This Is What Whales Are Betting On MongoDB

This Is What Whales Are Betting On MongoDB

Deep-pocketed investors have adopted a bullish approach towards MongoDB (NASDAQ:MDB), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MDB usually suggests something big is about to happen.

財力雄厚的投資者對MongoDB(納斯達克股票代碼:MDB)採取了看漲態度,這是市場參與者不容忽視的。我們對本辛加公開期權記錄的追蹤今天揭示了這一重大舉措。這些投資者的身份仍然未知,但是MDB的如此重大變動通常表明即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 18 extraordinary options activities for MongoDB. This level of activity is out of the ordinary.

我們今天從觀察中收集了這些信息,當時Benzinga的期權掃描儀重點介紹了MongoDB的18項非同尋常的期權活動。這種活動水平與衆不同。

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 33% bearish. Among these notable options, 11 are puts, totaling $373,310, and 7 are calls, amounting to $191,910.

這些重量級投資者的總體情緒存在分歧,50%的人傾向於看漲,33%的人傾向於看跌。在這些值得注意的期權中,有11個是看跌期權,總額爲373,310美元,還有7個是看漲期權,總額爲191,910美元。

Expected Price Movements

預期的價格走勢

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $320.0 to $440.0 for MongoDB during the past quarter.

分析這些合約的交易量和未平倉合約,看來大型企業一直在關注MongoDB在過去一個季度的價格範圍從320.0美元到440.0美元不等。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

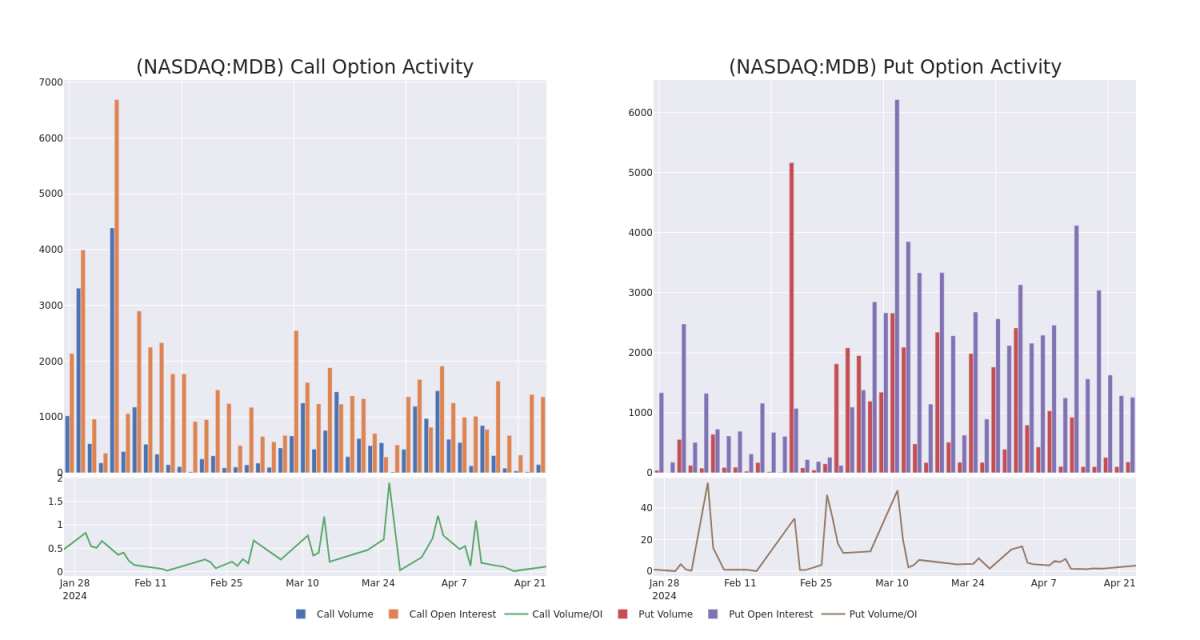

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in MongoDB's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to MongoDB's substantial trades, within a strike price spectrum from $320.0 to $440.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了指定行使價下MongoDB期權的流動性和投資者對它們的興趣。即將發佈的數據可視化了與MongoDB大量交易相關的看漲期權和看跌期權的交易量和未平倉合約的波動,在過去30天內,行使價範圍從320.0美元到440.0美元不等。

MongoDB Option Volume And Open Interest Over Last 30 Days

過去 30 天的 MongoDB 期權交易量和未平倉合約

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MDB | PUT | SWEEP | BULLISH | 05/03/24 | $10.6 | $10.15 | $10.15 | $360.00 | $70.0K | 239 | 27 |

| MDB | PUT | SWEEP | BEARISH | 08/16/24 | $21.2 | $20.95 | $21.2 | $320.00 | $38.1K | 100 | 40 |

| MDB | PUT | TRADE | BULLISH | 06/21/24 | $60.55 | $59.85 | $59.85 | $410.00 | $35.9K | 546 | 6 |

| MDB | PUT | SWEEP | BEARISH | 05/03/24 | $13.85 | $13.5 | $13.85 | $365.00 | $34.6K | 53 | 32 |

| MDB | PUT | TRADE | BULLISH | 05/17/24 | $20.4 | $20.35 | $20.35 | $370.00 | $34.5K | 142 | 4 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MDB | 放 | 掃 | 看漲 | 05/03/24 | 10.6 美元 | 10.15 美元 | 10.15 美元 | 360.00 美元 | 70.0K | 239 | 27 |

| MDB | 放 | 掃 | 粗魯的 | 08/16/24 | 21.2 美元 | 20.95 美元 | 21.2 美元 | 320.00 美元 | 38.1 萬美元 | 100 | 40 |

| MDB | 放 | 貿易 | 看漲 | 06/21/24 | 60.55 美元 | 59.85 美元 | 59.85 美元 | 410.00 美元 | 35.9 萬美元 | 546 | 6 |

| MDB | 放 | 掃 | 粗魯的 | 05/03/24 | 13.85 美元 | 13.5 美元 | 13.85 美元 | 365.00 美元 | 34.6K | 53 | 32 |

| MDB | 放 | 貿易 | 看漲 | 05/17/24 | 20.4 美元 | 20.35 美元 | 20.35 美元 | 370.00 美元 | 34.5 萬美元 | 142 | 4 |

About MongoDB

關於 MongoDB

Founded in 2007, MongoDB is a document-oriented database with nearly 33,000 paying customers and well past 1.5 million free users. MongoDB provides both licenses as well as subscriptions as a service for its NoSQL database. MongoDB's database is compatible with all major programming languages and is capable of being deployed for a variety of use cases.

MongoDB 成立於 2007 年,是一個以文檔爲導向的數據庫,擁有近 33,000 名付費客戶,免費用戶遠遠超過 150 萬。MongoDB 爲其 NoSQL 數據庫提供許可證和訂閱服務。MongoDB 的數據庫與所有主要的編程語言兼容,並且能夠針對各種用例進行部署。

Current Position of MongoDB

MongoDB 的當前位置

- With a volume of 644,685, the price of MDB is down -0.9% at $363.01.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 36 days.

- MDB的交易量爲644,685美元,下跌了-0.9%,至363.01美元。

- RSI指標暗示標的股票可能接近超買。

- 下一份業績預計將在36天后公佈。

Expert Opinions on MongoDB

專家對 MongoDB 的看法

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $455.0.

在過去的30天中,共有4位專業分析師對該股發表了看法,將平均目標股價設定爲455.0美元。

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $465.

- An analyst from Tigress Financial persists with their Buy rating on MongoDB, maintaining a target price of $500.

- Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for MongoDB, targeting a price of $440.

- In a cautious move, an analyst from Loop Capital downgraded its rating to Buy, setting a price target of $415.

- 尼德姆的一位分析師已將其評級下調至買入,將目標股價調整爲465美元。

- Tigress Financial的一位分析師堅持對MongoDB的買入評級,維持500美元的目標價格。

- Keybanc的一位分析師保持立場,繼續對MongoDB進行增持評級,目標價格爲440美元。

- Loop Capital的一位分析師謹慎地將其評級下調至買入,將目標股價定爲415美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest MongoDB options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。通過Benzinga Pro的實時提醒,隨時了解最新的MongoDB期權交易。