美元 | 3.55 美元 | 3.6 美元 | 17.00 美元 | 57.9 萬美元 | 1.1K | 286 |

| CCL | 打電話 | 掃 | 看漲 | 07/19/24 | 1.31 美元 | 1.29 美元 | 1.31 美元 | 15.00 美元 | 51.3 萬美元 | 4.8K | 465 |

| CCL | 打電話 | 掃 | 粗魯的 | 01/17/25 | 0.94 美元 | 0.92 美元 | 0.92 美元 | 20.00 美元 | 46.0 萬美元 | 29.7K | 721 |

| CCL | 打電話 | 掃 | 粗魯的 | 06/21/24 | 1.05 美元 | 1.03 | 1.03 | 15.00 美元 | 41.2 萬美元 | 26.6 K | 767 |

| CCL | 打電話 | 掃 | 看漲 | 06/20/25 | 2.47 美元 | 2.37 美元 | 2.47 美元 | 17.00 美元 | 37.5 萬美元 | 3.9K | 16 |

About Carnival

關於嘉年華

Carnival is the largest global cruise company, with 92 ships in service at the end of fiscal 2023. Its portfolio of brands includes Carnival Cruise Lines, Holland America, Princess Cruises, and Seabourn in North America; P&O Cruises and Cunard Line in the United Kingdom; Aida in Germany; Costa Cruises in Southern Europe; and P&O Cruises in Australia. Carnival also owns Holland America Princess Alaska Tours in Alaska and the Canadian Yukon. Carnival's brands attracted nearly 13 million guests in 2019, prior to covid-19, a level it reached again in 2023.

嘉年華是全球最大的郵輪公司,截至2023財年末,有92艘船在線。其品牌組合包括北美的嘉年華郵輪公司、荷美郵輪公司、公主郵輪公司和西伯恩郵輪公司;英國的P&O Cruises和Cunard Line;德國的艾達;南歐的Costa Cruises以及澳大利亞的P&O Cruises。嘉年華還在阿拉斯加和加拿大育空地區擁有荷美公主阿拉斯加之旅。在COVID-19之前,嘉年華的品牌在2019年吸引了近1300萬名客人,在2023年再次達到這一水平。

In light of the recent options history for Carnival, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於嘉年華最近的期權歷史,現在應該專注於公司本身。我們的目標是探索其目前的表現。

Carnival's Current Market Status

嘉年華當前的市場狀況

- With a volume of 14,396,886, the price of CCL is down -0.95% at $15.04.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 59 days.

- CCL的交易量爲14,396,886美元,價格下跌了0.95%,至15.04美元。

- RSI 指標暗示,標的股票目前在超買和超賣之間保持中立。

- 下一份業績預計將在59天后公佈。

Expert Opinions on Carnival

關於狂歡節的專家觀點

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $24.4.

在過去的30天中,共有5位專業分析師對該股發表了看法,將平均目標股價設定爲24.4美元。

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Carnival, targeting a price of $25.

- Maintaining their stance, an analyst from Tigress Financial continues to hold a Buy rating for Carnival, targeting a price of $25.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Carnival, targeting a price of $23.

- An analyst from Macquarie persists with their Outperform rating on Carnival, maintaining a target price of $24.

- Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on Carnival with a target price of $25.

- 巴克萊銀行的一位分析師保持立場,繼續維持嘉年華的增持評級,目標價格爲25美元。

- Tigress Financial的一位分析師維持其立場,繼續維持嘉年華的買入評級,目標價格爲25美元。

- 摩根大通的一位分析師保持立場,繼續維持嘉年華的增持評級,目標價格爲23美元。

- 麥格理的一位分析師堅持對嘉年華的跑贏大盤評級,將目標價維持在24美元。

- Stifel的一位分析師在評估中保持了對嘉年華的買入評級,目標價爲25美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carnival options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。通過Benzinga Pro的實時提醒,隨時了解最新的嘉年華期權交易。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧