-

市場

-

產品

-

資訊

-

Moo社區

-

課堂

-

查看更多

-

功能介紹

-

費用費用透明,無最低余額限制

投資選擇、功能介紹、費用相關信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 淺色

Options Corner: Adobe Options Activity Signal Investors Taking Bearish Stance

Options Corner: Adobe Options Activity Signal Investors Taking Bearish Stance

Deep-pocketed investors have adopted a bearish approach towards $Adobe (ADBE.US)$, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ADBE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Adobe. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 15% leaning bullish and 53% bearish. Among these notable options, 7 are puts, totaling $349,653, and 6 are calls, amounting to $699,791.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $430.0 to $630.0 for Adobe during the past quarter.

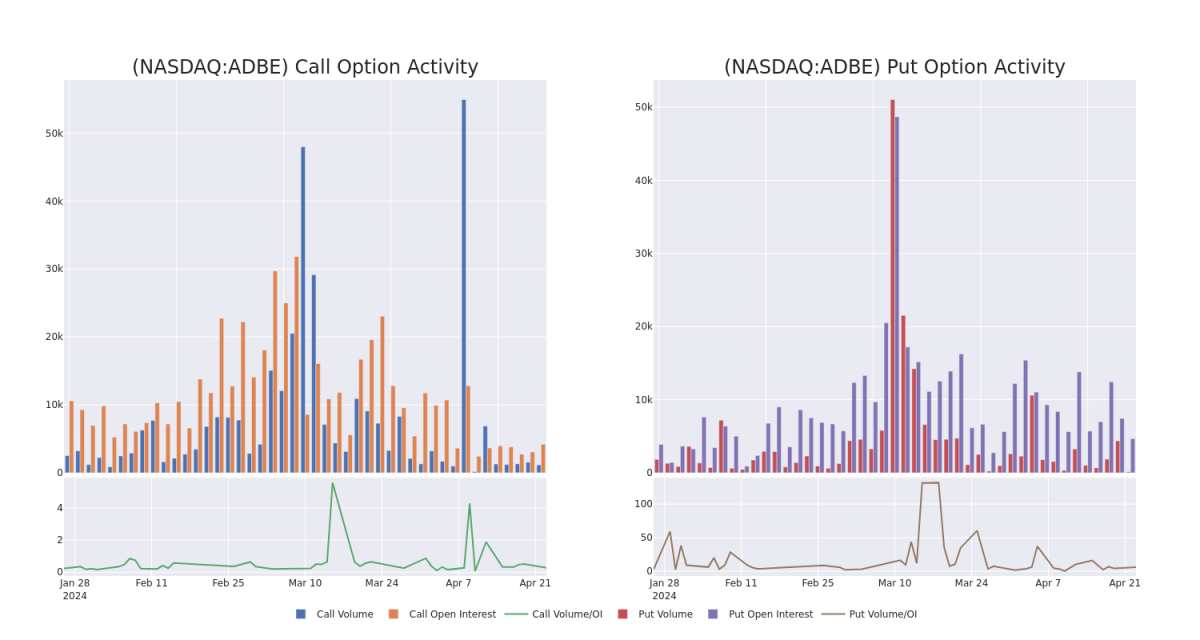

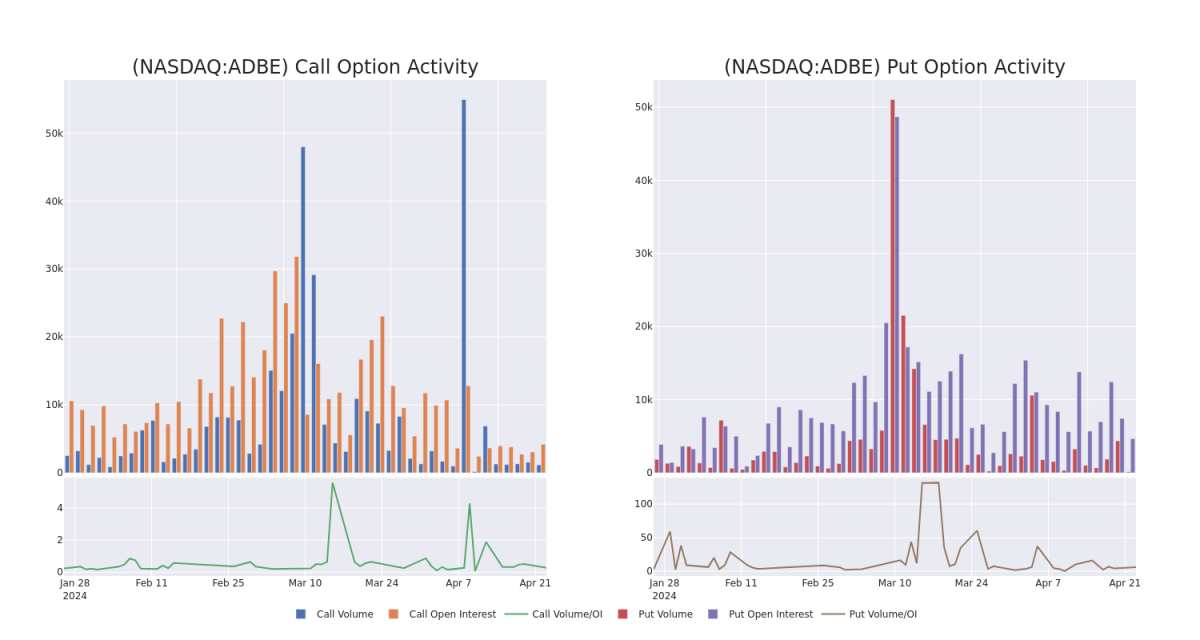

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Adobe's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Adobe's whale activity within a strike price range from $430.0 to $630.0 in the last 30 days.

Adobe Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

ADBE | CALL | TRADE | NEUTRAL | 05/17/24 | $13.35 | $13.0 | $13.2 | $475.00 | $528.0K | 236 | 15 |

ADBE | PUT | SWEEP | BEARISH | 05/17/24 | $155.6 | $153.6 | $154.89 | $630.00 | $108.4K | 7 | 7 |

ADBE | PUT | SWEEP | BEARISH | 01/17/25 | $27.7 | $27.05 | $27.7 | $430.00 | $66.4K | 356 | 24 |

ADBE | CALL | TRADE | BEARISH | 06/21/24 | $30.15 | $29.9 | $29.96 | $475.00 | $44.9K | 270 | 51 |

ADBE | PUT | SWEEP | BEARISH | 01/17/25 | $38.65 | $37.95 | $38.65 | $460.00 | $38.6K | 500 | 0 |

About Adobe

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizin,g and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Present Market Standing of Adobe

Trading volume stands at 1,048,460, with ADBE's price up by 1.1%, positioned at $478.09.

RSI indicators show the stock to be may be approaching oversold.

Earnings announcement expected in 50 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Adobe with Benzinga Pro for real-time alerts.

Deep-pocketed investors have adopted a bearish approach towards $Adobe (ADBE.US)$, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ADBE usually suggests something big is about to happen.

財力雄厚的投資者採取了看跌的態度 $Adobe (ADBE.US)$,這是市場參與者不應該忽視的事情。我們對本辛加公開期權記錄的追蹤今天揭示了這一重大舉措。這些投資者的身份仍然未知,但是ADBE的如此重大變動通常表明即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Adobe. This level of activity is out of the ordinary.

我們今天從觀察中收集了這些信息,當時Benzinga的期權掃描儀重點介紹了Adobe的13項非同尋常的期權活動。這種活動水平與衆不同。

The general mood among these heavyweight investors is divided, with 15% leaning bullish and 53% bearish. Among these notable options, 7 are puts, totaling $349,653, and 6 are calls, amounting to $699,791.

這些重量級投資者的總體情緒存在分歧,15%的人傾向於看漲,53%的人傾向於看跌。在這些值得注意的期權中,有7個是看跌期權,總額爲349,653美元,還有6個是看漲期權,總額爲699,791美元。

Predicted Price Range

預測的價格區間

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $430.0 to $630.0 for Adobe during the past quarter.

分析這些合約的交易量和未平倉合約,大型企業似乎一直在關注Adobe在過去一個季度的價格範圍從430.0美元到630.0美元不等。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平倉合約是一種對股票進行盡職調查的有見地的方法。

This data can help you track the liquidity and interest for Adobe's options for a given strike price.

這些數據可以幫助您跟蹤給定行使價下Adobe期權的流動性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Adobe's whale activity within a strike price range from $430.0 to $630.0 in the last 30 days.

下面,我們可以觀察過去30天內,Adobe所有鯨魚活動的看漲期權和未平倉合約分別在430.0美元至630.0美元範圍內的變化。

Adobe Option Volume And Open Interest Over Last 30 Days

過去 30 天的 Adobe 期權交易量和未平倉合約

Significant Options Trades Detected:

檢測到的重要期權交易:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

ADBE |

CALL |

TRADE |

NEUTRAL |

05/17/24 |

$13.35 |

$13.0 |

$13.2 |

$475.00 |

$528.0K |

236 |

15 |

ADBE |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$155.6 |

$153.6 |

$154.89 |

$630.00 |

$108.4K |

7 |

7 |

ADBE |

PUT |

SWEEP |

BEARISH |

01/17/25 |

$27.7 |

$27.05 |

$27.7 |

$430.00 |

$66.4K |

356 |

24 |

ADBE |

CALL |

TRADE |

BEARISH |

06/21/24 |

$30.15 |

$29.9 |

$29.96 |

$475.00 |

$44.9K |

270 |

51 |

ADBE |

PUT |

SWEEP |

BEARISH |

01/17/25 |

$38.65 |

$37.95 |

$38.65 |

$460.00 |

$38.6K |

500 |

0 |

符號 |

看跌/看漲 |

交易類型 |

情緒 |

Exp。日期 |

問 |

出價 |

價格 |

行使價 |

總交易價格 |

未平倉合約 |

音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

ADBE |

打電話 |

貿易 |

中立 |

05/17/24 |

13.35 美元 |

13.0 美元 |

13.2 美元 |

475.00 美元 |

528.0 萬美元 |

236 |

15 |

ADBE |

放 |

掃 |

粗魯的 |

05/17/24 |

155.6 美元 |

153.6 美元 |

154.89 美元 |

630.00 美元 |

108.4 萬美元 |

7 |

7 |

ADBE |

放 |

掃 |

粗魯的 |

01/17/25 |

27.7 美元 |

27.05 美元 |

27.7 美元 |

430.00 美元 |

66.4 萬美元 |

356 |

24 |

ADBE |

打電話 |

貿易 |

粗魯的 |

06/21/24 |

30.15 美元 |

29.9 美元 |

29.96 美元 |

475.00 美元 |

44.9 萬美元 |

270 |

51 |

ADBE |

放 |

掃 |

粗魯的 |

01/17/25 |

38.65 美元 |

37.95 美元 |

38.65 美元 |

460.00 美元 |

38.6 萬美元 |

500 |

0 |

About Adobe

Adobe

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizin,g and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Adobe 爲創意專業人士和營銷人員提供內容創作、文檔管理、數字營銷和廣告軟件和服務,用於在多個操作系統、設備和媒體上創作、管理、交付、測量、優化和參與引人入勝的內容。該公司分爲三個部門:數字媒體內容創作、營銷解決方案的數字體驗和傳統產品的出版(不到收入的5%)。

Present Market Standing of Adobe

Adobe 目前的市場地位

Trading volume stands at 1,048,460, with ADBE's price up by 1.1%, positioned at $478.09.

RSI indicators show the stock to be may be approaching oversold.

Earnings announcement expected in 50 days.

交易量爲1,048,460美元,ADBE的價格上漲了1.1%,爲478.09美元。

RSI指標顯示該股可能接近超賣。

預計將在50天后公佈業績。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Adobe with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了獲得更高利潤的可能性。精明的交易者通過持續的教育、戰略交易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解Adobe的最新期權交易信息,獲取實時提醒。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧