-

市場

-

產品

-

資訊

-

Moo社區

-

課堂

-

查看更多

-

功能介紹

-

費用費用透明,無最低余額限制

投資選擇、功能介紹、費用相關信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 淺色

Check Out What Whales Are Doing With PYPL

Check Out What Whales Are Doing With PYPL

Deep-pocketed investors have adopted a bearish approach towards PayPal Holdings (NASDAQ:PYPL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PYPL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 30 extraordinary options activities for PayPal Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 23% leaning bullish and 76% bearish. Among these notable options, 13 are puts, totaling $1,016,091, and 17 are calls, amounting to $1,537,611.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $40.0 to $85.0 for PayPal Holdings over the recent three months.

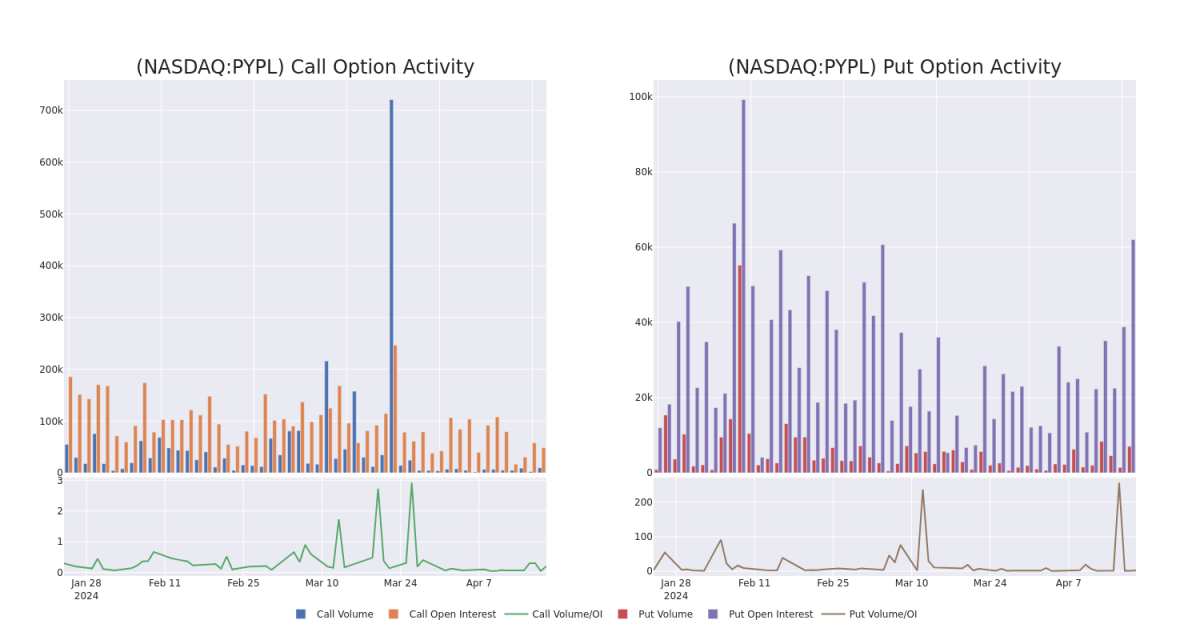

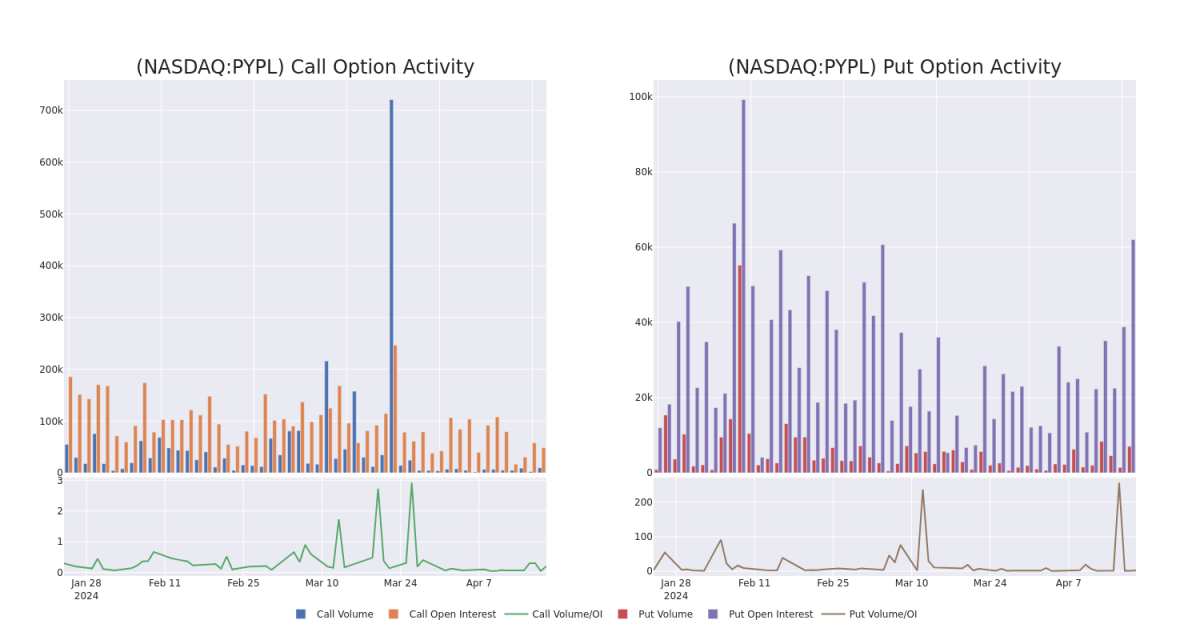

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for PayPal Holdings options trades today is 4257.54 with a total volume of 14,273.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for PayPal Holdings's big money trades within a strike price range of $40.0 to $85.0 over the last 30 days.

PayPal Holdings 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | SWEEP | BEARISH | 05/17/24 | $1.7 | $1.69 | $1.7 | $67.50 | $342.0K | 4.1K | 2.0K |

| PYPL | PUT | SWEEP | BEARISH | 07/19/24 | $4.8 | $4.7 | $4.75 | $62.50 | $332.5K | 4.2K | 58 |

| PYPL | PUT | TRADE | BULLISH | 05/17/24 | $3.75 | $3.7 | $3.7 | $62.50 | $237.5K | 6.3K | 802 |

| PYPL | CALL | TRADE | BULLISH | 05/17/24 | $2.45 | $2.43 | $2.45 | $65.00 | $196.0K | 11.4K | 845 |

| PYPL | CALL | TRADE | BULLISH | 04/19/24 | $9.85 | $9.5 | $9.75 | $52.50 | $185.2K | 870 | 0 |

About PayPal Holdings

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

Following our analysis of the options activities associated with PayPal Holdings, we pivot to a closer look at the company's own performance.

Where Is PayPal Holdings Standing Right Now?

- Trading volume stands at 8,245,581, with PYPL's price down by -0.55%, positioned at $61.76.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 11 days.

Expert Opinions on PayPal Holdings

4 market experts have recently issued ratings for this stock, with a consensus target price of $68.0.

- Maintaining their stance, an analyst from JMP Securities continues to hold a Market Outperform rating for PayPal Holdings, targeting a price of $70.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a In-Line rating on PayPal Holdings with a target price of $60.

- In a cautious move, an analyst from RBC Capital downgraded its rating to Outperform, setting a price target of $74.

- An analyst from Bernstein has decided to maintain their Market Perform rating on PayPal Holdings, which currently sits at a price target of $68.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

Deep-pocketed investors have adopted a bearish approach towards PayPal Holdings (NASDAQ:PYPL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PYPL usually suggests something big is about to happen.

財力雄厚的投資者對PayPal Holdings(納斯達克股票代碼:PYPL)採取了看跌態度,這是市場參與者不容忽視的事情。我們對本辛加公共期權記錄的追蹤今天揭示了這一重大舉措。這些投資者的身份仍然未知,但是PYPL的如此重大的變動通常表明即將發生大事。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 30 extraordinary options activities for PayPal Holdings. This level of activity is out of the ordinary.

我們從今天的觀察中收集了這些信息,當時Benzinga的期權掃描儀重點介紹了PayPal Holdings的30項非同尋常的期權活動。這種活動水平與衆不同。

The general mood among these heavyweight investors is divided, with 23% leaning bullish and 76% bearish. Among these notable options, 13 are puts, totaling $1,016,091, and 17 are calls, amounting to $1,537,611.

這些重量級投資者的總體情緒存在分歧,23%的人傾向於看漲,76%的人傾向於看跌。在這些值得注意的期權中,有13個是看跌期權,總額爲1,016,091美元,17個是看漲期權,總額爲1,537,611美元。

Predicted Price Range

預測的價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $40.0 to $85.0 for PayPal Holdings over the recent three months.

根據交易活動,看來主要投資者的目標是在最近三個月中將PayPal Holdings的價格從40.0美元擴大到85.0美元。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

In terms of liquidity and interest, the mean open interest for PayPal Holdings options trades today is 4257.54 with a total volume of 14,273.00.

就流動性和利息而言,今天PayPal Holdings期權交易的平均未平倉合約爲4257.54,總交易量爲14,273.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for PayPal Holdings's big money trades within a strike price range of $40.0 to $85.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天PayPal Holdings在40.0美元至85.0美元行使價區間內的大額資金交易的看漲和看跌期權交易量和未平倉合約的變化。

PayPal Holdings 30-Day Option Volume & Interest Snapshot

PayPal控股30天期權交易量和利息快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | SWEEP | BEARISH | 05/17/24 | $1.7 | $1.69 | $1.7 | $67.50 | $342.0K | 4.1K | 2.0K |

| PYPL | PUT | SWEEP | BEARISH | 07/19/24 | $4.8 | $4.7 | $4.75 | $62.50 | $332.5K | 4.2K | 58 |

| PYPL | PUT | TRADE | BULLISH | 05/17/24 | $3.75 | $3.7 | $3.7 | $62.50 | $237.5K | 6.3K | 802 |

| PYPL | CALL | TRADE | BULLISH | 05/17/24 | $2.45 | $2.43 | $2.45 | $65.00 | $196.0K | 11.4K | 845 |

| PYPL | CALL | TRADE | BULLISH | 04/19/24 | $9.85 | $9.5 | $9.75 | $52.50 | $185.2K | 870 | 0 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | 打電話 | 掃 | 粗魯的 | 05/17/24 | 1.7 美元 | 1.69 美元 | 1.7 美元 | 67.50 美元 | 342.0 萬美元 | 4.1K | 2.0K |

| PYPL | 放 | 掃 | 粗魯的 | 07/19/24 | 4.8 美元 | 4.7 美元 | 4.75 美元 | 62.50 美元 | 332.5 萬美元 | 4.2K | 58 |

| PYPL | 放 | 貿易 | 看漲 | 05/17/24 | 3.75 美元 | 3.7 美元 | 3.7 美元 | 62.50 美元 | 237.5 萬美元 | 6.3K | 802 |

| PYPL | 打電話 | 貿易 | 看漲 | 05/17/24 | 2.45 美元 | 2.43 美元 | 2.45 美元 | 65.00 美元 | 196.0K | 11.4K | 845 |

| PYPL | 打電話 | 貿易 | 看漲 | 04/19/24 | 9.85 美元 | 9.5 美元 | 9.75 美元 | 52.50 美元 | 185.2 萬美元 | 870 | 0 |

About PayPal Holdings

關於 PayPal 控股

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

PayPal於2015年從eBay分拆出來,爲商家和消費者提供電子支付解決方案,重點是在線交易。截至2023年底,該公司擁有4.26億個活躍賬戶。該公司還擁有人對人支付平台Venmo。

Following our analysis of the options activities associated with PayPal Holdings, we pivot to a closer look at the company's own performance.

在分析了與PayPal Holdings相關的期權活動之後,我們將轉向仔細研究公司自身的表現。

Where Is PayPal Holdings Standing Right Now?

PayPal Holdings現在處於什麼位置?

- Trading volume stands at 8,245,581, with PYPL's price down by -0.55%, positioned at $61.76.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 11 days.

- 交易量爲8,245,581美元,其中PYPL的價格下跌了-0.55%,爲61.76美元。

- RSI指標顯示該股可能接近超賣。

- 預計將在11天內公佈業績。

Expert Opinions on PayPal Holdings

關於PayPal控股的專家意見

4 market experts have recently issued ratings for this stock, with a consensus target price of $68.0.

4位市場專家最近發佈了該股的評級,共識目標價爲68.0美元。

- Maintaining their stance, an analyst from JMP Securities continues to hold a Market Outperform rating for PayPal Holdings, targeting a price of $70.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a In-Line rating on PayPal Holdings with a target price of $60.

- In a cautious move, an analyst from RBC Capital downgraded its rating to Outperform, setting a price target of $74.

- An analyst from Bernstein has decided to maintain their Market Perform rating on PayPal Holdings, which currently sits at a price target of $68.

- JMP Securities的一位分析師堅持其立場,繼續維持PayPal控股的市場跑贏大盤評級,目標價格爲70美元。

- Evercore ISI集團的一位分析師在評估中保持了對PayPal Holdings的在線評級,目標價爲60美元。

- 加拿大皇家銀行資本的一位分析師謹慎地將其評級下調至跑贏大盤,將目標股價定爲74美元。

- 伯恩斯坦的一位分析師已決定維持對PayPal Holdings的市場表現評級,該評級目前的目標股價爲68美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧