A Closer Look at Walgreens Boots Alliance's Options Market Dynamics

A Closer Look at Walgreens Boots Alliance's Options Market Dynamics

Investors with a lot of money to spend have taken a bearish stance on Walgreens Boots Alliance (NASDAQ:WBA).

有大量資金可以花的投資者對沃爾格林靴子聯盟(納斯達克股票代碼:WBA)採取了看跌立場。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

今天,當交易出現在我們在本辛加追蹤的公開期權歷史記錄上時,我們注意到了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with WBA, it often means somebody knows something is about to happen.

無論這些是機構還是僅僅是富人,我們都不知道。但是,當WBA發生如此大的事情時,通常意味着有人知道某件事即將發生。

So how do we know what these investors just did?

那麼我們怎麼知道這些投資者剛才做了什麼?

Today, Benzinga's options scanner spotted 8 uncommon options trades for Walgreens Boots Alliance.

今天,本辛加的期權掃描儀發現了Walgreens Boots Alliance的8筆不常見的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 37% bullish and 50%, bearish.

這些大資金交易者的整體情緒分爲37%的看漲和50%的看跌。

Out of all of the special options we uncovered, 2 are puts, for a total amount of $155,440, and 6 are calls, for a total amount of $424,015.

在我們發現的所有特殊期權中,有兩個是看跌期權,總額爲155,440美元,6個是看漲期權,總額爲424,015美元。

Predicted Price Range

預測的價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $10.0 and $25.0 for Walgreens Boots Alliance, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要的市場走勢者正在關注沃爾格林靴子聯盟在過去三個月中在10.0美元至25.0美元之間的價格區間。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

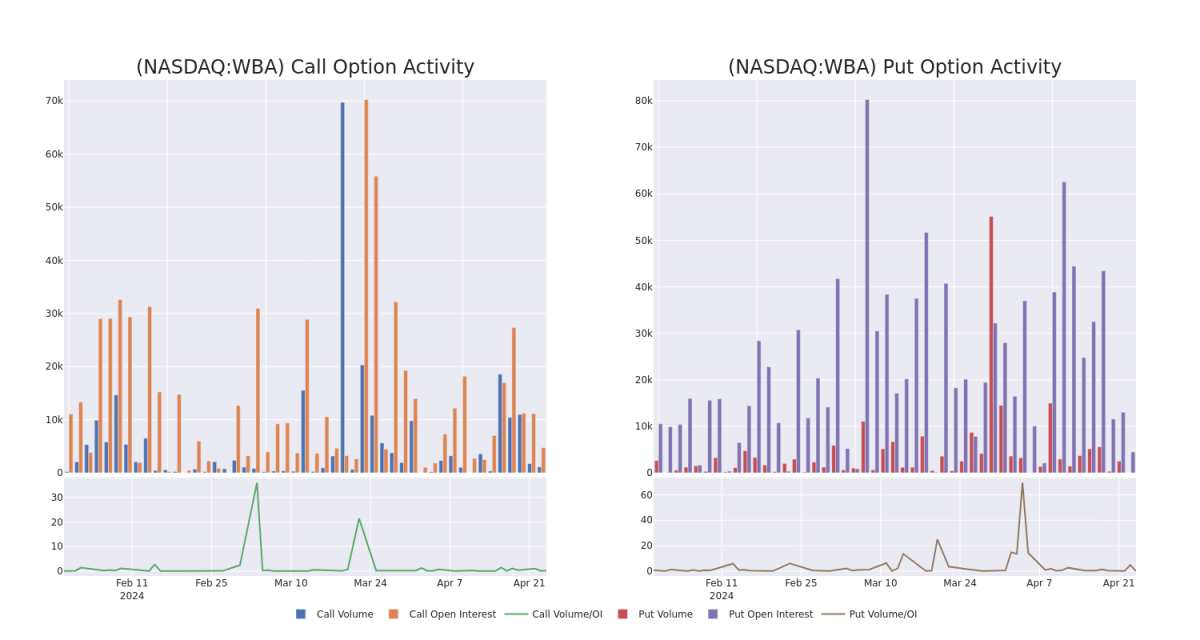

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Walgreens Boots Alliance's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Walgreens Boots Alliance's significant trades, within a strike price range of $10.0 to $25.0, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量Walgreens Boots Alliance期權在特定行使價下的流動性和利息水平的關鍵。下面,我們將簡要介紹過去一個月Walgreens Boots Alliance重大交易的交易量和未平倉合約的趨勢,行使價區間爲10.0美元至25.0美元。

Walgreens Boots Alliance Option Activity Analysis: Last 30 Days

Walgreens Boots Alliance 期權活動分析:過去 30 天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WBA | CALL | TRADE | BEARISH | 01/16/26 | $8.35 | $8.05 | $8.15 | $10.00 | $163.0K | 517 | 305 |

| WBA | PUT | SWEEP | BEARISH | 06/20/25 | $7.8 | $7.7 | $7.8 | $25.00 | $129.4K | 377 | 1 |

| WBA | CALL | SWEEP | BEARISH | 01/16/26 | $8.3 | $8.05 | $8.22 | $10.00 | $82.2K | 517 | 105 |

| WBA | CALL | SWEEP | BULLISH | 01/16/26 | $3.95 | $3.85 | $3.95 | $17.50 | $62.8K | 964 | 163 |

| WBA | CALL | TRADE | BEARISH | 06/20/25 | $4.5 | $4.45 | $4.45 | $15.00 | $44.5K | 3.2K | 0 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WBA | 打電話 | 貿易 | 粗魯的 | 01/16/26 | 8.35 美元 | 8.05 美元 | 8.15 美元 | 10.00 美元 | 163.0 萬美元 | 517 | 305 |

| WBA | 放 | 掃 | 粗魯的 | 06/20/25 | 7.8 美元 | 7.7 美元 | 7.8 美元 | 25.00 美元 | 129.4 萬美元 | 377 | 1 |

| WBA | 打電話 | 掃 | 粗魯的 | 01/16/26 | 8.3 美元 | 8.05 美元 | 8.22 美元 | 10.00 美元 | 82.2 萬美元 | 517 | 105 |

| WBA | 打電話 | 掃 | 看漲 | 01/16/26 | 3.95 美元 | 3.85 美元 | 3.95 美元 | 17.50 美元 | 62.8 萬美元 | 964 | 163 |

| WBA | 打電話 | 貿易 | 粗魯的 | 06/20/25 | 4.5 美元 | 4.45 美元 | 4.45 美元 | 15.00 美元 | 44.5 萬美元 | 3.2K | 0 |

About Walgreens Boots Alliance

關於沃爾格林靴子聯盟

Walgreens Boots Alliance is one of the largest retail pharmacy chains in the U.S., with over 8,500 locations. Nearly three quarters of Americans live within five miles of a Walgreens location. Roughly two thirds of revenue is generated from prescription drug sales; Walgreens makes up 20% of total prescription revenue in the U.S. Walgreens also generates sales from retail products (general wellness consumables and its own branded merchandise), European drug wholesale, and healthcare. With more locations incorporating additional services like Health Corner and Village Medical, Walgreens creates an omnichannel experience for patients and positions itself as a one-stop healthcare provider.

Walgreens Boots Alliance是美國最大的零售連鎖藥房之一,擁有超過8,500個分店。將近四分之三的美國人居住在距離沃爾格林所在地五英里以內。大約三分之二的收入來自處方藥銷售;沃爾格林佔美國處方藥總收入的20%。沃爾格林的銷售還來自零售產品(普通健康消耗品和自有品牌商品)、歐洲藥品批發和醫療保健。隨着越來越多的地點納入健康角和鄉村醫療等額外服務,Walgreens爲患者創造了全渠道體驗,並將自己定位爲一站式醫療保健提供商。

After a thorough review of the options trading surrounding Walgreens Boots Alliance, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對圍繞Walgreens Boots Alliance的期權交易進行了全面審查之後,我們將對該公司進行更詳細的審查。這包括評估其當前的市場狀況和表現。

Where Is Walgreens Boots Alliance Standing Right Now?

Walgreens Boots Alliance 現在的立場如何?

- With a trading volume of 3,248,114, the price of WBA is down by -2.08%, reaching $17.68.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 62 days from now.

- WBA的交易量爲3,248,114美元,下跌了-2.08%,至17.68美元。

- 當前的RSI值表明該股票可能被超賣。

- 下一份收益報告定於62天后發佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。