April 26, 2024

SBI Global Asset Management Co., Ltd.

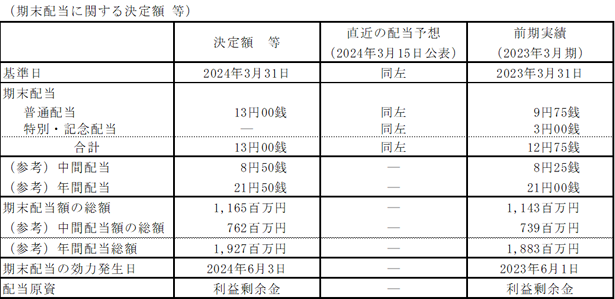

We are pleased to announce that at the Board of Directors meeting held today, we have decided to pay dividends from surplus with 2024/3/31 as the record date as follows.

Note

1. Details of dividends

We have decided that the dividend will be 13 yen per share, with 2024/3/31 as the reference date. The total annual dividend combined with the interim dividend (8 yen 50 sen) with 2023/9/30 as the reference date is 21 yen 50 yen, an increase of 50 sen (2.4%) compared to the previous fiscal year, and as a result, dividends have continued to increase for 15 consecutive terms. Note that since dividends based on the end of the previous fiscal year included a special and commemorative dividend of 3 yen per share, the average dividend alone would increase dividends by 3 yen 50 sen (19.4%) per year.

2. Reasons

We recognize stable and proper return of profits to shareholders as an important management issue, and we determine dividend levels from a comprehensive perspective, including balancing internal reserves that enable proper investment to improve competitiveness and profitability.

In the financial results for the fiscal year ending 2024/3 disclosed today, sales increased for 12 consecutive terms, hit a record high for 5 consecutive terms, and reached the 10 billion yen mark, and ordinary profit increased for 15 consecutive terms and hit a record high for 13 consecutive terms. Based on such strong current results, we determined that it is possible to continue to return higher profits to our shareholders, and decided to increase dividends by 50 yen compared to the previous fiscal year in the sum of the interim dividends and year-end dividends.

Furthermore, as a result, we have increased our dividends for 15 consecutive terms.

over

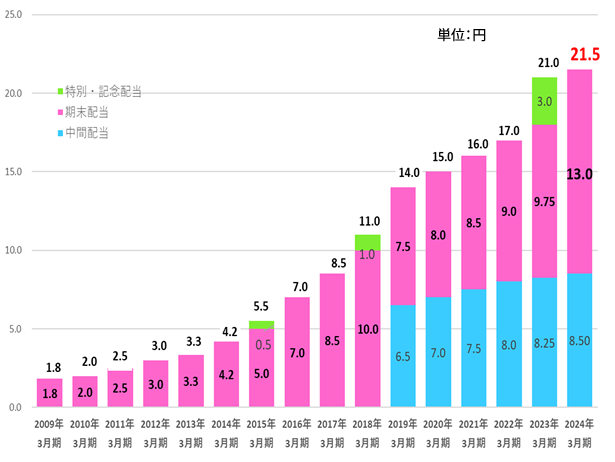

(Reference) Changes in annual dividends per share

Dividends have been increased for 15 consecutive terms, and the annual dividend amount will increase 11.7 times over the 15 years from the fiscal year ending 2009/3.

The year-end dividend amount per share multiplied by 1/300 is shown for comparison purposes for each consolidated fiscal year prior to the fiscal year ending 2013/3.