Unpacking the Latest Options Trading Trends in Johnson & Johnson

Unpacking the Latest Options Trading Trends in Johnson & Johnson

Financial giants have made a conspicuous bearish move on Johnson & Johnson. Our analysis of options history for Johnson & Johnson (NYSE:JNJ) revealed 9 unusual trades.

金融巨頭對強生採取了明顯的看跌舉動。我們對強生公司(紐約證券交易所代碼:JNJ)期權歷史的分析顯示了9筆不尋常的交易。

Delving into the details, we found 44% of traders were bullish, while 55% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $139,175, and 6 were calls, valued at $274,963.

深入研究細節,我們發現44%的交易者看漲,而55%的交易者表現出看跌趨勢。在我們發現的所有交易中,有3筆是看跌期權,價值爲139,175美元,6筆是看漲期權,價值274,963美元。

What's The Price Target?

目標價格是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $150.0 for Johnson & Johnson during the past quarter.

分析這些合約的交易量和未平倉合約,看來大型企業一直在關注強生在過去一個季度的價格範圍從105.0美元到150.0美元不等。

Volume & Open Interest Development

交易量和未平倉合約的發展

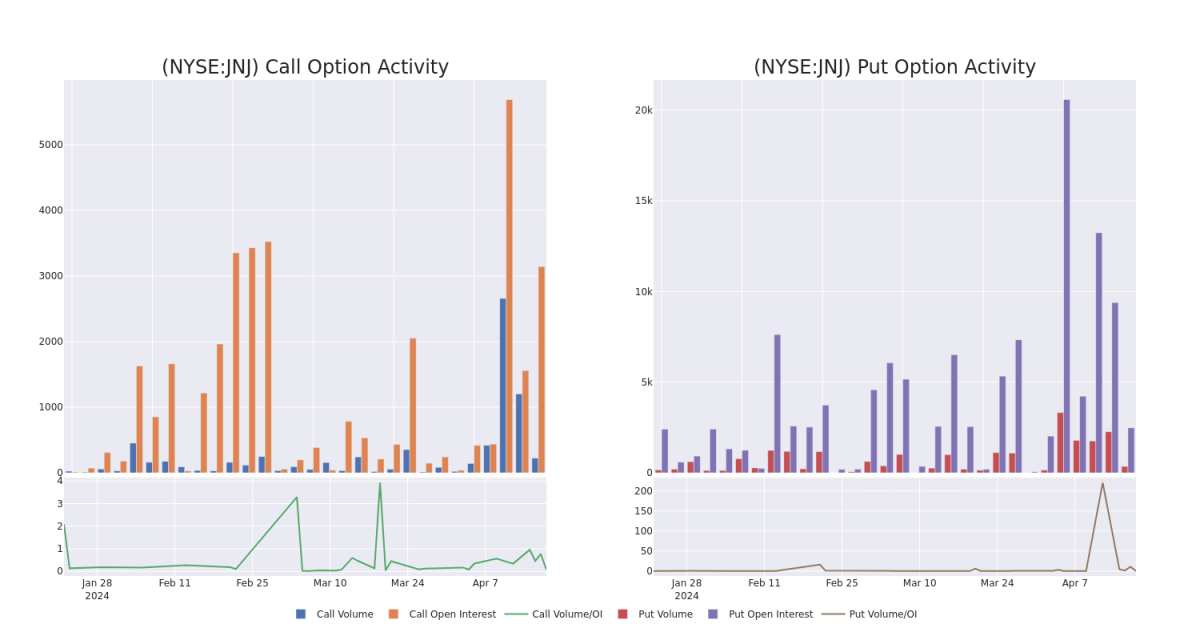

In today's trading context, the average open interest for options of Johnson & Johnson stands at 703.0, with a total volume reaching 579.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Johnson & Johnson, situated within the strike price corridor from $105.0 to $150.0, throughout the last 30 days.

在今天的交易背景下,強生期權的平均未平倉合約爲703.0,總成交量達到579.00。隨附的圖表描繪了過去30天內強生高價值交易的看漲期權和看跌期權交易量以及未平倉合約的變化,行使價走勢從105.0美元到150.0美元不等。

Johnson & Johnson Option Volume And Open Interest Over Last 30 Days

過去30天的強生期權交易量和未平倉合約

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JNJ | CALL | SWEEP | BEARISH | 07/19/24 | $2.77 | $2.56 | $2.76 | $150.00 | $78.9K | 575 | 57 |

| JNJ | PUT | SWEEP | BULLISH | 05/17/24 | $1.13 | $1.05 | $1.13 | $140.00 | $77.9K | 1.7K | 327 |

| JNJ | CALL | SWEEP | BULLISH | 01/17/25 | $10.3 | $9.55 | $9.7 | $145.00 | $41.7K | 420 | 103 |

| JNJ | CALL | SWEEP | BEARISH | 01/17/25 | $41.15 | $39.6 | $40.54 | $105.00 | $40.2K | 71 | 10 |

| JNJ | CALL | TRADE | BULLISH | 06/21/24 | $3.95 | $3.9 | $3.95 | $145.00 | $39.5K | 1.2K | 48 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JNJ | 打電話 | 掃 | 粗魯的 | 07/19/24 | 2.77 美元 | 2.56 美元 | 2.76 美元 | 150.00 美元 | 78.9 萬美元 | 575 | 57 |

| JNJ | 放 | 掃 | 看漲 | 05/17/24 | 1.13 | 1.05 美元 | 1.13 | 140.00 美元 | 77.9 萬美元 | 1.7K | 327 |

| JNJ | 打電話 | 掃 | 看漲 | 01/17/25 | 10.3 美元 | 9.55 美元 | 9.7 美元 | 145.00 美元 | 41.7 萬美元 | 420 | 103 |

| JNJ | 打電話 | 掃 | 粗魯的 | 01/17/25 | 41.15 美元 | 39.6 美元 | 40.54 美元 | 105.00 美元 | 40.2 萬美元 | 71 | 10 |

| JNJ | 打電話 | 貿易 | 看漲 | 06/21/24 | 3.95 美元 | 3.9 美元 | 3.95 美元 | 145.00 美元 | 39.5 萬美元 | 1.2K | 48 |

About Johnson & Johnson

關於強生公司

Johnson & Johnson is the world's largest and most diverse healthcare firm. Three divisions make up the firm: pharmaceutical, medical devices and diagnostics, and consumer. The drug and device groups represent close to 80% of sales and drive the majority of cash flows for the firm. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. The device segment focuses on orthopedics, surgery tools, vision care, and a few smaller areas. The last segment of consumer focuses on baby care, beauty, oral care, over-the-counter drugs, and women's health. The consumer group is being divested in 2023 under the new name Kenvue. Geographically, just over half of total revenue is generated in the United States.

強生公司是世界上最大、最多元化的醫療保健公司。公司由三個部門組成:製藥、醫療器械和診斷以及消費品。藥品和器械組佔銷售額的近80%,並推動了公司的大部分現金流。藥物部門專注於以下治療領域:免疫學、腫瘤學、神經病學、肺部、心臟病學和代謝性疾病。設備領域側重於骨科、手術工具、視力保健和一些較小的領域。最後一部分消費者關注嬰兒護理、美容、口腔護理、非處方藥和女性健康。該消費者集團將於2023年以新名稱Kenvue進行剝離。從地理上看,總收入的一半以上來自美國。

Present Market Standing of Johnson & Johnson

強生公司目前的市場地位

- Trading volume stands at 1,686,302, with JNJ's price up by 0.1%, positioned at $144.91.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 91 days.

- 交易量爲1,686,302美元,其中JNJ的價格上漲了0.1%,爲144.91美元。

- RSI指標顯示該股可能被超賣。

- 預計將在91天內公佈業績。

What The Experts Say On Johnson & Johnson

專家對強生的看法

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $188.4.

在過去的一個月中,5位行業分析師分享了他們對該股的見解,提出平均目標價爲188.4美元。

- Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Johnson & Johnson, targeting a price of $175.

- Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on Johnson & Johnson with a target price of $170.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $215.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Johnson & Johnson with a target price of $167.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $215.

- 加拿大皇家銀行資本的一位分析師保持立場,繼續維持強生的跑贏大盤評級,目標股價爲175美元。

- Bof A證券的一位分析師在評估中保持中性評級,目標價爲170美元。

- 坎託·菲茨傑拉德的一位分析師已將其評級下調至增持,將目標股價調整爲215美元。

- 摩根士丹利的一位分析師在評估中保持了對強生的同等權重評級,目標價爲167美元。

- 坎託·菲茨傑拉德的一位分析師將其行動評級下調至增持,目標股價爲215美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。