Geron Corporation (NASDAQ:GERN): Is Breakeven Near?

Geron Corporation (NASDAQ:GERN): Is Breakeven Near?

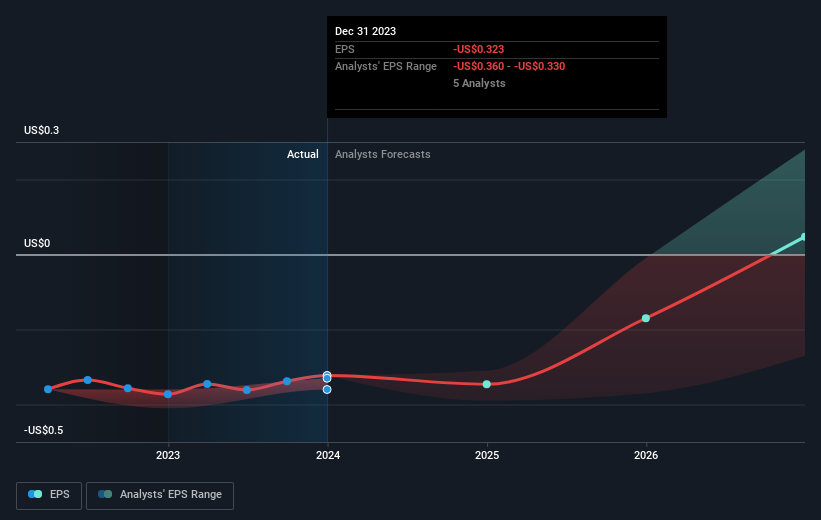

With the business potentially at an important milestone, we thought we'd take a closer look at Geron Corporation's (NASDAQ:GERN) future prospects. Geron Corporation, a late-stage clinical biopharmaceutical company, focuses on the development and commercialization of therapeutics for myeloid hematologic malignancies. On 31 December 2023, the US$2.1b market-cap company posted a loss of US$184m for its most recent financial year. The most pressing concern for investors is Geron's path to profitability – when will it breakeven? We've put together a brief outline of industry analyst expectations for the company, its year of breakeven and its implied growth rate.

由於該業務可能處於一個重要的里程碑,我們認爲應該仔細研究傑龍公司(納斯達克股票代碼:GERN)的未來前景。Geron Corporation是一家處於後期臨床生物製藥的公司,專注於髓系血液系統惡性腫瘤療法的開發和商業化。2023年12月31日,這家市值爲21億美元的公司公佈其最近一個財政年度的虧損1.84億美元。投資者最緊迫的擔憂是Geron的盈利之路——它何時會實現盈虧平衡?我們簡要概述了行業分析師對該公司、盈虧平衡年份和隱含增長率的預期。

Consensus from 6 of the American Biotechs analysts is that Geron is on the verge of breakeven. They expect the company to post a final loss in 2025, before turning a profit of US$44m in 2026. Therefore, the company is expected to breakeven roughly 2 years from now. In order to meet this breakeven date, we calculated the rate at which the company must grow year-on-year. It turns out an average annual growth rate of 62% is expected, which signals high confidence from analysts. If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

6位美國生物技術分析師的共識是,傑龍正處於盈虧平衡的邊緣。他們預計,該公司將在2025年公佈最終虧損,然後在2026年實現4400萬美元的盈利。因此,預計該公司將在大約兩年後實現盈虧平衡。爲了達到這個盈虧平衡日期,我們計算了公司必須同比增長的速度。事實證明,預計年均增長率爲62%,這表明分析師充滿信心。如果事實證明這個利率過於激進,該公司的盈利時間可能比分析師預測的要晚得多。

Underlying developments driving Geron's growth isn't the focus of this broad overview, but, bear in mind that typically a biotech has lumpy cash flows which are contingent on the product type and stage of development the company is in. This means that a high growth rate is not unusual, especially if the company is currently in an investment period.

推動Geron增長的潛在發展並不是本次廣泛概述的重點,但請記住,生物技術公司的現金流通常不穩定,這取決於公司所處的產品類型和發展階段。這意味着高增長率並不罕見,尤其是在公司目前處於投資期的情況下。

One thing we'd like to point out is that The company has managed its capital prudently, with debt making up 33% of equity. This means that it has predominantly funded its operations from equity capital, and its low debt obligation reduces the risk around investing in the loss-making company.

我們想指出的一件事是,該公司謹慎地管理了資本,債務佔股權的33%。這意味着其運營資金主要來自股權資本,其低債務債務降低了投資這家虧損公司的風險。

Next Steps:

後續步驟:

There are key fundamentals of Geron which are not covered in this article, but we must stress again that this is merely a basic overview. For a more comprehensive look at Geron, take a look at Geron's company page on Simply Wall St. We've also compiled a list of relevant factors you should further research:

本文沒有介紹Geron的關鍵基礎知識,但我們必須再次強調,這只是一個基本的概述。要更全面地了解 Geron,請查看 Geron 在 Simply Wall St 上的公司頁面。我們還整理了一份你應該進一步研究的相關因素清單:

- Historical Track Record: What has Geron's performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Geron's board and the CEO's background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

- 歷史記錄:傑隆過去的表現如何?詳細了解過去的往績分析,並查看我們分析的免費可視化表示,以提高清晰度。

- 管理團隊:由經驗豐富的管理團隊掌舵增強了我們對業務的信心——看看誰是Geron董事會成員以及首席執行官的背景。

- 其他表現優異的股票:還有其他股票可以提供更好的前景並有良好的往績記錄嗎?在這裏瀏覽我們免費列出的這些優質股票。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。