Investors with a lot of money to spend have taken a bearish stance on PENN Entertainment (NASDAQ:PENN).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PENN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 11 uncommon options trades for PENN Entertainment.

This isn't normal.

The overall sentiment of these big-money traders is split between 27% bullish and 63%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $129,200, and 8 are calls, for a total amount of $637,858.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $10.0 to $37.5 for PENN Entertainment during the past quarter.

Volume & Open Interest Development

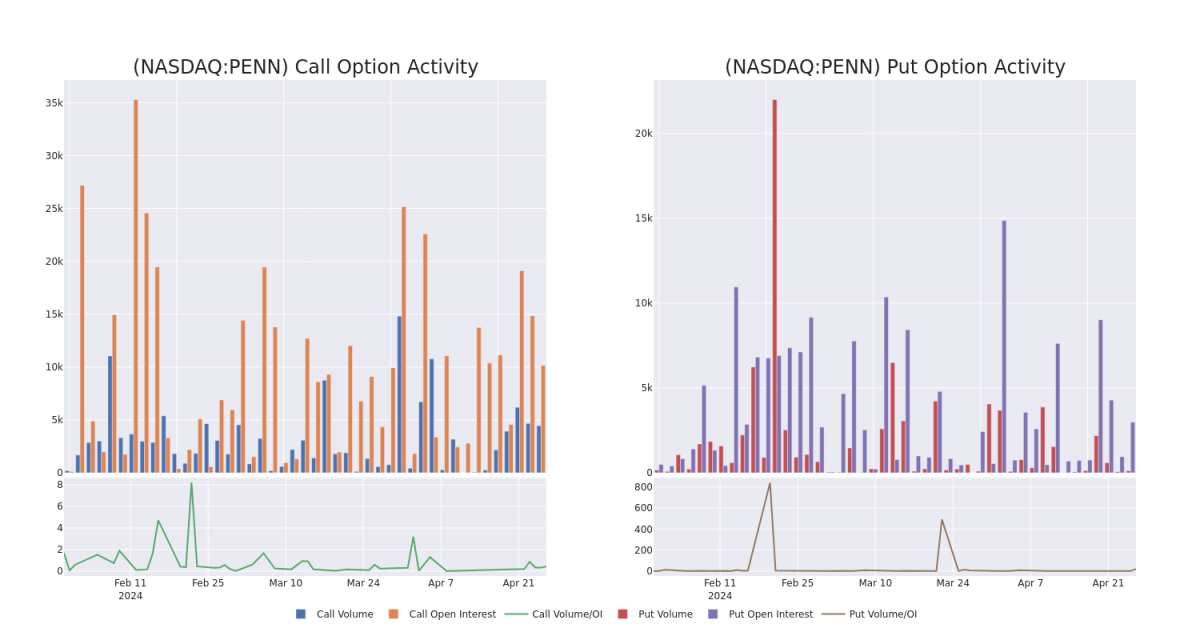

In today's trading context, the average open interest for options of PENN Entertainment stands at 1640.5, with a total volume reaching 4,577.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in PENN Entertainment, situated within the strike price corridor from $10.0 to $37.5, throughout the last 30 days.

PENN Entertainment 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PENN | CALL | SWEEP | BULLISH | 01/17/25 | $2.68 | $2.57 | $2.68 | $20.00 | $285.6K | 4.5K | 2.0K |

| PENN | CALL | SWEEP | NEUTRAL | 01/17/25 | $2.64 | $2.36 | $2.5 | $20.00 | $125.0K | 4.5K | 8 |

| PENN | PUT | TRADE | BEARISH | 04/26/24 | $0.45 | $0.24 | $0.39 | $17.50 | $63.3K | 1.9K | 0 |

| PENN | CALL | SWEEP | BEARISH | 05/31/24 | $1.88 | $1.87 | $1.86 | $16.00 | $47.2K | 246 | 376 |

| PENN | CALL | SWEEP | BULLISH | 01/16/26 | $9.3 | $9.15 | $9.3 | $10.00 | $44.6K | 103 | 72 |

About PENN Entertainment

Penn Entertainment's origins date back to its 1972 racetrack opening in Pennsylvania. Today, Penn operates 43 properties across 20 states and 12 brands (such as Hollywood Casino and Ameristar), with land-based casinos representing 89% of total sales in 2023 (11% was from the interactive segment, which includes sports, iGaming, and media revenue). The retail portfolio generates mid-30% EBITDAR margins and helps position the company to obtain licenses for the digital wagering markets. Additionally, Penn's media assets, theScore and ESPN (starting with its partnership launch Nov. 14, 2023), provide access to sports betting/iGaming technology and clientele, helping it form a leading digital position.

Having examined the options trading patterns of PENN Entertainment, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of PENN Entertainment

- Trading volume stands at 2,502,884, with PENN's price down by -1.22%, positioned at $16.98.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 6 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.