-

市場

-

產品

-

資訊

-

Moo社區

-

課堂

-

查看更多

-

功能介紹

-

費用費用透明,無最低余額限制

投資選擇、功能介紹、費用相關信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 淺色

Lucid Gr Unusual Options Activity

Lucid Gr Unusual Options Activity

Investors with significant funds have taken a bearish position in Lucid Gr (NASDAQ:LCID), a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in LCID usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 9 options transactions for Lucid Gr. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 22% being bullish and 77% bearish. Of all the options we discovered, 8 are puts, valued at $1,339,015, and there was a single call, worth $30,200.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $1.0 to $3.0 for Lucid Gr during the past quarter.

Volume & Open Interest Trends

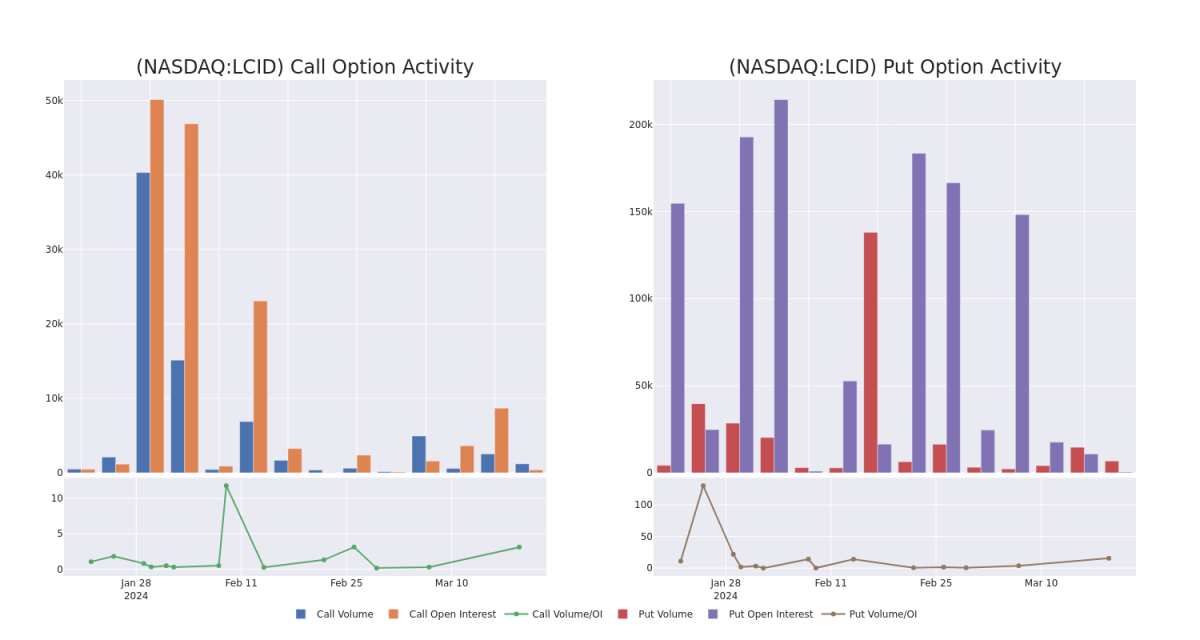

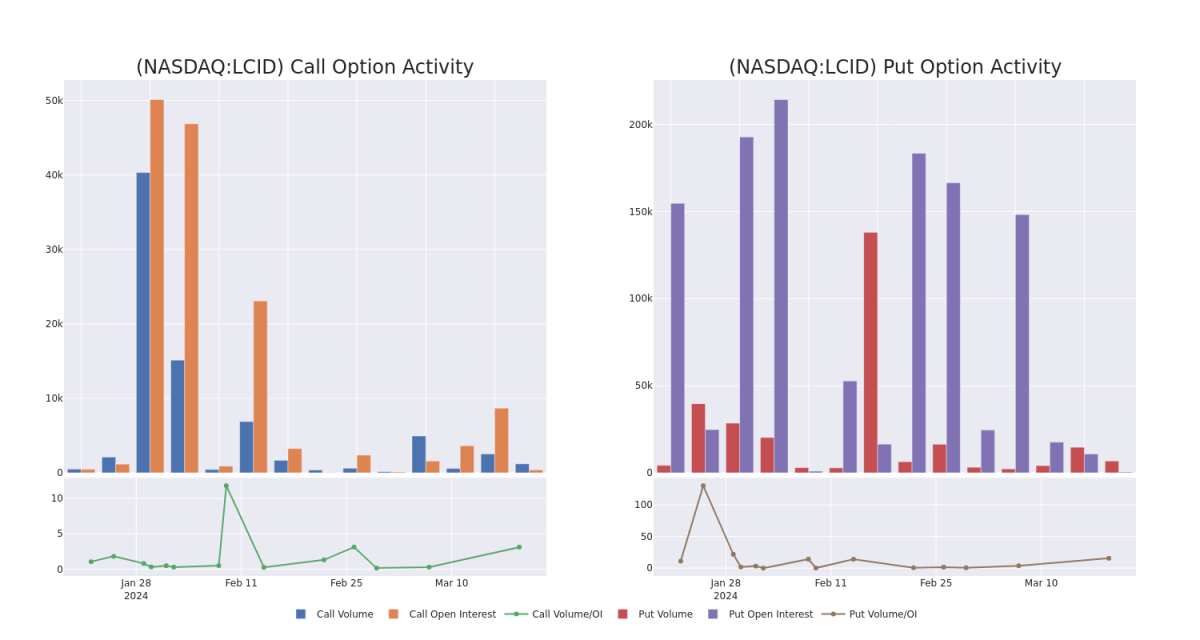

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lucid Gr's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lucid Gr's substantial trades, within a strike price spectrum from $1.0 to $3.0 over the preceding 30 days.

Lucid Gr 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LCID | PUT | SWEEP | BEARISH | 01/17/25 | $0.67 | $0.58 | $0.67 | $2.00 | $334.0K | 28.6K | 5.0K |

| LCID | PUT | TRADE | BEARISH | 01/17/25 | $0.68 | $0.6 | $0.66 | $2.00 | $222.3K | 28.6K | 8.5K |

| LCID | PUT | SWEEP | BEARISH | 08/16/24 | $0.69 | $0.65 | $0.69 | $2.50 | $207.0K | 6.3K | 4.8K |

| LCID | PUT | TRADE | BULLISH | 05/17/24 | $0.76 | $0.68 | $0.7 | $3.00 | $140.0K | 67.7K | 1 |

| LCID | PUT | SWEEP | BEARISH | 01/17/25 | $1.36 | $1.24 | $1.36 | $3.00 | $132.0K | 149.9K | 2.1K |

About Lucid Gr

Lucid Group Inc is a technology and automotive company. It develops the next generation of electric vehicle (EV) technologies. It is a vertically integrated company that designs, engineers, and builds electric vehicles, EV powertrains, and battery systems in-house using our own equipment and factory.

In light of the recent options history for Lucid Gr, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Lucid Gr

- With a volume of 6,608,517, the price of LCID is up 0.2% at $2.44.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 17 days.

Expert Opinions on Lucid Gr

1 market experts have recently issued ratings for this stock, with a consensus target price of $3.0.

- An analyst from Morgan Stanley persists with their Underweight rating on Lucid Gr, maintaining a target price of $3.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

Investors with significant funds have taken a bearish position in Lucid Gr (NASDAQ:LCID), a development that retail traders should be aware of.

擁有大量資金的投資者對Lucid Gr(納斯達克股票代碼:LCID)持看跌立場,零售交易者應該注意這一事態發展。

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in LCID usually indicates foreknowledge of upcoming events.

今天,通過對本辛加可公開訪問的期權數據的監控,這引起了我們的注意。這些投資者的確切性質仍然是個謎,但是LCID的如此重大變動通常表明對即將發生的事件的預感。

Today, Benzinga's options scanner identified 9 options transactions for Lucid Gr. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 22% being bullish and 77% bearish. Of all the options we discovered, 8 are puts, valued at $1,339,015, and there was a single call, worth $30,200.

今天,Benzinga的期權掃描儀爲Lucid Gr確定了9筆期權交易。這是一種不尋常的事件。這些大型交易者的情緒喜憂參半,22%的人看漲,77%的人看跌。在我們發現的所有期權中,有8個是看跌期權,價值1,339,015美元,還有一個看漲期權,價值30,200美元。

What's The Price Target?

目標價格是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $1.0 to $3.0 for Lucid Gr during the past quarter.

分析這些合約的交易量和未平倉合約,看來大型企業一直在關注Lucid Gr在過去一個季度的價格範圍從1.0美元到3.0美元不等。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lucid Gr's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lucid Gr's substantial trades, within a strike price spectrum from $1.0 to $3.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了Lucid Gr在指定行使價下期權的流動性和投資者對Lucid Gr期權的興趣。即將發佈的數據可視化了與Lucid Gr的大量交易相關的看漲期權和未平倉合約的波動,在過去的30天內,行使價範圍從1.0美元到3.0美元不等。

Lucid Gr 30-Day Option Volume & Interest Snapshot

Lucid Gr 30 天期權交易量和利息快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LCID | PUT | SWEEP | BEARISH | 01/17/25 | $0.67 | $0.58 | $0.67 | $2.00 | $334.0K | 28.6K | 5.0K |

| LCID | PUT | TRADE | BEARISH | 01/17/25 | $0.68 | $0.6 | $0.66 | $2.00 | $222.3K | 28.6K | 8.5K |

| LCID | PUT | SWEEP | BEARISH | 08/16/24 | $0.69 | $0.65 | $0.69 | $2.50 | $207.0K | 6.3K | 4.8K |

| LCID | PUT | TRADE | BULLISH | 05/17/24 | $0.76 | $0.68 | $0.7 | $3.00 | $140.0K | 67.7K | 1 |

| LCID | PUT | SWEEP | BEARISH | 01/17/25 | $1.36 | $1.24 | $1.36 | $3.00 | $132.0K | 149.9K | 2.1K |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LCID | 放 | 掃 | 粗魯的 | 01/17/25 | 0.67 美元 | 0.58 美元 | 0.67 美元 | 2.00 美元 | 334.0 萬美元 | 28.6K | 5.0K |

| LCID | 放 | 貿易 | 粗魯的 | 01/17/25 | 0.68 美元 | 0.6 美元 | 0.66 美元 | 2.00 美元 | 222.3 萬美元 | 28.6K | 8.5K |

| LCID | 放 | 掃 | 粗魯的 | 08/16/24 | 0.69 美元 | 0.65 美元 | 0.69 美元 | 2.50 美元 | 207.0 萬美元 | 6.3K | 4.8K |

| LCID | 放 | 貿易 | 看漲 | 05/17/24 | 0.76 美元 | 0.68 美元 | 0.7 美元 | 3.00 美元 | 140.0K | 67.7K | 1 |

| LCID | 放 | 掃 | 粗魯的 | 01/17/25 | 1.36 | 1.24 美元 | 1.36 | 3.00 美元 | 132.0 萬美元 | 149.9 萬 | 2.1K |

About Lucid Gr

關於 Lucid Gr

Lucid Group Inc is a technology and automotive company. It develops the next generation of electric vehicle (EV) technologies. It is a vertically integrated company that designs, engineers, and builds electric vehicles, EV powertrains, and battery systems in-house using our own equipment and factory.

Lucid Group Inc是一家科技和汽車公司。它開發下一代電動汽車(EV)技術。它是一家垂直整合的公司,使用我們自己的設備和工廠在內部設計、工程和製造電動汽車、電動汽車動力總成和電池系統。

In light of the recent options history for Lucid Gr, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於Lucid Gr最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Current Position of Lucid Gr

Lucid Gr 的當前位置

- With a volume of 6,608,517, the price of LCID is up 0.2% at $2.44.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 17 days.

- LCID的交易量爲6,608,517美元,價格上漲0.2%,至2.44美元。

- RSI 指標暗示標的股票可能已接近超賣。

- 下一份業績預計將在17天后公佈。

Expert Opinions on Lucid Gr

關於 Lucid Gr 的專家意見

1 market experts have recently issued ratings for this stock, with a consensus target price of $3.0.

1位市場專家最近發佈了該股的評級,共識目標價爲3.0美元。

- An analyst from Morgan Stanley persists with their Underweight rating on Lucid Gr, maintaining a target price of $3.

- 摩根士丹利的一位分析師堅持對Lucid Gr的減持評級,維持3美元的目標價。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Futu Securities (Australia) Ltd提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧