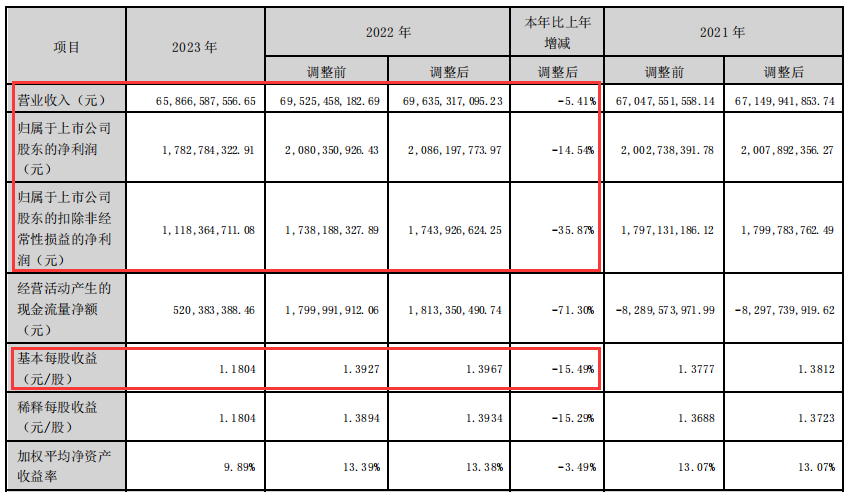

Wave's performance was hampered by the server and parts business. Throughout 2023, Inspur Information's total revenue fell 5.41% year-on-year to 65.867 billion yuan. Net profit attributable to mother decreased by 14.54% year over year to 1,783 billion yuan.

Wave's performance was dragged down by the server and parts business, and both revenue and net profit declined.

On the evening of April 19, Inspur Information published the standard 2023 annual report with unqualified opinions. Financial reports show that throughout 2023, Inspur Information's total revenue fell 5.41% year-on-year to 65.867 billion yuan. Net profit attributable to mother decreased by 14.54% year over year to 1,783 billion yuan.

In addition, Inspur Information's 2023 profit distribution plan is to distribute a cash dividend of 1.30 yuan (tax included) to all shareholders for every 10 shares, for a total cash dividend of 190 million yuan.

Revenue growth rate was negative for the first time since 2009, down 5.41% year on year

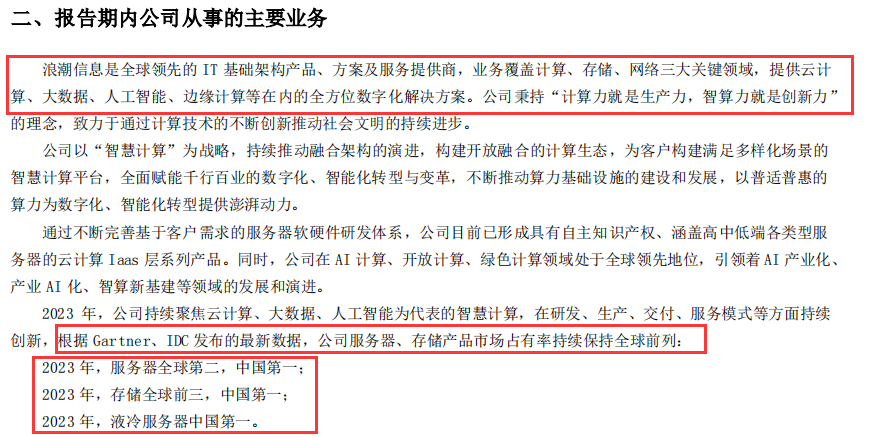

According to the annual report, the company's main business is the development, production and sale of computer hardware, software and system integration. Among them, the market share of servers, storage, and liquid-cooled servers all ranked first in China in 2023. The market share of server and storage products remains among the highest in the world.

In 2023, the company achieved total revenue of 65.867 billion yuan, far surpassing its peers. The revenue scale ranked 113rd out of 5365 listed companies. (Of the 5365 A-share listed companies, a total of 82 companies had total revenue greater than 100 billion yuan; a total of 135 companies greater than 50 billion; and a total of 489 companies greater than 10 billion yuan).

Although the company's total revenue has gradually increased since 2003, the company's revenue growth rate has gradually slowed down. The growth rate in the past four years has declined significantly compared to 2018 and before.

It is worth noting that the company's revenue growth rate in 2023 was negative year on year for the first time since 2009, down 5.41% year on year.

Looking at the specific composition of revenue, by product, servers and components accounted for 99.04% of revenue, a year-on-year decline of 5.53%. IT terminals and spare parts accounted for 0.6%, an increase of 29.77% over the previous year. Others accounted for 0.36%, down 14.73% year over year. Therefore, compared to the insignificant revenue of the other two businesses, the server and parts business is the main reason for dragging down the company's revenue growth.

By region, the domestic share was 85.51%, a year-on-year decline of 6.87%. Overseas accounts for 14.49%, up 4.17% year over year. As a result, mainly domestic business has been affected.

Therefore, the main reason for the decline in the company's revenue was the decline in the domestic server and parts business.

(Wave Information Note: The amount of revenue corresponding to performance obligations that have been signed but not yet fulfilled or not fulfilled at the end of the reporting period is 7.099 billion yuan, of which 7.099 billion yuan is expected to confirm revenue in 2024.)

Net profit to mother fell 14.54% year on year, and gross margin decreased 1.15% year on year

In terms of profit, Wave Information's net profit in 2023 was 1,783 billion yuan, down 14.54% year on year. After deducting non-net profit of 1,118 billion yuan, a year-on-year decrease of 35.87%. Basic earnings per share were 1.18 yuan/share, down 15.49% year over year.

In addition, the gross margin of Wave Information in 2023 was 9.89%, down 1.15% year over year.

By product, the gross margin of servers and components was 9.94%, down 1.11% year on year. IT terminals and parts were 1.36%, a year-on-year decrease of 7.52%.

In recent years, the gross margin of Inspur Information has been above 10%, and the fluctuation is very small. Moreover, there is no gross margin advantage in the industry.

In response, Wave Information indicates the main risks that the company's business development may face:

1. Market risks caused by fluctuations in the macroeconomic situation: If global economic growth continues to slow in the future or China's macroeconomic economy fluctuates sharply in the short term, it may affect downstream demand in the server industry and cause the growth of server market demand to slow down, thus causing the company to face the risk of declining business performance, which will have a certain adverse impact on the company's business development.

2. Market competition risk: The server industry in which the company is located is a combination of knowledge-intensive and capital-intensive industries. The barriers to entry are high. Only a few manufacturers in the world have mastered relevant technology and formed a production scale, and the market concentration is high. Currently, the development of the company's server business is mainly facing market competition from well-known domestic and foreign companies.

3. Risk of exchange rate fluctuations: The company needs to purchase some raw materials through import trade, and the company also exports and sells some products, so the company had a large amount of import and export trade during the reporting period. Large exchange rate fluctuations will affect the company's imports and exports

Direct business impact.4. Supply chain risk: Currently, some raw materials in the domestic server industry still need to be imported. Although supply is currently relatively stable, in the context of intensifying international trade frictions and increasingly complex geopolitics, China's server manufacturers will face some raw material supply risks.

Looking ahead, the wave message states:

Whether it is the value of data elements or the rapid development of artificial intelligence, it is inseparable from intelligent and efficient computing power infrastructure. The “2023-2024 China Artificial Intelligence Computing Power Development Assessment Report” indicates that during the period from 2022 to 2027, the compound annual growth rate of China's intelligent computing power reached 33.9%. Inspur Information will continue to thoroughly implement the “smart computing” strategy, continuously improve and strengthen the product technology layout based on the principle of open source, actively develop intelligent computing, and build a solid computing power base to accelerate the construction of a digital China and the development of the artificial intelligence industry.

In 2023, China's artificial intelligence server market will reach 65 billion yuan, an increase of 82.5% over the previous year; the scale of intelligent computing power is expected to reach 414.1 EFLOPS (10 billion floating point operations per second), an increase of 59.3% over the previous year.